The Reserve Bank of India (RBI) is one of the few institutions Indians respect (paywall). India’s central bank is known for being clean, sensible, and well-run. It is also extremely cautious. That is one reason India has remained a laggard in the mobile money revolution sweeping the poor world.

That may soon change. The RBI this month issued a set of draft guidelines (pdf) for the establishment of a new kind of bank in India, called a “payments bank.” Such banks would not be allowed to lend—one of the core functions of anything that usually wants to call itself a bank. Instead, they will be restricted to accepting and cashing out deposits and remittances. And the first to apply for these licenses will be mobile operators.

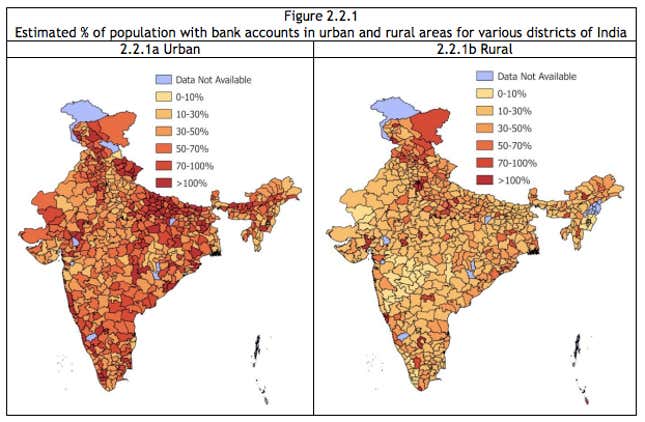

India has remained a laggard in mobile money services because Indian regulations have required mobile operators work with banks to dispense hard currency, preventing them from using their distributors and agents to cash out money sent through their networks. That has hampered the growth of the industry because Indian banks are lousy when it comes to serving the rural population that would most benefit from using mobile money accounts. After all, what’s the point of transferring money electronically if the payee still needs to trudge to the nearest bank branch—which can often be several miles away—in order to get cash in hand?

Under the new regulations, a variety of entities, including mobile telephone companies and supermarket chains, will be eligible to become payments banks. That means India’s unbanked poor, who have remained locked out of the financial system, will finally be able to open accounts and store money electronically. Indeed, one stipulation for the new kind of bank is that it must have at least a quarter of its access points (which includes agents, if not necessarily full-service branches) in rural locations with a population of fewer than 10,000 people.

“It would mean if you want to remit money to your uncle in your village, or receive money from your brother in Dubai, you can do that,” said Nachiket Mor, who chaired the committee that drafted the report suggesting payments banks, in an interview with the Financial Times (paywall). “It would be basic banking for the masses, and it would be hugely popular.”

For migrant workers who have had to rely on slow postal money orders, expensive third-party transfer services, and informal remittance services, payments banks will mean a simpler, safer way of sending money home. For the many mobile money service providers—India has 15 services, second only to Nigeria—that would mean being able to realize the full potential of their networks. That could see revenues rise anywhere from 1% and 8%, according to a Credit Suisse estimate.

The shift will also bring real competition to the sector. Customers will make choices based on the size of the operators’ agent networks and their service fees—which will mean that not all mobile money operations will survive.