Last August, president Barack Obama strolled up to a mechanical engineer visiting the White House. Ann Marie Sastry, in town from Michigan for “Demo Day,” an exhibition of potentially game-changing American inventions, had something to show him.

As cameras snapped, Obama examined the coin-size piece of technology on display before him, and Sastry described the feat it represented: Her startup, Sakti3, had built a cell with double the energy density of commercial lithium-ion batteries.

Her batteries, developed with an eye toward the electric-car market, would first go into household appliances and consumer electronics, she told the president, “and after that, the sky’s the limit.”

While the invention was not quite ready for the market, it was welcome news for Obama, for whom the electrification of the US car fleet has been a priority since the start of his administration, stymied by a stumbling block—the high cost of powerful batteries.

“Have you solved it?” the president asked.

“We believe so,” Sastry replied. The two briefly discussed how the company could “scale up” its breakthrough, and then posed for more pictures.

Seven years after launching Sakti3, Sastry is one of the highest-profile executives in advanced batteries. She has spoken before TedX, and been profiled in the Wall Street Journal and Scientific American. She had her startup named the 23rd-smartest company of 2015.

And then on Oct. 15, two months after her White House visit, Sastry startled the battery world by selling Sakti3 to Dyson, the UK-based appliance company known best for its cordless vacuum cleaners, for $90 million in cash.

But there is still no public evidence for important aspects of the claims Sastry has made to Obama, or anyone else. The energy-density breakthrough she described that day at the White House may have been achieved at lab scale, but she has offered little substantiation of this.

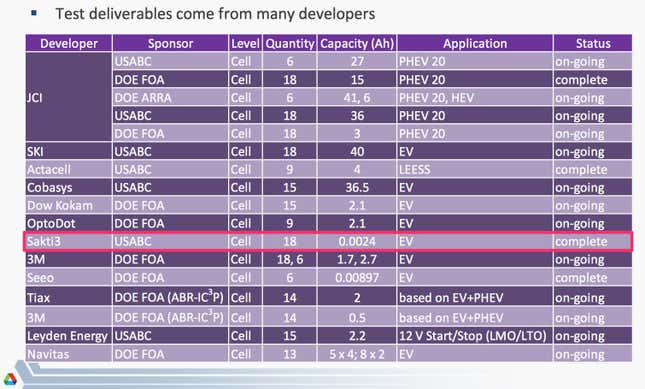

The most recent—and perhaps only—independently verified example of Sakti3’s work is much more modest: As of 2014, Sakti3’s apparent best cell (pdf, slide 6), submitted to the US Department of Energy (DOE), could power only a tiny medical implant, of a size meant for the human brain, experts say. In the remote chance that such cells were optimized for an electric car, some two million would be required at a cost of millions of dollars at current prices.

Meanwhile, Sastry has yet to publicly release a sample or disclose detailed data on a commercial battery of any size, let alone one capable of powering an electric car—or even a vacuum cleaner.

The cell tested for the DOE was itself deemed a failure: The $1 million project through which it was produced was canceled prematurely when Sakti3 failed not only to show progress, but to replicate baseline claims made in its original proposal, people involved told Quartz.

Behind one of the industry’s most inscrutable companies is an executive whose guardedness has bred intense skepticism from peers and independent battery experts.

In an industry riven with exaggeration and outright lying, Sastry’s resistance to sharing even seemingly innocuous performance data—including with her own employees—has prompted suspicion that she is evasive for reasons no more complicated than that she has little impressive to disclose. ”She is very good in terms of selling herself and her vision, and quick and adept at shifting the conversation,” said Cosmin Laslau, an analyst with Lux Research, a Boston-based technology consultancy that has recommended that clients “treat Sakti3 with caution because of its unproven production process.”

Sastry, who declined requests to be interviewed, suggested in a brief telephone call in August that she had no obligation to disclose internal details about her company before it has a commercial product.

But the wariness expressed by her critics undercuts what has been widely portrayed as one of the best chances for struggling lithium-ion batteries finally to break through and bring on an electrification revolution with cross-cutting benefits ranging from new jobs to a reduction in greenhouse gases.

