A trade war ends with Trump blinking — for now

If this was a poker game, China may have just called the American president's bluff

If you blinked, you might have missed the president who built his economic agenda on tariffs quietly turning the page on the U.S.-China trade war — for now — with barely a whisper of the fire and fury that he launched it with barely more than a month ago. No fanfare. No victory parade.

After bruising tariff hikes, bellicose Truth Social posts, and a supposed “great decoupling” of the American and Chinese economies, the first phase of the trade war between the two countries ended Monday not with a bang. Instead, it fizzled with a somewhat quiet backpedal from the White House.

The Trump administration announced a sweeping 90-day de-escalation of the trade war, with both sides agreeing to lower tariffs and another round of negotiations. The announcement was full of vague promises of resumed trade — and no clear wins for U.S. structural demands.

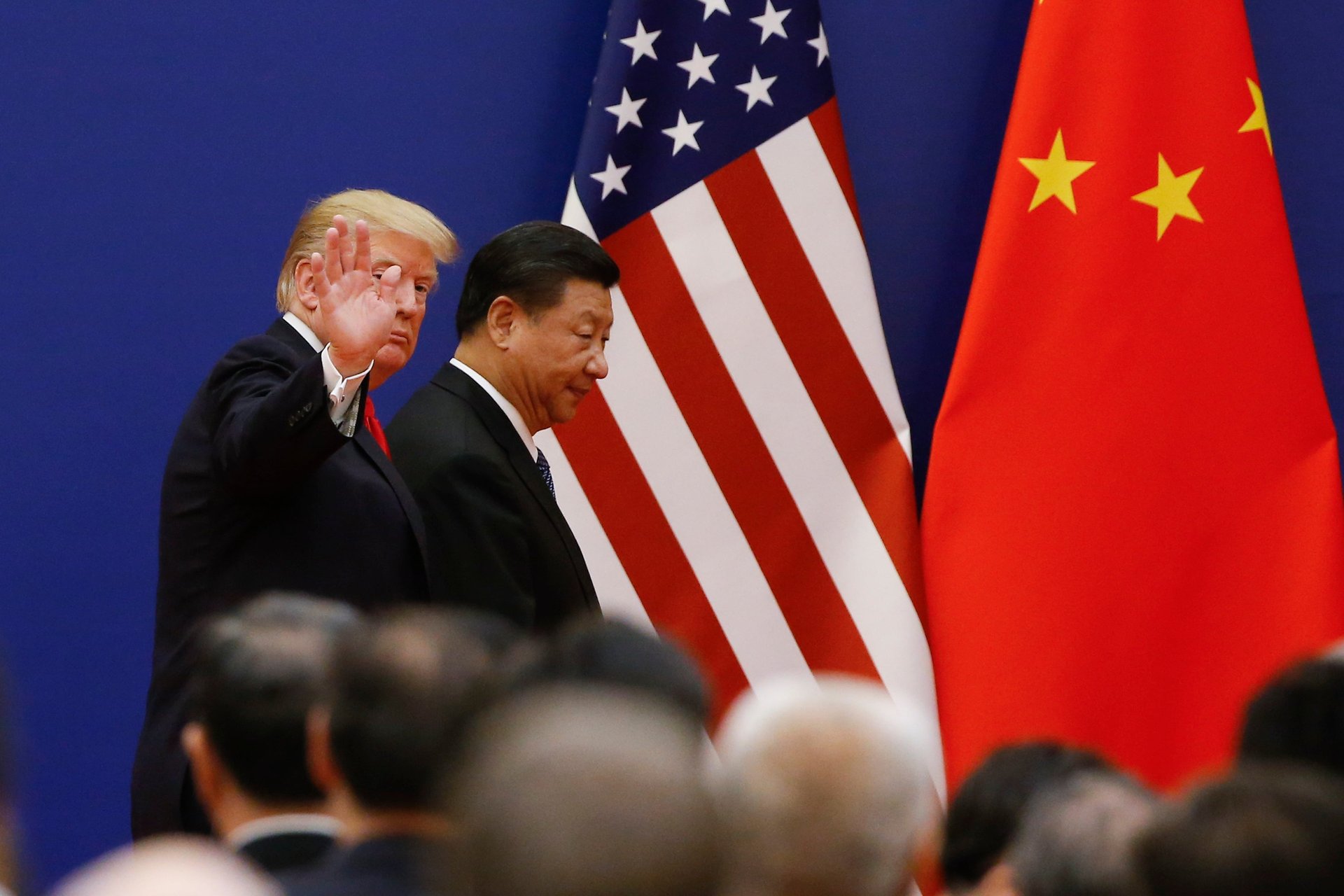

If this was a poker game, China may have just called President Donald Trump’s bluff.

Before the trade talks in Geneva over the weekend, Trump had floated slashing tariffs on China to 80% — down from the eyebrow-raising 145% he’d imposed just weeks prior. But he also said on social media that he would leave the details to “Scott B,” Treasury Secretary Scott Bessent. Turns out Bessent had other ideas. Thedeal hashed out in Geneva landed at a 30% levy on Chinese imports — a number padded by a 20% fentanyl-related tariff already on the books.

That’s not exactly what Trump had been broadcasting.

A trade deal rewritten in real time

For a president who once said that “trade wars are good and easy to win,” the optics are hard to ignore: China gets breathing room, Wall Street gets its market rally, and Trump gets a chance to change the subject.

“The biggest thing to me is the opening up,” Trump told reporters hours after the trade deal was announced, pivoting from his earlier emphasis on tariffs. “I think it would be fantastic for our businesses if we could go in and compete.”

That’s a far cry from Trump’s recent rhetoric claiming that tariffs on China could raise trillions for the U.S. government.

