It has been a while since market watchers could report a large ruble rally. But earlier today the Russian currency notched its biggest one-day gains against the dollar since 1999, and it seems to be holding onto its sizeable—and rare—gains.

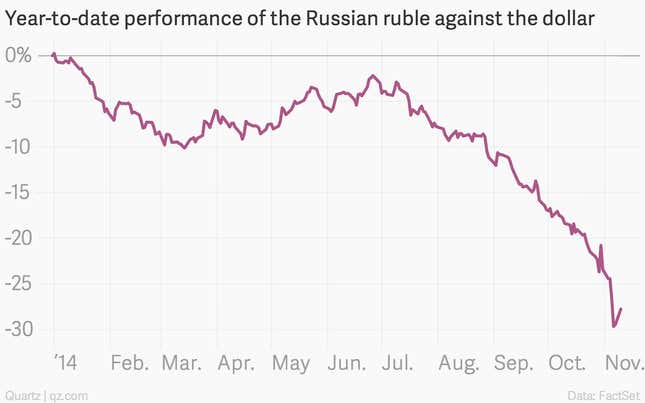

Mind you, a 3% gain in one day isn’t much when the currency has already lost nearly 30% of its value so far this year:

Today’s rally may seem odd, given the central bank cut its economic growth forecasts, boosted its estimates for capital outflows, and pushed out the deadline for bringing inflation down to its target level. Separately, the bank said it would stop automatic interventions to prop up the currency, responsible for burning up $30 billion in reserves in a futile effort to stem the ruble’s slide last month.

What gives?

One name, two words—Vladimir Putin. The Russian president spoke out about the exchange rate today, supporting the central bank’s somewhat muddled policy statements. He decried “speculators” pushing down the ruble’s value and said that the central bank stood ready to defend the currency if need be. He doesn’t often sound off on such matters, so the comments were seen as an important endorsement of the country’s beleaguered monetary authority.

For a variety of reasons, a weaker ruble helps Russia in the short term, as we have recently explained. But the way that the central bank has cut its currency loose suggests a policy hatched on the fly, which does not inspire confidence that it can get a handle on things in the long term. In a matter of weeks the bank went from tweaking its target trading bands to capping the level of daily interventions, to—today—letting the currency float freely. Central banks are generally not known for revising key policies so quickly and unpredictably.

The bank previously suggested that a free-floating ruble would only come at the start of 2015. It looks like it now wants to keep its powder dry, dipping into its $400 billion-plus of reserves only if a renewed slide in the ruble threatens financial stability.

In a sense, it is daring the markets to test it, backed up by the country’s highest authority figure, who is hardly a shrinking violet.

Who will blink first? The rally today suggests that traders see the threat issued by Putin as credible, or it might just be a reaction to a good day for oil prices. Looking ahead, Russian companies need to redeem huge piles of dollar-denominated debt, which will keep downward pressure on the ruble. Renewed fighting in eastern Ukraine doesn’t bode well for the lifting of Western sanctions on Russia. The remedy for curbing inflation stoked by the weak ruble—interest rate hikes—risks slowing Russia’s already stagnant economy.

Markets have short memories, but the ruble has been falling so steadily for so long that it won’t be easy for Putin and other officials to convince investors that they have suddenly devised an effective strategy for stabilizing it.

But it also takes brave souls to accuse a tough-talking former KGB agent of bluffing.