“China’s shadow banking system”—it just sounds scary, doesn’t it? And the explosion of risky, undisclosed loans in China’s financial system since 2009 is certainly cause for alarm. As Quartz reported recently, unless China can bring its credit bubble under control with a mixture of deleveraging and market reforms, it could pose a significant threat to global growth.

Even worse, the complicated mechanisms of shadow finance can make the system even more volatile. As Michael Pettis, a professor of finance at Peking University, explained in a recent note, the “growth (and contraction) of the shadow banking system tends to be highly pro-cyclical and so is likely to make good times better than expected and bad times worse.”

Shadow credit is complicated, so here are some pictures

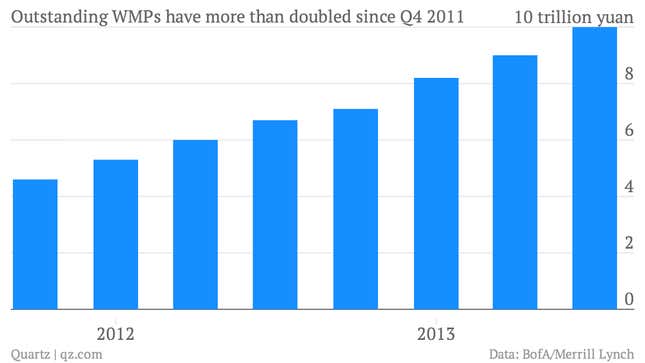

Let’s start with the main kind of shadow deposit, known loosely as wealth management products (WMPs). Chinese banks market these high-interest-rate accounts as an alternative to savings accounts, the annual yields on which the government limits to a puny 3%. That’s why customers have been plowing money into them like crazy:

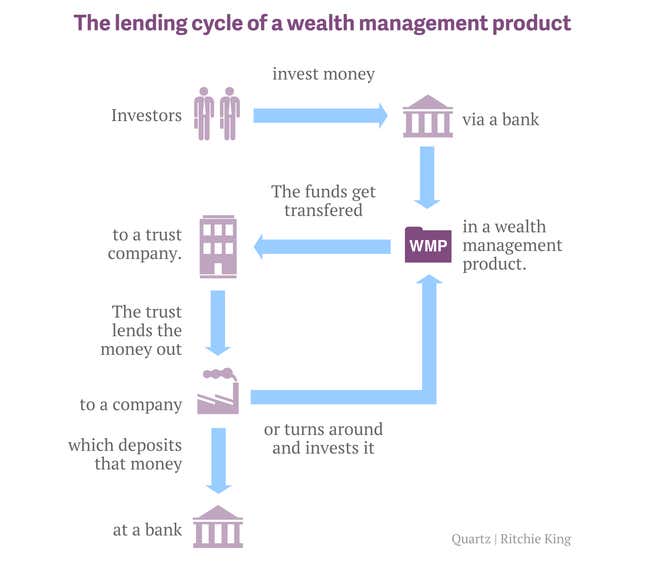

One reason WMPs offer higher rates is that they are based on riskier bank loans. And what makes WMPs shadowy is that banks don’t hold these loans on their balance sheets or set aside capital against their potential defaults. Instead, they typically extend them via intermediaries called trust companies—firms that are not allowed to accept deposits or formally loan out money, but are allowed to manage it. The trust companies create investment products like WMPs, which banks market for them in return for a commission. The trust then invests the money gathered through a WMP in a given company (we’ll call this sum a “loan” for the sake of convenience, though, legally speaking, it’s sometimes more like an equity investment).

Here’s a very rough sketch of how a trust-linked WMP, like the $469 million one that nearly defaulted in January, works:

The money multiplier and the RRR

The important thing to understand in the diagram above is what happens at the end of the cycle, when the company receives the loan. It might spend some of the money right away, and deposit the rest—either in a bank, or in another WMP.

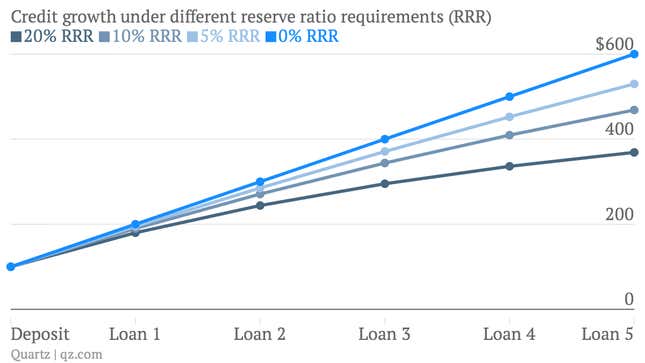

If it puts the money in a bank, the bank can then lend it out again, but only some of it. The Chinese government sets what’s called the reserve requirement ratio (RRR, or sometimes, liquidity ratio), a percentage of deposits that banks must withhold from lending.

The RRR is used both as a monetary tool and as a way to ensure that banks have enough liquidity in the event of loan defaults. China’s RRR is 20% for major banks, which is super-high by international standards, and often cited as a reason that Chinese banks are healthy.

So if a company deposits $100 in a bank account, the bank must set aside $20 and can lend out $80 to another company. That company uses some of the money, perhaps, but deposits the rest—and 80% of that gets loaned out to another company. And so on.

