Look out below! On Wall Street, revenue from fixed-income trading is dropping fast. And the outlook for the second quarter isn’t good. If it seems like a replay of the first-quarter results, that’s because it is–only worse.

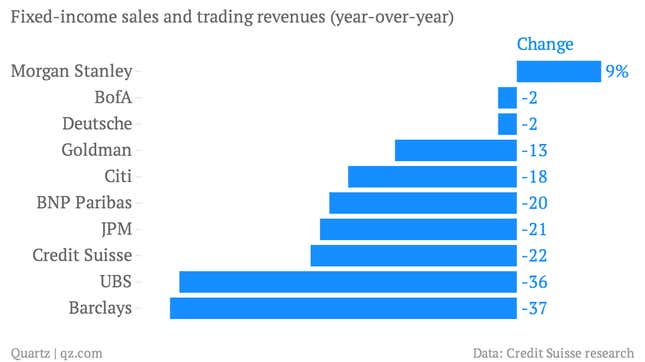

Credit Suisse delivers the latest grim predictions, in a report released today, noting the trading divisions at major financial institutions are in a serious tailspin. In the research piece, Credit Suisse forecasts that revenue in the fixed income, currencies and commodities groups (FICC) —where the bulk of Wall Street trading is done—may be down by as much as 20% year-over-year, when the second quarter ends next month. This is a particularly grim prediction given that the biggest banks in the industry already reported first-quarter results in trading that were pretty bad. Here’s a look at the first-quarter results.

The lone standout: Morgan Stanley, which managed to post a year-over-year 9% improvement in its trading revenue. It’s important to note that Morgan Stanley’s results were given a lift by strength in commodities but also a weaker performance relative to its peers in the prior year quarter.

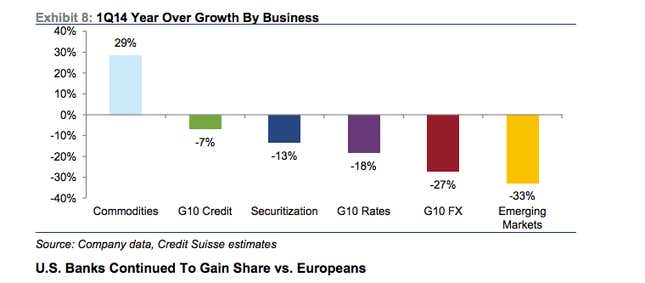

Indeed, during the first quarter commodities also turned out to the strongest area of fixed-income trading for banks, with other areas like emerging markets and currency trading lagging badly relative to a year ago:

Credit Suisse is forecasting that commodities revenue likely will be stronger than a year ago in the second quarter but weaker than this year’s first quarter, which was driven by unseasonably cold weather.

Over the past few weeks, bank officials have been spotlighting a lack of trading appetite, driven by uncertainty about the outlook for the US and global economies. These points have been voiced most recently by both Goldman’s president and chief operating officer Gary Cohn yesterday and Citigroup’s chief financial officer John Gerspach on Tuesday. Bank officials indicate that low trading volume is continuing to drive revenue lower.

Of course June could prove a stronger month, but I wouldn’t bet on it. Citigroup is forecasting as much as a 25% decline year-over-year in its trading business. Deutsche Bank expects a 10% decline. JP Morgan has warned of a 20% drop in trading revenues.