US president Donald Trump thinks the US is importing too much. He’s threatened to block goods from several countries—most recently Germany, which he called “bad, very bad” for sending the US so many cars. His administration has also launched a slew of investigations into whether the US should restrict certain foreign products, including steel, solar panels, and carton-closing staples from China.

His goal is to reduce the US’s $502 billion trade deficit, by lowering imports to be more in line with exports. But what if, instead of lowering imports, he focused on growing exports? China built up its industry to eventually become the world’s top exporter, and according to a new paper from the US’s National Bureau of Economic Research, the surprising key to that was to buy more from abroad, not less.

The researchers started out trying to answer a very narrow question: How did China’s entry into the World Trade Organization (WTO) benefit consumers in the US? (That’s essentially the title of the study.) They don’t address trade deficits at all, and look at only a few years, from 2000 to 2006. But their work shows how manufacturers can benefit by importing the inputs they need to make their products—and how making those inputs more expensive, by raising tariffs, could hurt them.

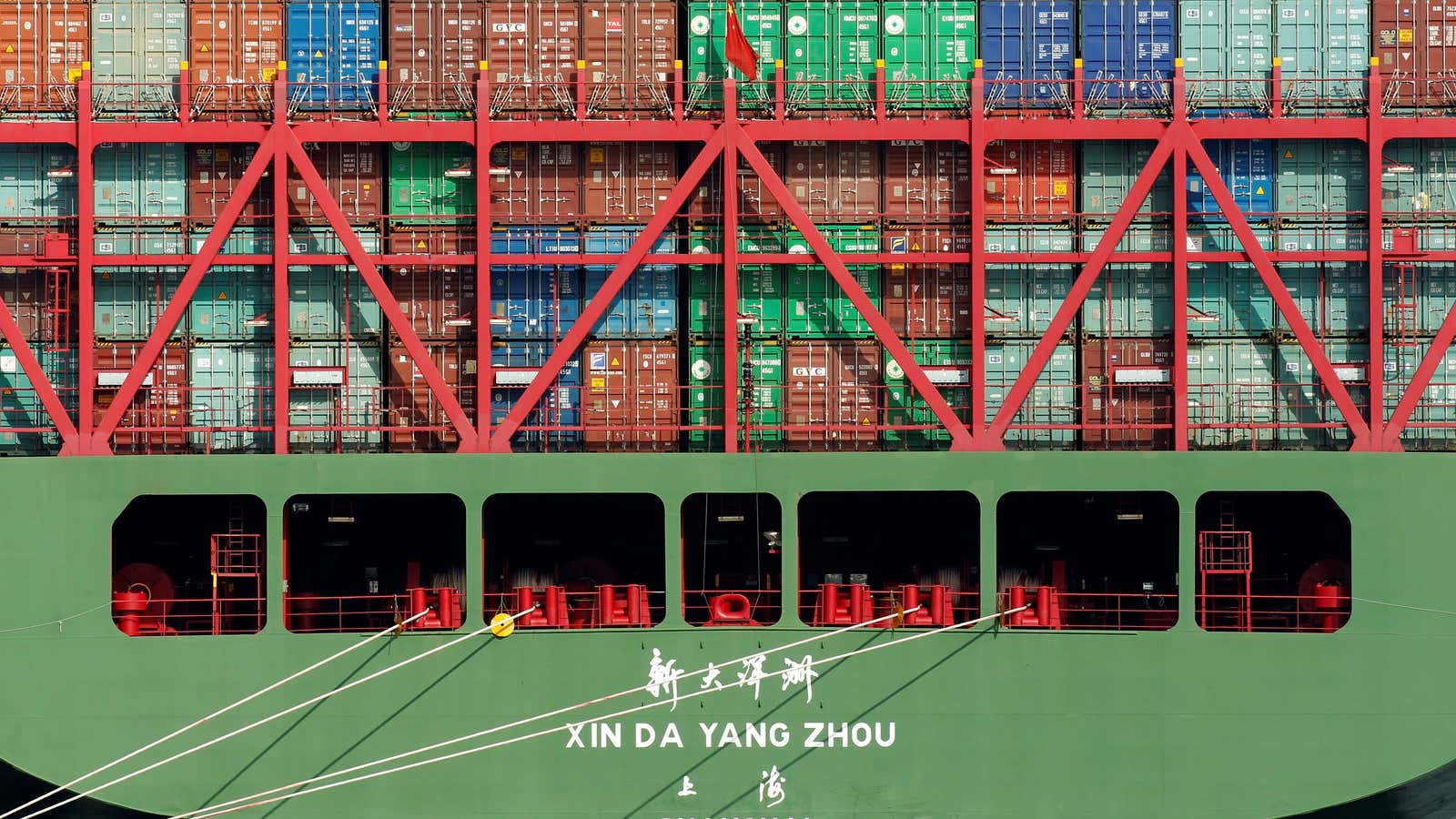

First, here’s a summary of what happened after China joined the WTO in 2001. Its exports, including those to the US, rapidly climbed.

The surge in cheap Chinese products lowered the prices of manufactured goods in the US by 7.6%, in real terms, from 2000 to 2006, the study found. That was good for consumers—and bad for some American companies, which went out of business because they couldn’t compete.

That last part roughly fits with the Trumpian narrative of how China decimated US jobs by becoming a WTO member. Trump’s version, however, appears to miss something: China’s entry into the WTO didn’t make the US drop its tariffs on Chinese goods. The US had essentially treated Chinese goods the same way since 1980. What changed after 2001 was that the US granted it “permanent normal trade relations” status, so the preferential tariff arrangement didn’t have to be renewed every year.

So if it wasn’t lower tariffs that boosted China’s exports to the US, what was it? The paper’s authors argue that the main factor was that China lowered its own import tariffs. That suddenly increased the kinds of inputs available to manufacturers in China. That, in turn, brought the prices of their own goods down. And that made the manufacturers more productive and their products more competitive abroad. In addition, firms that hadn’t exported before were able to start selling to the US.