The higher the RRR, therefore, the lower the potential of any given loan to create extra credit, called the “money multiplier.” By keeping the RRR quite high, the Chinese government is trying to prevent loan growth from causing the supply of money to grow too large. Here’s a look at how much credit an initial $100 loan can create under different levels of RRR, assuming that each time a loan is disbursed, the recipient immediately deposits the total amount:

WMPs and crazy-quick credit creation

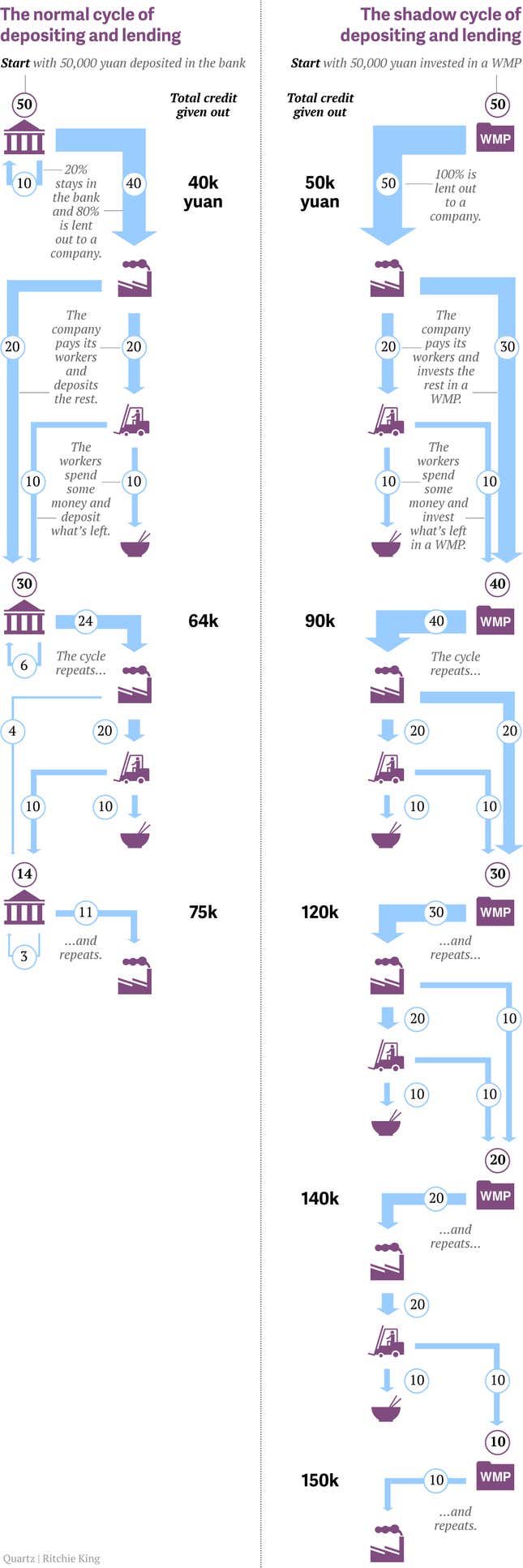

But what if instead of depositing its loan, the company turned around and invested in another WMP?

Since the WMPs operate off bank balance sheets, the RRR doesn’t apply. For example, if someone invests $100 in a WMP, which disburses $100 to a company, that company could in theory invest $100 in another WMP (presumably one that promises a higher interest rate than it has to pay on the initial loan). That WMP will disburse those funds to another company. In the official banking system, that first $100 deposit created $180 in credit in two lending iterations; in the shadow system, it created $200.

In other words, the RRR for WMPs is effectively 0%. An RRR of 0% has the potential to create a lot more credit than if banks have to reserve a set amount each time the new loan is deposited. In the chart below, we show what happens if 50,000 yuan ($8,250) is lent out via the official banking system, compared with what would happen if every time a new loan was extended, the recipient invested in a WMP:

The hazy nature of China’s shadow lending system makes it hard to tell how often the scenario on the right is mixing with the scenario on the left. Some analysts doubt official credit is commingling with shadow credit much at all.

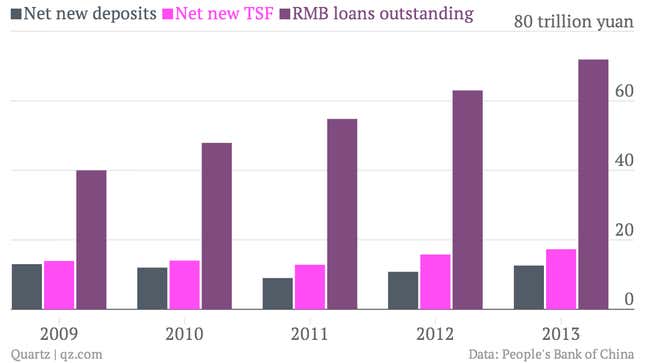

But if recipients of both official loans and WMP funds are putting their cash in bank deposit accounts and calling it a day, then it should be harder for banks to issue loans when their deposit base grows more slowly. And loan growth has increased much faster than deposits since WMPs because popular. Indeed, bank deposits are barely increasing, but banks are lending more than ever.

The government has been threatening to crack down on the shadow lending that’s fueled by these WMP investment flows. And with good reason; the shadow sector enables wasteful, overly risky lending that ups both the risks of a financial crisis and the likely impact if one hits. But Pettis argues that plugging up shadow channels could come with unintended consequences.

“These same mechanisms will force the PBoC into unplanned ‘tightening’ as it takes steps to regain control of the shadow banking system,” he writes. “The net impact is to imbed a highly pro-cyclical mechanism into the national balance sheet that, like all pro-cyclical mechanisms, will increase volatility both on the way up and on the way down.”

In short, adding funds to the WMP channel has been making credit grow at a higher-than-normal multiplier—and for long enough now that it’s become the norm. Blocking that channel would therefore arrest the pace of credit growth that China’s financial system has long since become used to. If Pettis is right, in order to offset the rapid slowdown in credit growth, the government will need to loosen monetary conditions to allow more official lending at the same time as it cracks down on shadow lending. The People’s Bank of China has the tools to do this, but if it wrongfoots the timing, the bad times ahead are likely to be much worse.