There has been a massive amount of hype about the Alibaba IPO this week. And fair enough, it’s the biggest IPO in a long time (it could end up being the biggest ever), and it involves a massive and mysterious Chinese company.

Arguably, one aspect of the deal being overlooked is the chain reaction that it could set off. Obviously, a successful offering would bode well for future IPOs, from China and elsewhere. But it could also be the catalyst for a lot more…

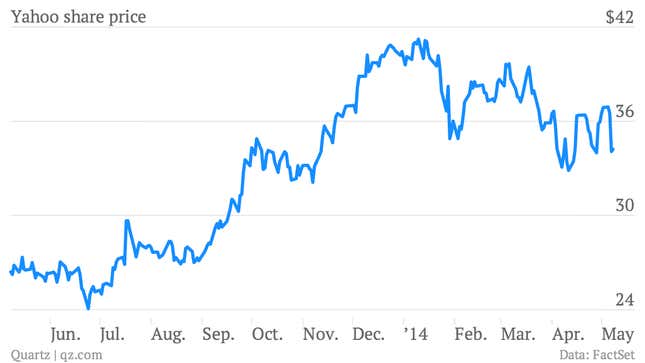

Yahoo is in line for a massive windfall

Yahoo owns about 24% of Alibaba and is expected (but not necessarily obliged) to sell 40% of that stake into the offering. With an expected cash windfall in excess of $10 billion, chief executive Marissa Mayer could buy back more stock, pay out a special dividend, acquire more companies (Yahoo has been loosely linked with the likes of Yelp and Pinterest), or invest in things of its own (like original content). Or pursue a combination of all of the above.

As we’ve argued before, its probably the biggest decision she will face in the job.

So is Softbank…

The Japanese telecom behemoth’s 34% stake in Alibaba (incredibly, it first invested just $20 million) is worth an estimated $58 billion. The company’s ambitious CEO, Masayoshi Son, has pledged to hold on to the entire investment, for the time being at least. “Of course that doesn’t mean we promise to hold it forever, but for now we consider Alibaba a core strategic partner,” he said this week according to Reuters.

…as it eyes T-Mobile US…

Son has made no secret of his desire to see US wireless carrier Sprint (in which Softbank already owns a majority stake after a takeover last year) combine with T-Mobile, the US’s fourth-largest carrier. A formal bid is expected in June or July, Bloomberg has reported. Any deal is likely to be debt-financed. But Softbank’s stake in Alibaba could prove useful in the future if it wants to reduce its debt, or invest in spectrum and infrastructure.

…which Deutsche Telekom owns

The German telecom, which would have to agree to sell its majority stake in T-Mobile to Softbank, is either playing hard to get or signaling that it thinks a deal is unlikely.

Alibaba’s rival Tencent could be affected…

Alibaba’s main competitor in Chinese e-commerce (particularly in mobile) is probably Tencent, which owns the fast-growing WeChat messaging platform and 15% of JD.com. Tencent actually wrested market share away from Alibaba last year, according to Euromonitor. We don’t yet know how much Alibaba will actually net in proceeds from the IPO, since a lot of shares will be sold by existing stockholders like Yahoo (proceeds of which will not go to Alibaba). Reuters has reported that the company will sell new shares as it seeks to “bulk up a cash war chest depleted by a rash of recent acquisitions.” That new capital could be used by Alibaba to win back momentum in China.

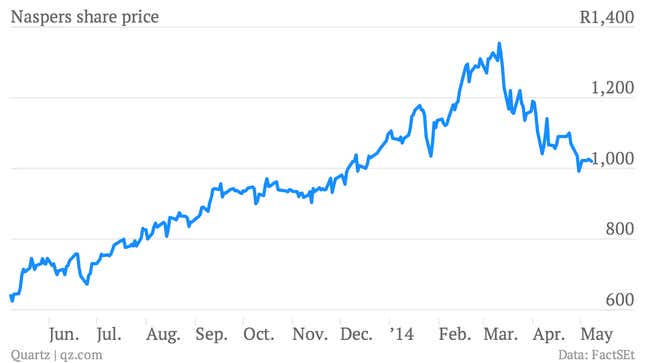

…which would impact South Africa’s Naspers

A bit like the situation with Yahoo and Alibaba, Naspers—whose dark history we explored earlier this year—owns 34% of Tencent and its shares have become a proxy for the Chinese company. If a reinvigorated Alibaba hurts Tencent, Naspers will also suffer.