Dyson conducted due diligence before acquiring Sakti3, according to a document describing the merger, and USA Today reports that the British company now plans to build a major battery plant, possibly in Sakti3’s home state of Michigan, at a cost of up to $1 billion. But the buyout itself raises a perplexing question: In an age of routine billion-dollar tech deals and global fever for electric cars and clean-energy research, how did one of the few perceived jewels of advanced batteries sell for less than $100 million—to a vacuum cleaner company?

Batteries have been having a hard time

The story of Sakti3 has tracked the more than half-decade-long, high-stakes global chase for a leap in battery technology to power mainstream-priced electric cars and help deliver electricity at urban scale.

After numerous setbacks, an industry consensus has recently formed, voiced most consistently by Tesla CEO Elon Musk, that a battery breakthrough isn’t likely anytime soon. Lithium-ion batteries still will become cheaper in coming years, only not because of innovation in the lab. Instead, it will be thanks to engineers tinkering on the factory floor.

The prospect for advances in manufacturing technique, as opposed to battery technology, is largely what has led Musk to forecast a 50% drop in battery costs with the construction of Tesla’s future lithium-ion “gigafactory” outside Reno, Nevada.

Despite all the skepticism, the hope for battery science has persisted. The governments and private sectors of the major industrial nations—the US, Germany, Japan, China, and South Korea—have continued to fund battery research. The common goal is to push down battery costs to about one-fourth the current level, or $100 per kilowatt hour. At that point, according to the DOE, electric cars will finally compete head to head with the gasoline-fueled internal combustion engine.

Basic physics prevent current lithium-ion technology from achieving such cost savings. The next best chance, many experts believe, is a solid-state battery. By definition, this simply means eliminating the battery’s liquid electrolyte—the volatile substance behind the fires that have plagued lithium-ion—and replacing it with a solid, such as a polymer.

If this can be achieved, the benefits would be go beyond safety. Foremost, a solid electrolyte could allow for the use of a powerful metallic lithium electrode instead of the current standard graphite, an advance that, because of added energy density to the battery, could by itself boost electric cars into the mainstream.

Lithium-ion batteries contain two electrodes, but until now no one has figured out how to safely make one of them out of difficult-to-manage metallic lithium. Solid electrolyte promises to be the method that works. In addition, some entrepreneurs, including Sastry, have been working to pair solid-state technology with cheap silicon-wafer manufacturing, for a blockbuster product that would be extremely powerful and relatively inexpensive.

At the start, the money came ‘no questions asked’

Sakti3 goes back about a decade to the University of Michigan, where Sastry was an engineering professor. Fabio Albano, one of her doctoral students, wrote a 2008 dissertation describing a solid-state micro-battery. It was two square millimeters in size, perfect for a cochlear implant, an intraocular sensor in the eye, or for the brain to monitor Parkinson’s disease. Cost wasn’t factored into the research, Albano told Quartz. Instead, the aim was to create a battery without flammable liquid electrolyte that would therefore be safe in the human body.

Impressed, Sastry asked other students to do some mathematical modeling of how such a battery would be engineered. There seemed to be no obstacle to scaling up a solid-state battery that would produce a significant increase in energy density over conventional lithium-ion.

In 2007, applications were filed for two patents. With electric cars on her mind, Sastry asked Albano if he wanted to co-found a startup based on the work. The timing was propitious: It was the front end of a battery frenzy in Silicon Valley, and Sastry hit paydirt—$2 million in funding from venture capitalist Vinod Khosla.

Khosla’s firm demanded little hard data, Albano said, and that fit Sastry’s strategy. “We were after the higher-risk-tolerant VCs who didn’t demand a lot of detail,” Albano said. “We got the $2 million with no questions asked.”

Neither Khosla nor Samir Kaul, his partner who was closely involved in the investment, responded to Quartz’s requests for a comment.

Solid state was great—until you tried to scale it up

There is one major problem with solid-state battery material. Lithium ions do not move easily through it, not compared with liquid electrolyte anyway. And the ions must move relatively quickly in order to power any device, particularly a car.

The solution around which most researchers have coalesced is making the solid electrolyte ultra-slim, so that the lithium-ions, even if they do move slowly, do so through only a little bit of material. The method calls for the use of thin films, the width of a few dozen or even a single micron.

