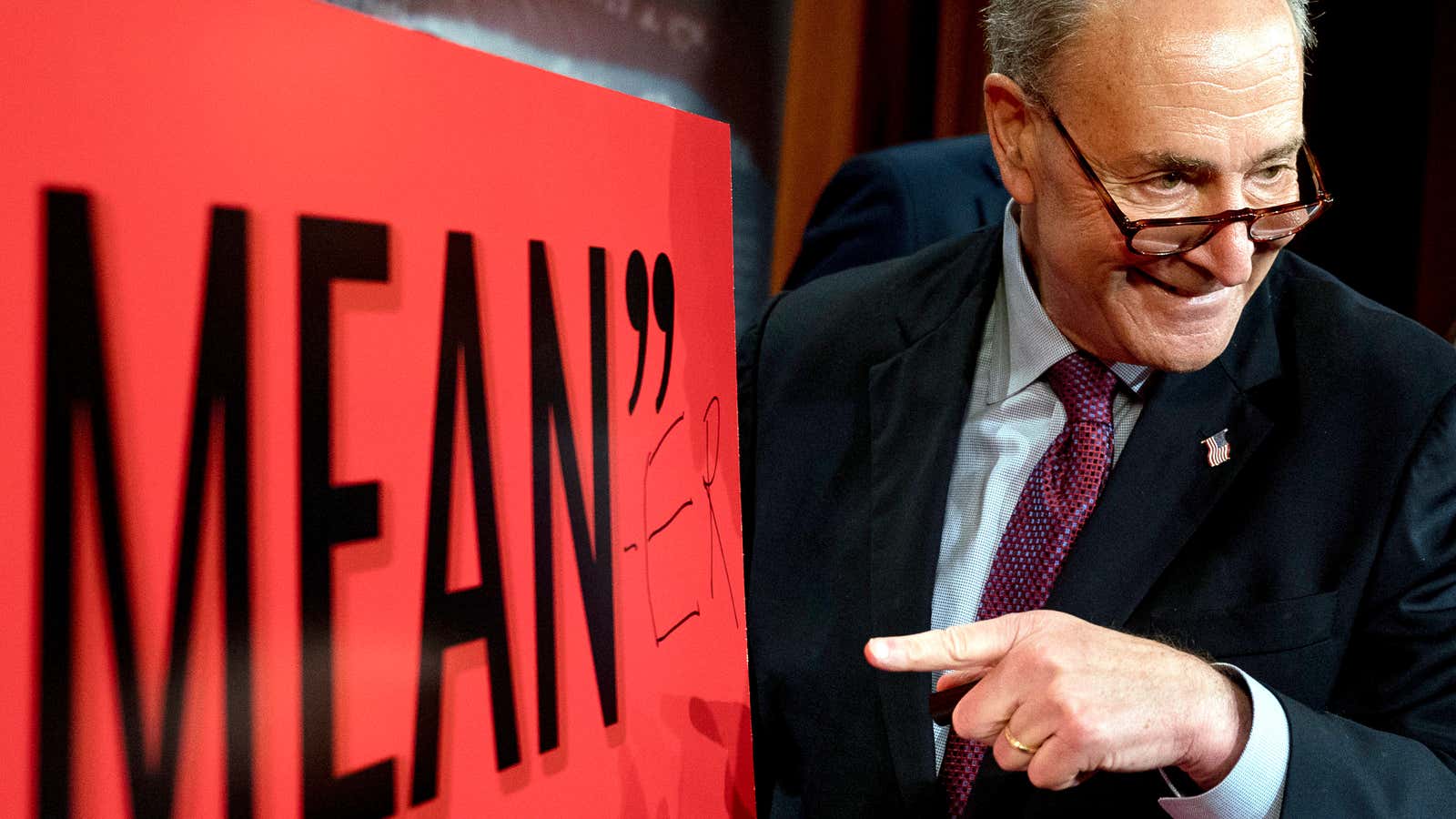

The first version of the Republican health-care bill was rejected by the US House of Representatives. The second was derided as “mean” by president Donald Trump. Now the Congressional Budget Office (CBO) has delivered its independent assessment (pdf) of the third and latest proposal to overhaul the US health care system and plough any savings into tax cuts for the wealthy, and the deal is not good.

