Coffee doesn’t appear to be cutting it these days.

A growing thirst for caffeinated “energy” drinks, which include the likes of Red Bull, Monster, and Rockstar, has spurred a heart-thumping surge in sales. Globally, the energy drink industry has gone from a $3.8-billion business in 1999, to a $27.5-billion business last year, according to data from market research firm Euromonitor. That’s a more than 620% jump.

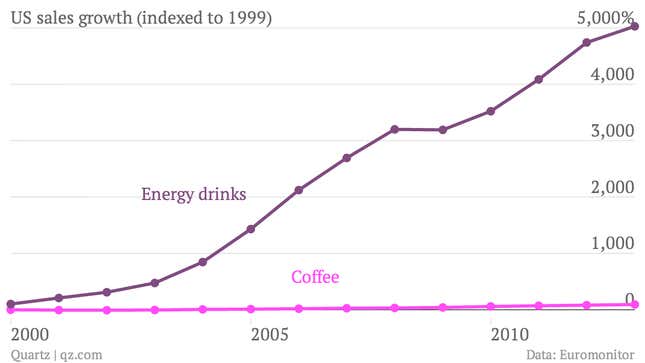

But no one is crazier about the bubbly—and potentially dangerous—caffeine-packed cans than Americans. In the US, energy drink sales have grown by more than 5000% since 1999.

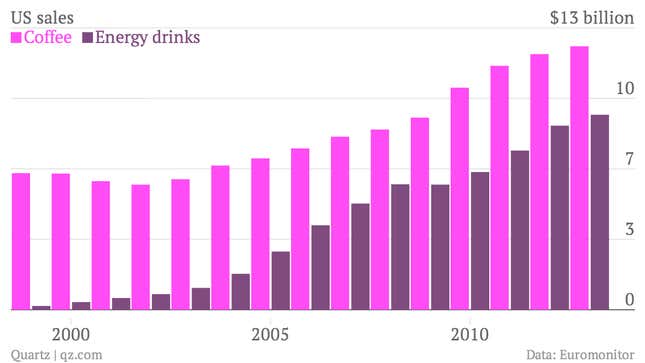

While the energy drink industry was much smaller circa 2000, it wasn’t non-existent—the market raked in more than $350 million that year. Caffeinated sodas, like Jolt Cola, have existed for years. But the introduction of Red Bull in 1997, and the many other energy drinks that followed in its footsteps, have helped turn the industry from a big one into an enormous one.

The rise of Red Bull and Monster, which accounted for nearly 80% of US energy drink sales last year, is such that the energy drink category now legitimately rivals our old-fashioned caffeine delivery system—coffee. In 1999, coffee sales in the US outpaced energy drink sales by a factor of nearly 36 to 1. This past year, coffee sales came in at just above $12 billion in the US, while energy drink sales were just below $9 billion—a gap of less than 1.5 to 1.

It’s not unreasonable to expect the two to eventually overlap. Over the next five years, energy drink sales are slated to continue growing at about twice the rate of coffee sales, according to Euromonitor.

What’s so cool about energy drinks? Well, obviously, they have caffeine—and plenty of it. Sometimes, they even have more than advertised. They have become staples at colleges, where under-slept students crave alertness. But they are also being heavily marketed as morning coffee alternatives, and are mixed with any number of alcohols at night. As Murray Carpenter notes in his book Caffeinated, there’s plenty of precedent for the nightclub staple of Red Bull and vodka, or of convenience store canned drinks such as Four Loko, which originally contained roughly six beers and hefty amounts of caffeine and was banned in some US states. ”Americans have had a long history of mixing alcohol and caffeine,” Murray writes, citing coffee-flavored liquor such as Kahlua.

When it comes to drinks, consumers are looking for a bit more than deliciousness these days. “The question has become, ‘what can a beverage do for you?’ As opposed to merely, ‘what does a beverage taste like?'” Jonas Feliciano, an industry analyst at Euromonitor told Quartz.

There’s also the possibility that Americans are getting amped because it’s seen as manly to down something that keeps the eyelids open a bit wider. “The macho image linked to energy drinks is a potential influence here,” a report by market research firm Canadean noted earlier this year.

No matter the impetus, the success of the energy drink industry is undeniable. It has even inspired spinoffs and riffs. The energy shot market, which is dominated by 5-hour energy, is now an over-$1-billion business in the US in its own right. “Energy shots took off because of energy drinks,” Chris Schmidt, a consumer health analyst at Euromonitor said. “If you’re a white collar worker, you’re not necessarily willing to down a big Monster energy drink, but you may drink an energy shot.”

The industry is basically intent on reaching as many demographics as possible. Caffeine—or “energy,” as it’s more popularly branded—can now be found in everything from gum to mints, water, jellybeans, and even bacon maple lollipops.