Pioneered in the late 1980s at Oak Ridge National Laboratory, the thin-films approach borrows from the manufacture of potato chip bags, silicon wafers, and solar cells; the idea is to use thin films not only for the electrolyte, but for the two electrodes that comprise a battery as well.

The manufacturing process is called vacuum deposition. A vacuum close to that of outer space is created within a chamber, and a material is deposited onto a substrate. The objective is to keep out any contaminants. With potato chip bags, the process is relatively easy—the aluminum lining is 50 to 100 microns thick and, since a sterile environment is unnecessary, the lines can move at a fast 1,000 meters a minute.

But semiconductor wafers must be made with extreme sterility and precision—any particle in the air could create a defect, thus ruining the chip. The process can take 15 to 20 minutes per layer.

Batteries are even harder, though. They require the same sterile environment as a silicon wafer, and the same, slow processing. But, unlike silicon wafers, battery electrodes have to be thick—the volume of dense, lithium-rich material is what makes a battery energetic. So you need to stack numerous single-micron-thick layers, each representing an individual battery, especially if you want to reach the $100-a-kilowatt-hour goal. It can take an hour or longer to put down each layer.

No one working with Sastry knew how to do any of this. She needed specialists. So she went headhunting.

‘Within two years, there would be an IPO’

In 2010, Steve Buckingham, an expert in the characterization of solid-state materials, was working for an Atlanta company called Excellatron when he heard from a headhunter about a new business looking to staff up. For Buckingham, the timing was opportune—Excellatron was struggling, and he needed a lifeline out of the company.

Meeting Sastry, Buckingham found a “very pleasant, well-spoken, and intelligent woman. A great person. Easy to talk to.” Sastry, he told Quartz, “spoke very positively about what they were doing.”

What she did not do, however, was go into much detail. She declined to take Buckingham around the office. “I had to take it all on her word,” he said. But he perked up when Sastry said that he would receive stock options–7,870 shares at a strike price of 68 cents.

“Within two years, there would be an IPO,” Buckingham said Sastry had told him. “It would all be great. The way she was talking, I thought she had already made a battery a meter square.”

Buckingham agreed to become Sakti3’s 10th employee, and Sastry was terrifically eager for him to arrive—within two days, she said. Buckingham’s wife was unhappy with the demands for a fast relocation from their home in Atlanta, but two weeks later, in November 2010, they were in Ann Arbor, Michigan.

On Buckingham’s first day at work, a group of officials from a government agency that had put up some funds for Sakti3 were in the office. Sastry asked him and others to show them around and chat. Only, the officials seemed uninterested in any such courtesy. In fact, they were “extremely hostile,” Buckingham recalled. “We were told to ignore it, but they weren’t happy at all. They didn’t care about any of our questions. I think they were forced to fund us.”

In 2011, Sastry recruited her biggest hire yet—Bob Kruse, the architect of GM’s electric-car program, who became her chief operating officer. The hire gave Sastry heightened credibility, tagging Sakti3 as an up-and-coming player. But the relationship turned antagonistic, according to former Sakti3 employees, and Kruse left the company in 2013.

When Sastry did finally provide Buckingham with a “champion cell,” the best example of what the company was producing, it was not a square meter in size, but rather a square centimeter, a sample pressed between two glass slides. In effect, it was a prototype.

At Excellatron, he had already seen a startup make batteries a meter long and 10 centimeters wide. Sakti3’s capabilities seemed meager to him in comparison. “I was very disappointed,” Buckingham said. Leaving wasn’t an option, though. He and his wife already had rented out their house in Atlanta on a two-year lease, and there was no job to go back to, anyway. “If I could have, I would have left right away. But I couldn’t.”

The only thing to do was to help figure out how to scale up that minuscule cell into a much larger battery.

One option: build a battery 24 kilometers long

The team got to work. “We went through every possible cathode, anode, and electrolyte combination,” Buckingham said.

Albano, the Sakti3 co-founder, said the researchers prioritized accelerating the vacuum deposition, and making it cheaper. Toward that, they tried to eliminate possibly superfluous pieces of equipment. One target: the expensive and cumbersome sterility system. “Do you really need a clean room?” Albano said. “We removed the clean room.” Also destined for the dust bin: a high-end vacuum, swapped out for a less-extreme version.