In short, more imports led to more exports.

The study authors calculate that this effect—cheaper Chinese imports, and a wider variety of them—accounted for most of that 7.6% drop in prices of manufactured goods in the US. China’s WTO entry made only a minor difference: It led to the US making preferential tariffs for Chinese goods permanent, thus removing the risk that they wouldn’t be renewed each year. That gave more certainty to Chinese exporters so they could plan longer-term.

To be sure, lower tariffs are only one reason China became an export juggernaut. China’s vast army of low-skilled workers also helped, and so did the Chinese government’s persistent devaluing of the yuan (though it had stopped doing that by 2015). Both things made Chinese exports more competitive.

Also, it’s true that simply increasing imports isn’t an automatic prescription for helping domestic manufacturers. Some will benefit, but those that make inputs for them will suffer if those inputs can be imported more cheaply.

Still, it’s important to pay attention to how this nets out. To take one example, putting higher tariffs on steel would save jobs at US steelmakers. But for every steelworker in the US, there are 60 others (paywall) in industries that use steel as a raw material, and those could suffer if higher tariffs make steel more expensive.

More broadly, intermediate goods—products used to make other products, such as wood or computer chips—made up roughly 40% of what the US imported in 2015, according to an analysis by the Brookings Institution, so restricting those imports would likely mean higher costs for a large swathe of US industry. Even from China, nearly 30% of what the US imports is intermediate goods.

This is even more true when you look at Canada and Mexico, the US’s partners in the North American Free Trade Agreement (Nafta). Half of the US’s trade with those countries is in intermediate goods. After initially threatening to tear up Nafta, Trump is now preparing to renegotiate it. Among the things the US imports from Canada and Mexico are circuit boards that power US-made car seats, sugar that gets spun into sweets in places such as Ohio and Illinois, and steel to make car parts. US manufacturers of at least two of those product categories—candy and car parts—are already complaining about how Trump’s protectionist bent will hurt them.

Correction (Jun. 14): An earlier version of this story used the monthly figure for the US’s trade deficit. It’s been replaced with the latest annual figure.