The headline number is the 22 million more people who would be uninsured by 2026, compared to the existing law passed during Barack Obama’s administration. In the previous two versions of the bill it was 24 million and 23 million, respectively—in other words, not that different.

Republicans spent years condemning the individual health care markets created under Obamacare for gaps in competitive coverage that left some people with just one insurance option or none at all. The CBO concluded that the new plan, written by a small group of Republican senators behind closed doors, leads to that very same problem: “A small fraction of the population resides in areas in which—because of this legislation, at least for some of the years after 2019—no insurers would participate in the nongroup market or insurance would be offered only with very high premiums.”

The new bill would eliminate payments that reduce out-of-pocket costs (such as deductibles) as well as shrinking the subsidy provided directly to consumers through tax credits. This would leave most lower-middle-class people paying higher annual insurance premiums than under the current law, to start.

To understand how that works, it’s useful to compare the rules for the benchmark plans in both. Under the new proposal, known as the Better Care Reconciliation Act (BCRA), an insurance company’s benchmark health-care plan must cover just 58% of the company’s best guess at a customer’s future health-care costs. In current law, the Affordable Care Act (ACA), the benchmark plan must cover 70% of those costs. A higher coverage rating generally means a lower deductible, and vice versa.

Here’s a chart showing how premiums would change for people making $26,500 a year, or 175% of the federal poverty line. This a key demographic when it comes to health-care policy, since these are people who earn enough to be ineligible for Medicaid (health assistance for the poor), but typically not enough to afford individual insurance. Depending on age, their premiums are anything from noticeably to punishingly higher under the new law. This plan is referred to a silver plan, which for this income bracket must cover 87% of costs under the current law, and 70% under the BCRA:

The BCRA premiums are higher mostly because the new law cuts subsidies to low-income people seeking to buy health insurance. There’s another obvious change under BCRA: Older people who aren’t yet on Medicare (the government plan for the elderly) would see a big increase in their premium, because the bill allows insurers to charge older customers up to five times more than young people. The current law allows them to charge only three times as much.

But the problem with falling subsidies becomes clear when you look at this from the point of view of a middle-aged person who makes $26,500 a year. The big increase in premiums for plans in both systems that cover 70% or more of future health care costs would make many people decide not to purchase them, according to the CBO. However, in the new system, they will have a much harder time stepping down to a cheaper, lower-coverage plan because of its higher out-of-pocket costs.

This move to push risk on to customers can be seen by comparing the two benchmark plans under each plan—covering 70% of future costs under current law and 58% under the new proposal:

What this chart shows it that under the current law, an adult at the bottom end of the middle class can buy a benchmark “silver” insurance policy for $1,700, with a deductible of $3,600—which is undoubtedly high. Under the new proposal, the benchmark plan’s premium, while $100 less, comes with a deductible of $6,000.

Faced with roughly the same premiums, a hypothetical consumer might look to pay less for less coverage. Under current law, they could drop down to a lower-quality plan, called a bronze plan, with a $700 premium and an $800 deductible. That option doesn’t exist in the new proposal.

The CBO predicts the choice between a premium that’s too high to manage and a deductible that is more than one-fifth their annual income will lead millions of Americans to not buy coverage at all if the law is enacted.

The new health-care law does deliver lower premiums for some consumers, but only because insurers would be allowed to charge older people more money and push a larger share of the costs of procedures and doctor visits on to their customers. The deal improves, but not by much, in the middle class proper:

You can see that the up-front savings, at $1,500, is quite real. But any kind of semi-serious accident or illness, or the use of expensive prescription medication for a chronic issue, could mean paying more in total.

And once again, the savings on these plans come at the expense of higher costs on the elderly. Is it worth it for a 40-year-old to save $100 a year on their premium if their parents are suddenly playing $13,700 more?

The best that can be said about the proposed bill’s effect on individual insurance is that young people would generally pay lower premiums for individual insurance, and that middle-class people will be able to save up to a thousand dollars or so on their premiums—as long as they make it through the year without a trip to the emergency room.

Throughout the last seven years, the most effective slogan used by Republicans to push their version of health reform has been that the individual market created by Obamacare has failed to deliver low-cost options to Americans looking to buy health insurance. Their plan to fix the system doesn’t appear to solve the problem at all.