Is China facing a US-style housing crash and banking crisis? Unlikely, Zhu Haibin, an economist at JP Morgan, told Xinhua on May 16; China’s not about to have a wave of mortgage defaults. And Zhu’s probably right—if you’re only talking about mortgage defaults.

The problem is that Chinese banks also use property as collateral for a lot of loans that aren’t mortgages. (In other countries they might ask the borrower for an income statement instead, but these aren’t too reliable in China.) At the end of 2013, 38% of the value of outstanding loans (paywall) issued by big commercial banks used real estate as collateral, according to China’s banking regulator. That’s roughly 28.8 trillion yuan ($4.6 trillion) in loans.

And it’s likely much bigger. The regulator’s data counts only loans to developers or individuals—overlooking some of the companies in unrelated sectors that invested in property for profit, as well as the untold sums of shadow loans issued off bank balance sheets and supported by property collateral.

What all this means is that, if the property market continues to slide and the slowing economy makes it hard for borrowers to pay back those debts, banks with defaulting borrowers will be left with collateral worth only a fraction of what they’re owed. And then, as banks try sell off this collateral en masse, prices will plummet still further, causing a vicious cycle.

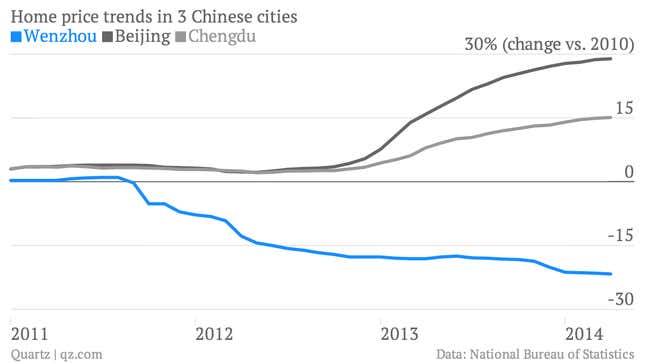

That’s what happened in the Chinese city of Wenzhou in mid-2011, when a rash of corporate bankruptcies left banks unloading real estate to salvage their loan books, crashing Wenzhou’s housing market. As you can see, it still hasn’t recovered:

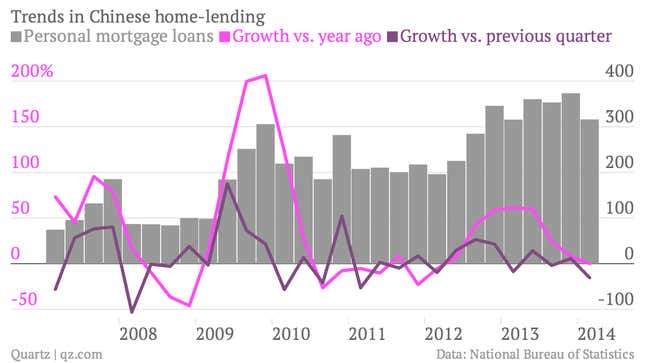

But while property collateral is a more serious threat to China’s financial system than a wave of mortgage defaults, mortgages could still hit banks hard.

Housing prices have soared so much that nearly four-fifths of the average family’s income (paywall) goes toward mortgage payments, according to Ha Jiming, Goldman Sachs’ vice-chairman for China. Only four years ago, that share was two-thirds. If a slowing economy leads Chinese families to cut back on spending, their loan payments will likely slide.

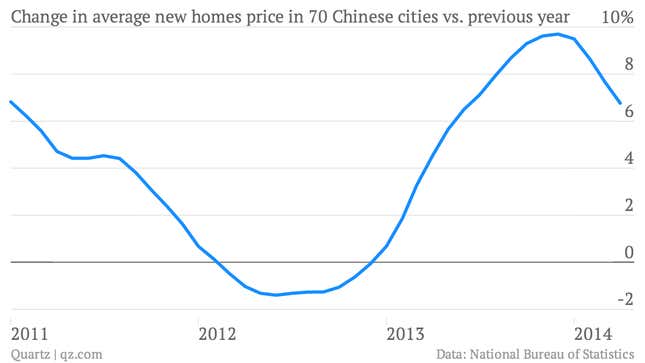

As for whether China’s market is really faltering, here’s the round-up of the latest news that provides a pessimistic snapshot:

- New home prices fell in eight of the 70 big cities tracked by the government, versus the previous month; in March, only four cities reported decreasing prices.

- Only 28% of China’s 110 domestically listed property companies reported net cash inflows from operations in Q1 2014, says Goldman Sachs Gao Hua, a securities firm.

- A plot of residential land in Nanjing failed to sell at auction (link in Chinese) even though the starting prices was 9,175 yuan/square meter. A neighboring plot went for 12,927 yuan/square meter only last year.

- New stock of commercial housing in 35 major cities tracked by E-House, a real-estate research company, hit a “record high” in April (link in Chinese) of 249 million square meters—nearly 20% higher than in March. More inventory tends to mean lower prices.

- A manager at a large state-owned bank in Shanghai reported a recent uptick in owners of high-end property stopping their mortgage payments (link in Chinese).