Susan Shirk, a longtime China expert and a former deputy assistant secretary of state in the Bureau of East Asia and Pacific Affairs, said the trade standoff was “a crisis created by the Trump imposition of tariffs” and described the administration’s strategy as “ludicrous.” Bessent, she noted, had only recently called on allies to cut trade with China — a move that swiftly unified international opposition against Washington.

“The Trump administration declares victory. Fine. Who cares?” said Shirk, now a professor at the University of California, San Diego. She added that the scale of the tariff reductions surprised even close watchers of the talks.

Arthur T. Dong, a professor at Georgetown’s McDonough School of Business, described the trade deal as monumental, saying both sides knew they had too much to lose.

“I would use a sort of military analogy: mutually assured economic destruction,” Dong said. “We were playing with, in a sense, a nuclear economic warfare — you don’t conduct nuclear warfare because you will destroy each other.”

Dong said he wouldn’t be surprised if there was a summit between Trump and his Chinese counterpart, Xi Jingping, in the not-to-distant-future.

“Both sides will claim victory,” he added, “but I would say that, overall, the global economy is the winner.”

A win, a wobble, or a reset?

The market’s verdict? Relief.

Capital Economics’ Mark Williams told The Wall Street Journal that it’s important to note China hasn’t offered meaningful concessions. “It will be interesting to see whether China is willing to offer anything substantive in these talks, but I can’t see that they’ll feel under a huge amount of pressure to do so,” he said. “China has successfully called Trump’s bluff.”

And in a research note, analysts at Jeffries (JEF) called the deal “a sign that the U.S. is more desperate than China to deliver the ‘de-escalation’ message to the market.”

“Trump would unlikely accept defeat in his tariff-driven MAGA plan,” the Jeffries analysts said, “but his tactic to ‘raise price and then discount’ to make a final deal looks like a good deal to the market and the other side.”

China, for its part, painted the outcome as a clear victory for its domestic audience. “China’s firm countermeasures and resolute stance have been highly effective,” said one social media account tied to China’s CCTV state television.

Analysts have warned against assuming this “deal” is anything more than a temporary ceasefire. The 30% tariff rate on China remains punishing by historical standards. A study released Monday from The Budget Lab at Yale University found that, even with Monday’s China truce and last week’s trade deal with the U.K., the average effective U.S. tariff rate on imports is the highest it’s been since 1934. Exemptions to tariffs on China for tech and consumer electronics are narrowly tailored and time limited.

And current negotiations are still focused on “reciprocal” tariffs, while sector-specific duties could be back on the table by July.

Trump, for his part, surely won’t call this deal a retreat. His pattern — hike first, discount later — allows him to frame even a modest concession as a masterstroke.

“If the U.S. and China ultimately settle around a 40–45% tariff level for a two-year truce, markets will likely cheer it,” Jeffries said, “because it looks moderate compared to the chaos that came before.” That framing — from 145% to 30% — makes this week’s outcome look like a breakthrough. But businesses, and Beijing, know better than to assume the storm has passed.

Jamie Cox, managing partner of the Harris Financial Group, said the 90-day pause leaves everything on the table.

“If the U.S. can get the Chinese to commit to meaningful trade rebalancing within 90 days, it would be historic,” Cox said in a note. “However, the Chinese are quite adept at stalling, so there’s still a very steep hill to climb to get a real agreement.”

Cox said in an interview that “the wild card is always going to be Trump” and that there is no real playbook to the president’s negotiations.

“Markets kind of understood that the off-ramp would be built, that no matter what, Trump was going to zig and zag — whatever he had to do to not hurt him,” Cox said.

The president, however inadvertently, may have found a way forward on the tariffs to quell fears and claim negotiating wins.

“Now that China is at the table... the last thing you want to be is last in line,” Cox said. “These 18 or so countries who have just sort of been sitting on the fence waiting to see what China does — they have an answer.”

After weeks of hand-wringing over the specter of runaway protectionism, the emerging consensus on Wall Street is one of cautious relief.

“Markets are reacting extremely positively to the news that the Trump administration was using tariffs as a negotiating tactic after all, and we aren’t going to go blindly back to the Smoot-Hawley days,” said Chris Zaccarelli, chief investment officer for Northlight Asset Management.

Dan Ives, an analyst at Wedbush Securities, described the deal in a Monday morning note as a “dream scenario” and a “huge win for the market and bulls.”

A ceasefire, not a permanent trade deal

Still, the broader geopolitical picture remains murky.

Peter Dutton, a senior fellow in the Paul Tsai China Center at Yale Law School, said this isn’t the end of the decoupling debate — just a recognition that disentangling two giant economies will be far harder than political slogans suggest.

“Both the U.S. and China have an interest in a stable arrangement,” Dutton said. “This is just the beginning of a process of stabilizing economic components of the relationship, and it’s likely to be a long and steady process.”

Dong, the Georgetown professor, offered a fitting metaphor: “There’s an ancient Chinese saying: The tree that bends is the one that survives.”

Trump bent. But it may be China that stood tall.

In the end, the ambiguity of the deal lets both sides declare victory. But it resolves none of the thornier issues — tech transfer, state subsidies, data governance. Beijing walks away appearing measured. Washington walks away recalibrated.

And with a 90-day clock now ticking, the real test still lies ahead.

Talks will resume. Tariffs may resume, too. But the bigger challenge may come in the form of credibility. After so many threats, so much volatility, and so little to show for it, allies and adversaries alike may begin questioning how seriously to take the White House’s threats.

“American credibility has been severely damaged,” said Shirk, the former deputy assistant secretary of state. “This agreement won’t repair that. It’s going to take a lot more to — if ever — restore that.”

The trade war started with Trump promising economic conquest.

Now, there’s a ceasefire that looks a lot like a carefully staged retreat.

And if you blink, you might just miss what comes next.