Such moves were risky. The removal of the filtering system, for instance, violated lithium-ion orthodoxy—contaminants are believed to significantly reduce battery performance, and the aim is usually to be as close to absolute sterility as possible.

Ultimately, though, no manipulation of the vacuum deposition technology seemed to provide the needed energy density, capacity, and production speed. In one exercise of absurdist mathematics, Buckingham calculated that they could stack two thin-film battery layers atop one another in order to meet the capacity and energy density needed to propel, say, a Chevy Volt, but each would have to be a meter wide and 24 kilometers long.

Marc Langlois, a thin-film and vacuum deposition expert who was Sakti3’s vice president of product development, made an even more mind-boggling computation. Keeping in mind a more-or-less standard smartphone battery, he reckoned that to achieve the necessary energy density, they would have to stack 20,000 to 30,000 single-micron-thick layers atop one another. Each would have to be laid down separately and perfectly, with no particles and no wrinkles.

Given the speed of vacuum deposition, it would take at least six months.

“I know of no product with this number of layers, not that would power a cell phone, let alone a car,” said Langlois, who is now a senior manager at San Diego electronics firm Cymer. “There is no real precedent to build and scale up a device like this with high yield and no defects.”

The climate of distrust and secrecy didn’t help

In 2010, after Sastry had raised a second round of funding, Khosla—the Silicon Valley venture capitalist who had been Sun Microsystems’ first CEO and was Sakti3’s first investor—showed up at the lab. He had just finished reading a book on cyber-terrorism, and was worried: Sakti3 had a substantial security threat to address, he told the startup’s team, according to an employee who witnessed the incident but asked not to be identified. The company, Khosla said, was being run like a freewheeling university lab—someone could just walk off with the company’s intellectual property.

Sastry soon had magnetic swiping devices installed on interior doors, and confined researchers more or less to their own departments—Buckingham’s card, for instance, did not permit him to enter the prototyping or pilot production groups, even though he felt he had reason to share ideas with people in those areas on how to move ahead.

These measures added to a climate of secretiveness that had been part of the company’s culture from the outset. According to Albano, Sastry did not want him nor anyone else on her staff sharing ideas outside the building, speaking in public, or writing papers. Albano found that frustrating, because he suspected that the problems with the science of solid-state batteries could be solved faster by conferring, even if cautiously, with other experts.

The furtiveness carried over to Sastry’s relationship with her investors. She resisted disclosing data or providing cell samples to investors, including Jon Lauckner, the head of GM Ventures, who in 2010 had put $3.2 million into Sakti3.

Lauckner declined to be interviewed. But on making the investment, his team was shown extremely little data on the company, according to a person with knowledge of the transaction who asked not to be identified. Once he was on the board, Lauckner began asking for a test cell, but Sastry brushed him off, saying she was not prepared as yet to share such data.

Finally Lauckner delivered an ultimatum—he had to see a working cell. At the end of 2011 or the beginning of 2012, Sastry delivered “the very best performing cells we were making at the time,” Buckingham said. They were square-centimeter cells testing at 0.0001 ampere hours, the same tiny capacity as before.

As part of the conditions agreed to between Sastry and Lauckner, GM was not permitted to speak publicly about the performance.

Senator Carl Levin to the rescue

Along the way, Sastry had been successful in cajoling Michigan politicians to visit Sakti3 and to lobby on her behalf in the state and in Washington. None of her connections worked in 2009, however, when Sakti3 was shut out of the Obama administration’s $2 billion grant program for battery and electric-car makers.

That’s when Carl Levin, the Michigan Democrat who was then the state’s senior US senator, stepped in with heavy pressure on the DOE to find money for the company, according to three former Sakti3 employees and an official familiar with the program. Levin, who retired this year and is now senior counsel at a Detroit law firm, did not respond to emails requesting comment. His efforts, according to these sources, led to a $1 million matching grant from the US Advanced Battery Consortium (USABC), a DOE-funded program supervised by the three big Detroit carmakers—GM, Ford, and Fiat Chrysler.

