What is AGI? A guide to adjusted gross income — and what it means for your taxes

Discover what AGI is and how it impacts your taxes. Plus, learn the difference between AGI and gross income

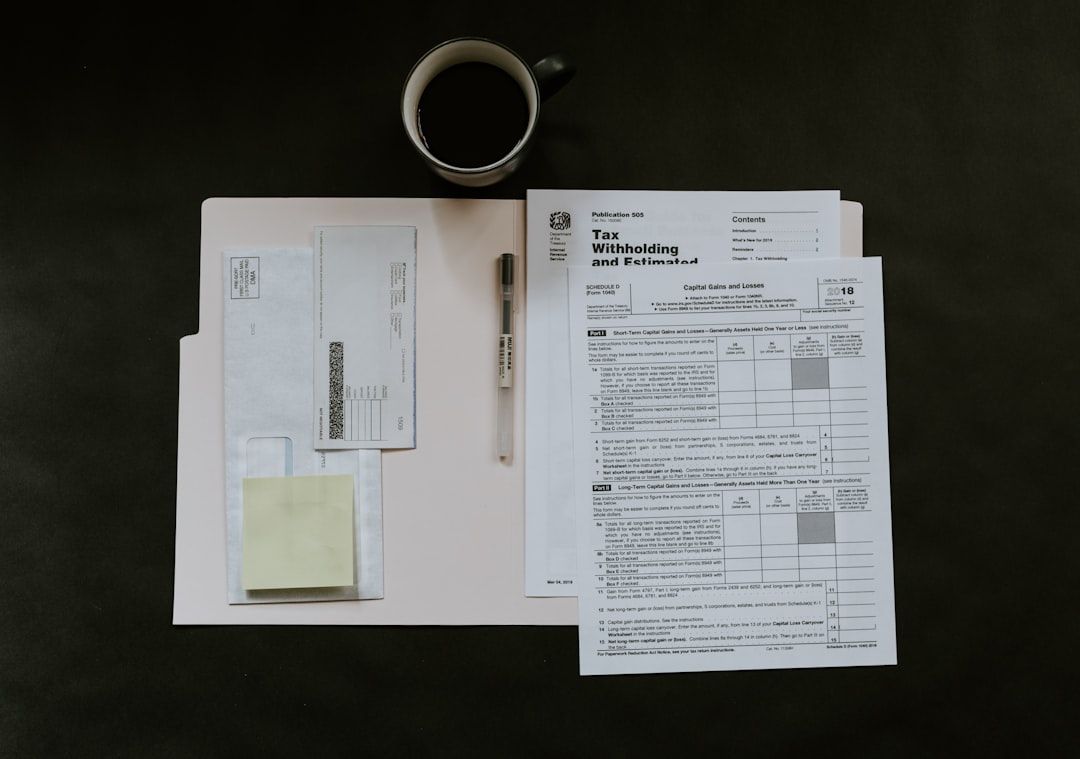

With standard deductions on the rise due to inflation and other factors, Americans may wonder how much income tax they'll pay. Calculating your tax bill or refund starts with understanding your adjusted gross income (AGI).

Your AGI is your total income minus certain IRS-allowed adjustments. You can find your AGI on Form 1040 of your tax return. Keep reading to find out more about AGI, including how it's calculated and whether you can reduce it.

2 / 9

Why does AGI matter?

Nataliya Vaitkevich via Pexels

Your AGI helps determine your taxable income and whether you're eligible for certain deductions or credits. It's also a key factor in determining your eligibility for health insurance subsidies and numerous financial aid benefits.

3 / 9

How is AGI calculated?

AGI is calculated with a formula that starts with your total income and subtracts what are called "above-the-line" adjustments allowed by the IRS.

Start by determining your gross income — that's your total income from all sources before you account for deductions. Depending on your situation, you might need to include:

- Wages. Your salary or hourly pay from an employer is typically found on Form W-2.

- Tips. Even if tips aren't shown on your W-2, you are supposed to report them. Keep track of tips manually so you can include them in your income each year.

- Interest and dividends. Interest from savings accounts and dividends from investments are taxable income. These are reported on Form 1099-INT (interest) and Form 1099-DIV (dividends).

- Capital gains. Some profits from selling assets like stocks, property, or crypto may be considered capital gains. These are typically reported on a 1099 form.

- Rental income. If you rent out property, you'll need to track income and report it on your tax return. You can offset it with any expenses related to your rental business.

- Business income. If you're self-employed or run a side gig, you'll likely receive a Form 1099-NEC or 1099-K. Even if you don't, you should track income manually to include on your tax return.

- Other taxable income. Some government benefits payments, canceled debts, and gambling winnings are also considered taxable income.

Once you have your gross income, you subtract allowed adjustments to get to your AGI. The IRS will enable adjustments like IRA or HSA contributions, interest paid on certain loans, and educator expenses.

Don't worry if this is starting to sound too complex. Tax preparation services and software handle most of the details for you and walk you through entering the right information from various tax forms each year.

4 / 9

AGI vs other tax terms: What’s the difference?

Other tax terms and acronyms also come up when you're filing your taxes. Here are a few of them and how they differ from AGI:

- Gross income. This is your total income before any deductions.

- Taxable income. This is the amount of income you actually pay taxes on. Usually, it's your AGI minus the standard deduction or, if you itemize, itemized deductions.

- Modified adjusted gross income (MAGI). This is an amount used to determine your eligibility for certain tax credits. It's your AGI with certain deductions added back in.

5 / 9

Where to find your AGI

You can find your AGI on line 11 of Form 1040. If you're married filing jointly, this number reflects your combined AGI. Knowing where to find your AGI is important because some providers and the IRS use this amount to help verify your identity. When using online services, including e-filing, or calling IRS customer service, you may need to reference this number.

6 / 9

How to reduce your AGI

Several legitimate methods exist for reducing your AGI. Lowering your AGI can help reduce your tax burden or qualify you for tax benefits like credits. Note that you may also be able to benefit from other tax deductions, like the home office tax deduction. However, these are not part of the AGI calculation.

7 / 9

Contribute to a traditional IRA or HSA

Money you put into a traditional IRA or a health savings account (HSA) may reduce your AGI. That's as long as your contributions fall within the annual IRS limits.

Contribution limits are updated regularly and can depend on factors like your age. When making a plan to reduce AGI via pre-tax contributions to IRA or HSA plans, check the IRS website or ask your financial advisor for current limits.

IRA and HSA accounts also come with added benefits like tax-deferred growth or tax-free withdrawals for qualified medical expenses.

8 / 9

Deduct student loan interest

If you paid interest on qualified student loans, you can deduct up to a certain amount each year. This adjustment applies even if you don’t itemize your deductions, as you deduct as part of the AGI calculation.

9 / 9

Deduct educator expenses

Teachers and eligible school employees can deduct an approved amount of unreimbursed classroom expenses. This deduction covers out-of-pocket spending on classroom supplies and can help reduce your AGI while recognizing your contributions to education.

Check the IRS website or ask your tax preparer about the current allowed amount. Tax preparation software like TurboTax automatically considers current allowances when calculating your AGI.