Lagging soda sales in the US are a given nowadays. But it’s another thing entirely for soda sales to drop worldwide.

Coca-Cola sold less soda globally through the first three months of 2014 than it did a year earlier. It’s the first time that’s happened since 1999—or, in other words, in roughly 60 quarters. Coke’s soda pop sales dipped by 1% in the US, which at this point has become a virtual expectation (to the delight of public health advocates, who say this trend contributed to a drop in child obesity rates). But the company’s soda sales also dipped in Europe, as well as in Mexico, where a newly minted soda tax has made them a good deal more expensive.

“As far as Mexico is concerned, I think sparkling volume for us was sort of in the mid-single-digits decline for the first quarter,” CEO Muhtar Kent told investors yesterday morning.

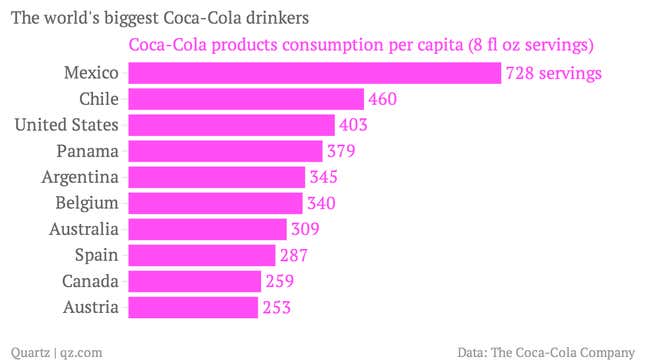

The fall in Mexico is particularly disconcerting to Coca-Cola. Mexico’s new soda levy tacks on an extra peso ($.08) per liter to all soft drink sales in the country. The move is meant to help address the country’s obesity epidemic—over 70% of Mexico’s population is now overweight. If that initiative succeeds in curbing soda consumption, it will also shave off a sizable portion of the largest soda-maker’s sales in the country. For Coca-Cola, that’s a major problem. No country downs as many of Coca-Cola’s beverages per capita as Mexico. In fact, it’s not even terribly close:

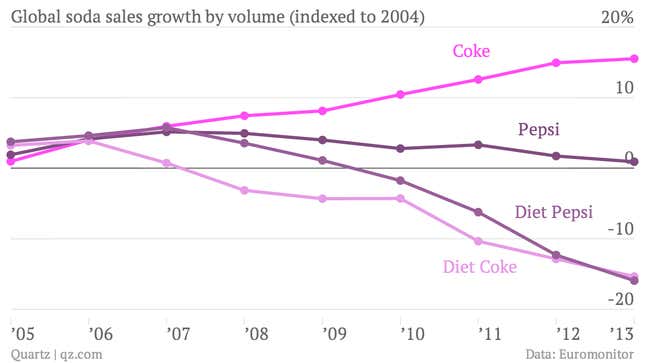

Coca-Cola CFO Gary Fayard told Yahoo that the global sales decline is ”not as concerning to us [Coca-Cola] as it would look at first pass.” But a sustained, simultaneous drop in both American and Mexican Coca-Cola consumption could reverse what has otherwise been a strong last decade for the company’s most popular product—especially if the decline continues in Europe, where it fell by another 5% this past quarter. Coca-Cola sales have risen by roughly 15% since 2004. But they slowed last year, and, Diet Coke, the supposed savior of the soda industry, hasn’t been selling like it used to.

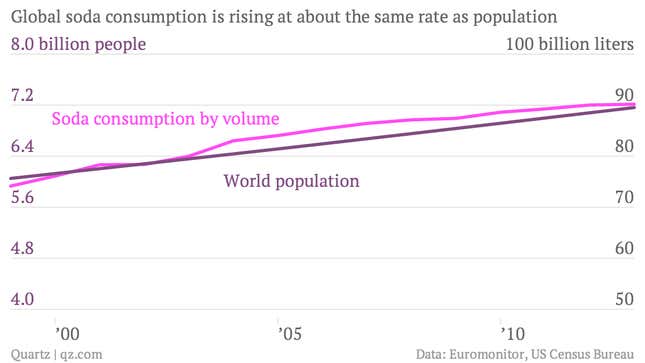

There’s some reason to believe some soda drinkers aren’t shunning soda altogether, but rather turning to smaller, niche offerings. Global soda sales have climbed by about 18% since 2000. So per capita consumption has remained pretty level.

That being said, there is plenty of reason to believe some soda drinkers are indeed skipping the carbonated cans for other refreshments. Energy drink sales, for one, are soaring. They’ve grown by 5,000% over the past 15 years. People—though Americans especially—are also buying more bottled water. That’s good news for Coca-Cola because it also sells bottled water. An 8% jump in volume of non-carbonated beverage sales meant that overall, the world’s largest soda-maker beat out expectations this past quarter—making up for the drop in soda sales by selling a bit more of everything else.