Begun in 2012, the USABC project involved creating cells intended for an electric car. But USABC terminated it early—on Feb. 1, 2014—when Sakti3 was unable to replicate its baseline battery performance assertions from its original grant proposal, two officials involved with the program confirmed.

According to a document presented publicly (pdf, page 6) in Washington by a research scientist from Argonne National Laboratory, Sakti3 had submitted 18 cells to USABC for testing. The result was a capacity of 0.0024 ampere hours. That was a big improvement over the cells given to GM a couple of years before, but were still only the size that would go into a medical device intended for implanting into an ear or an eye.

Ted Miller, the head of the USABC’s management committee and the director of battery research at Ford, told Quartz that Sakti3 perhaps could work on scaling up its technology to go into wearable electronics. “Then you could start talking about an engineering effort for automotive,” he said.

Miller said that although the Sakti3 project with USABC failed, it was nonetheless beneficial to the car consortium because it provided data on the performance of solid-state batteries. “That was the success of the program. We have data,” he said.

It may in fact be the only time so far that verified data from Sakti3 has become public.

Dyson steps in with $90 million in cash

By 2014, Sakti3’s cash was running short and a new infusion was needed. GM and Khosla were prepared to add to their investment—but only if a new backer was brought in to lead the fresh funding round, according to people familiar with the situation. That was Sastry’s challenge—to find a new investor at a time of much doubt about the medium-term commercial prospects for advanced battery research.

In August 2014, Sakti3 announced a big jump in its capabilities: It had produced a battery cell measuring volumetric energy density of 1,100 watt hours per liter, more than double the performance of current commercial batteries. Not only that, it had done so on “fully scalable equipment.”

The announcement seemed to suggest that, just months after losing the USABC contract for a failure to meet its baseline performance assertions, the startup had overcome the challenges of vacuum deposition.

Sastry’s peers in the battery industry were intensely skeptical, although none seemed to note this publicly at the time. Among their questions: How many battery layers had Sakti3 stacked? (If it was a single layer, the claim was hardly worth reporting because it would lack a crucial feature known as specific energy density.) And did the number she reported take into account the substrate, the rigid though inactive layer of material on which the battery must be deposited, and that can cause specific energy density to plummet?

Despite the skepticism, Sastry’s discussions with UK billionaire entrepreneur James Dyson and Mark Taylor, chief of research and development at Dyson’s company, appear to have opened in the subsequent weeks, according to a report in Wired and a partial chronology in a 307-page merger document sent this month to stockholders and obtained by Quartz. According to a report in Crain’s Detroit Business, Dyson had reached out to Sastry about investing in Sakti3 after seeing articles in Fortune and Scientific American in 2014 about the breakthrough Sastry claimed to have achieved.

By December 2014, Dyson had agreed to lead a $20 million round of funding, of which it would provide $15 million and GM and Khosla the rest. The agreement was announced publicly three months later, but already Dyson and Sakti3 were in discussions about an outright acquisition, according to the merger document. In June of this year, they signed a non-binding term sheet outlining the main points of the acquisition, and Dyson began a period of due diligence.

Two months later, Sastry was meeting Obama at the White House. And less than two months after that, the Dyson and Sakti3 boards had approved the acquisition. According to the merger documents reviewed by Quartz, Sastry will net more than $10 million in the deal while staying on at Dyson at an unspecified salary.

Albano, the University of Michigan doctoral student whose dissertation launched Sakti3, left the company in 2011 and is now director of research and development at XALT, a Michigan battery maker. He stands to earn $676,000 in the Dyson acquisition from stock options. Buckingham, meanwhile, is back in Atlanta, as lead surface scientist at the aluminum company Novelis.

In interviews with Quartz, Albano said he was glad for the far more open atmosphere he has found at XALT, where he can speak with experts outside the company and publish his work in peer-reviewed journals. He says the technology developed thus far by Sakti3 “should be for medical devices or a sensor,” not a car.

And he remains skeptical that Sastry has figured out the manufacturing process to build a better battery at scale. “If the doubt about it wasn’t there,” he says, “the news now would be about an IPO and a billion-dollar company versus a $90 million one.”