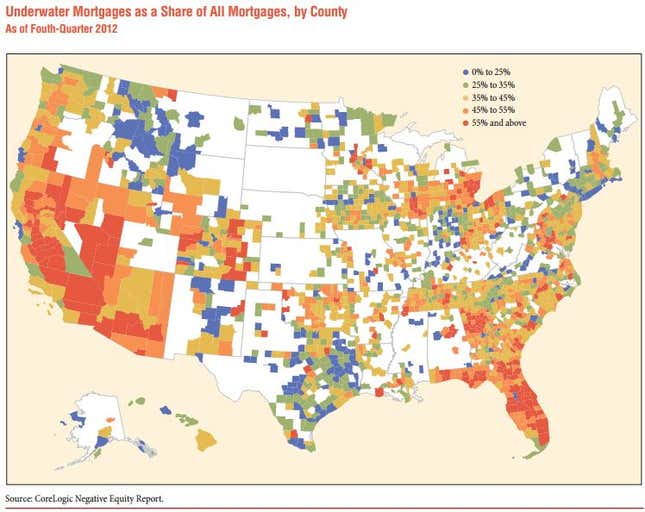

If you’re a frequent Quartz reader, then you’re probably aware that the US housing market has been doing a lot better lately. But if you live in some cities in the US, then you’re probably asking where the recovery is—and how long the foreclosures will continue against homeowners struggling to pay off their mortgages.

Enter the small city of Richmond, California, which is spearheading a plan (paywall) to expropriate mortgages from the banks and trusts that hold them, so they cannot force any more foreclosures. Although it could expand the scope of this already controversial public policy, known as “eminent domain,” some think expropriating mortgages may be the best way to make the US financial-services industry accountable for causing a housing bubble and financial crisis.

The reasoning behind the expropriations is as follows. When a homeowner cannot meet mortgage payments or is “underwater”—owes more money to the bank than the home is worth—the bank has little leeway to offer easier payment terms, because mortgages are generally packaged up and sold to investors as mortgage-backed securities. These investors have little incentive to bend; in fact, it makes more sense for them to drag out lengthy foreclosure proceedings, because banks and other mortgage servicers have been able to manipulate federal programs meant to help homeowners get back on their feet in the process.

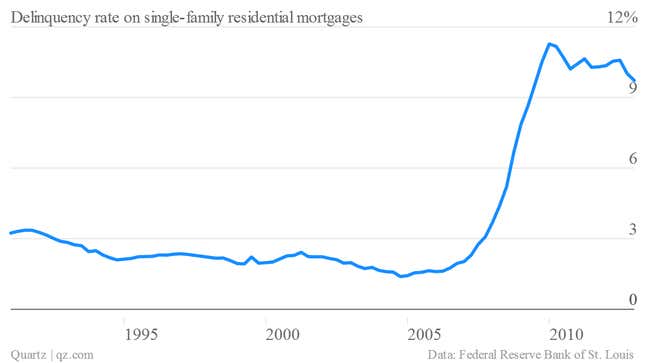

That’s part of why the delinquency rate on home loans—the percentage of homeowners late on their payments and at risk of foreclosure—has fallen only slightly since it peaked at at 11.3% in 2010. In the first quarter of 2013, 9.7% of single-family residential mortgages were delinquent. Mortgage servicer Fannie Mae estimates that 7.5 to 9.5 million homes (pdf) are likely to go into delinquency in the next few years.

Foreclosures—particularly on a large scale—are terrible for communities. Homeowners frequently gut and abandon their homes, which soon become targets for squatters. Crime generally joins that. So Richmond is at serious risk; about half of its homeowners are underwater on their loans.

The city’s plan is therefore to use eminent domain to forcibly buy mortgages from banks and bond investors. Then—with the help of San-Francisco-based investment firm Mortgage Resolution Partners—it will reduce the principal homeowners have left to pay and refinance the rest, modifying the mortgages in a way banks can’t or won’t.

Banks, asset managers, and other financial services firms have been fighting tooth and nail against this policy ever since a variant of the idea was first presented in 2008. Their reasoning is hardly complicated; local governments would determine the fair values of mortgages (pdf) based not only on the initial value but the homeowner’s likelihood of default, and the banks will have to put the losses on their books.

And while Richmond itself is a small city—it plans to buy only 624 mortgages—it could set a precedent. If its move succeeds, it would likely set up a wave of mortgage seizures by municipal governments around the country. Cities in Nevada, Washington, and elsewhere in California have already expressed interest in following suit, though only Richmond has actually sent letters to mortgage bondholders threatening eminent domain.

However, this may end up being the best way for the public sector to hold Wall Street accountable for extending loans to homeowners who could not pay them back. The US Securities and Exchange Commission has managed to nab just one investment banker for “causing” the financial crisis, but has otherwise been losing steam (paywall) in its attempts to prosecute banks and hedge funds. A few years after a generous government bailout, many banks are raking in big profits, even as the rest of the US economy slumps along. Moreover, prosecuting big Wall Street firms swells the coffers of the federal government but doesn’t directly help struggling homeowners. Halting foreclosures does.

So is it finally time for Wall Street to face the music? Not so fast. Predictably, they’ll see Richmond in court (paywall).