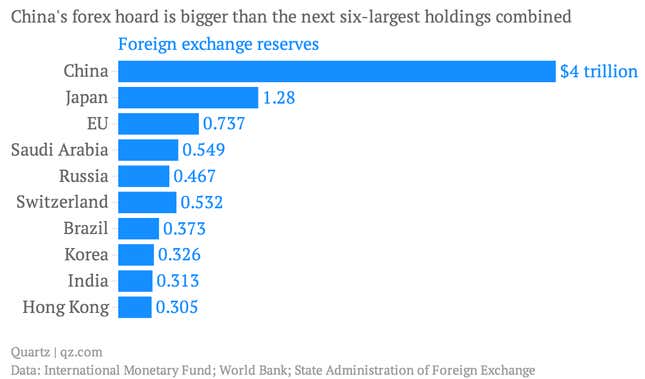

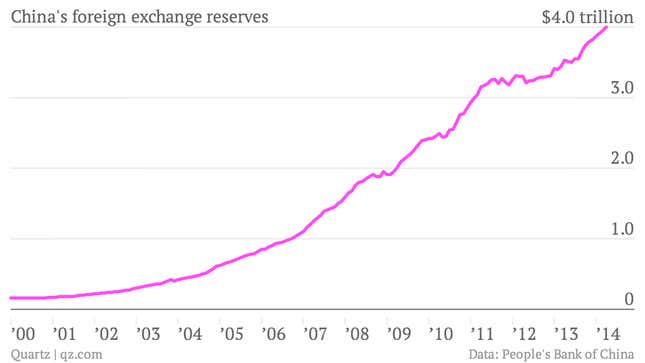

China’s foreign-exchange reserves hit $4 trillion in the second quarter of 2014, according to Chinese government officials. That’s so massive it exceeds the next six biggest national reserves combined; so huge that it equals nearly half of China’s GDP.

It certainly sounds impressive. But China’s foreign currency reserves are not just money lying around to be used for anything. Understanding what they can and can’t be used for highlights the fact that they’re not the bulwark of Chinese financial stability that many assume.

What China can do with $4 trillion

“Reserves are less powerful than maybe people think they are because they’re really only good for one or two things,” says Andrew Polk, an economist at the research group The Conference Board. Here are some of the things they can be used for:

- Currency “defense”: A currency’s value falls when people sell it for other currencies—a.k.a “capital outflow.” A weaker currency can be good in that it makes exports more competitive. But it also diminishes people’s confidence in the country’s economy and can leave companies with foreign-currency debt owing a lot more than they planned (more on China’s external debt here). A country can prevent that weakening by buying its own currency—keeping its value stable—and using some of its foreign reserves to pay for it. In other words, whenever China wants to prevent the yuan from shedding value against the dollar, it can swap some of its foreign-exchange reserves for yuan, increasing the domestic currency’s value.

- Cheap borrowing: Dangerous things can happen when people suspect a country can’t afford to pay its foreign debts, both sovereign and commercial. As we mentioned above, a sharp drop in the value of the yuan would make it hard for Chinese companies to pay foreign debts—and that suspicion alone will drive up borrowing costs. China’s enormous reserves means most people assume both that the yuan won’t drop in value, and that the government guarantees the obligations of state-affiliated companies. And that means the government and many Chinese companies can borrow cheaply.

The big danger those dollars can’t forestall

Many assume that foreign currency reserves can be used to bail out banks in the event of a financial crisis. This isn’t a totally daffy conclusion to draw; between 2003 and 2005, China injected some $60 billion of its reserves into debt-swamped Chinese banks via some fancy accounting.

But it wouldn’t be so easy this time, as Capital Economics, a research firm, flags in a recent note. Here’s what those foreign currency reserves can’t do:

- Reserves aren’t a pool of rainy-day money. As we’ve explained before, in order to buy the dollars that come into China, the People’s Bank of China has to print money. When you print a lot of money and then hand it over to banks bringing you the dollars they bought from exporters, you cause inflation, which can collapse an economy. So in order to purchase those dollars, the PBoC “sterilizes” them, buying the dollars not with hot-off-the-press yuan, but with central bank bills—agreements that the PBoC will pay the bank whatever the equivalent amount in yuan is. If the PBoC up and decides to use its dollars to pay for banking bailouts, it still’s on the hook to pay those bank bill obligations. That wouldn’t mean the PBoC would immediately go bankrupt. But it would mean that the Chinese government would ultimately have to find a way to pay for those debts.

- Recapitalizing banks with dollars means having to buy those dollars twice. Handing Chinese banks a bunch of dollars is what Capital Economics calls a “stopgap measure rather than a final solution” since at some point commercial banks would need to swap these dollars for yuan. Since the yuan’s not freely traded, the PBoC is the only potential buyer—which means it will have to buy those dollars with newly printed central bank bills all over again. Adding this to the fact that the yuan’s steady strengthening against the dollar has forced the PBoC to take losses on its foreign-exchange reserves already, eventually the PBoC’s debt obligations will exceed its reserves.

- The alternative is causing massive deflation. The PBoC could in theory raise yuan to recapitalize banks by selling its dollars for yuan first. But by draining yuan from circulation, that would suck up the liquidity that’s currently keeping the financial system’s engines running. Even though demanding yuan should in theory cause inflation, the sudden vanishing of yuan would be heavily deflationary.

- And $4 trillion simply might not be enough cash. Officially, Chinese commercial banks’ bad loans make up only 1% of total outstanding loans. That sounds very comforting, but it’s also risibly wrong. Chinese banks are notorious for rolling over loans and undercounting bad debt. Even if the PBoC could use dollars to recapitalize its banks, at 18% of China’s total outstanding debt, they very likely wouldn’t be enough.

If banks start needing bailouts, there’s nothing saying that the PBoC absolutely cannot use its foreign exchange reserves to give them new money. Through more deft accounting, it certainly can gradually reshuffle money around. And it can do so in ways that don’t even look like a typical banking bailout.

However, that would ultimately mean shifting corporate debt onto the Chinese government’s already expanding balance sheet. And as Japan’s eerily similar debt surge a couple of decades ago showed, no amount of foreign reserves can help once a government starts drowning itself in debt.