With China’s banks shaking, Brazilians in the streets and miners striking in South Africa, the case for investing in the BRICS is crumbling.

For the last decade or so, the acronym BRICS—for Brazil, Russian, India, China (and sometimes South Africa)—has served as short-hand for the concept of investing in emerging markets with high growth potential.

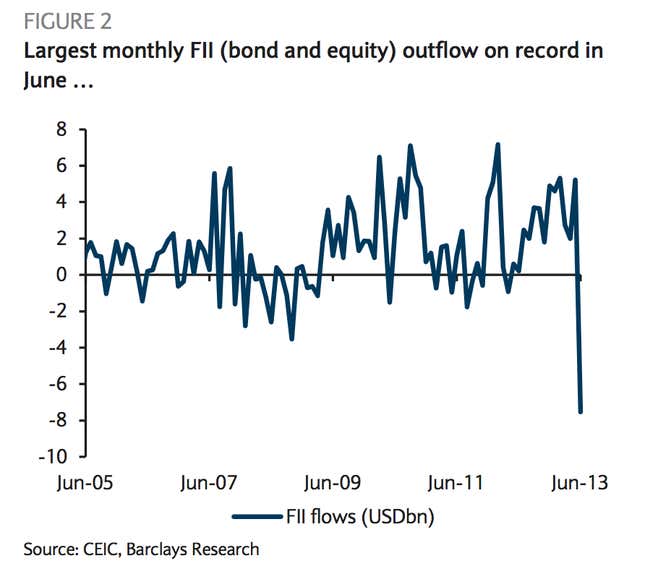

But times change, and one sign of that is India. Investors appear to be running out of patience in awaiting the onset of the country’s economic miracle. Barclays analysts spotlighted the largest-ever outflow of foreigner institutional investors (FIIs) from India’s bond and stock markets in June.

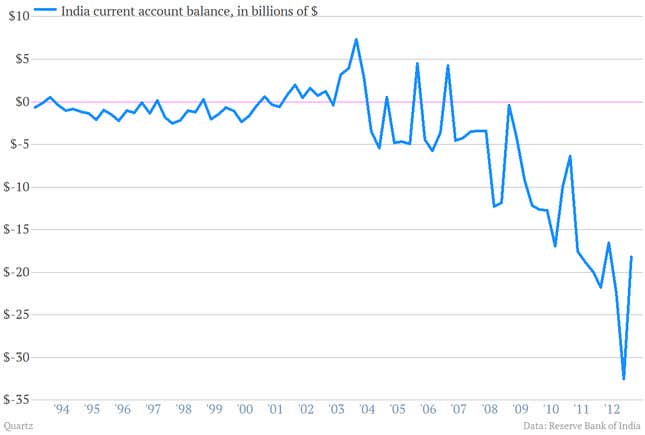

This is a problem. For one thing, India has depended on foreign investments in bond and stock markets—so-called portfolio flows—to help it pay for its import-heavy economy. In other words, it’s running a current account deficit), which has only worsened recently. (The recent bounce is tied to efforts from the government to curtail imports of gold.)

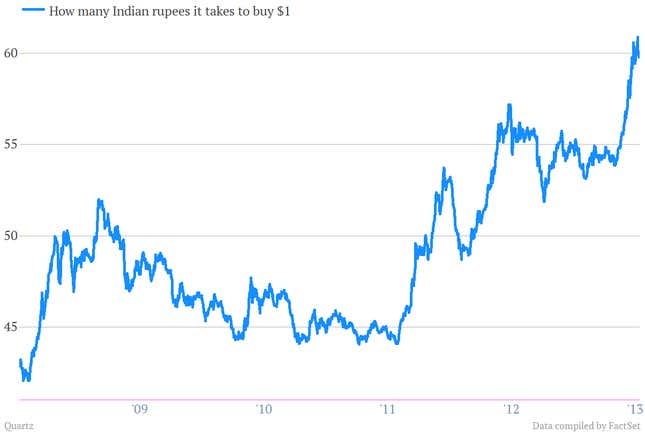

The outflow of foreign capital is also weakening the Indian currency, the rupee. Foreign investors have fled rupee-denominated investments, converting them into dollars or other currencies, which has lowered the rupee’s value. It now takes about 60 rupees to buy $1, which exacerbates inflation, partly because the weakened rupee makes imports of foreign commodities such as energy much costlier.

So what can be done?

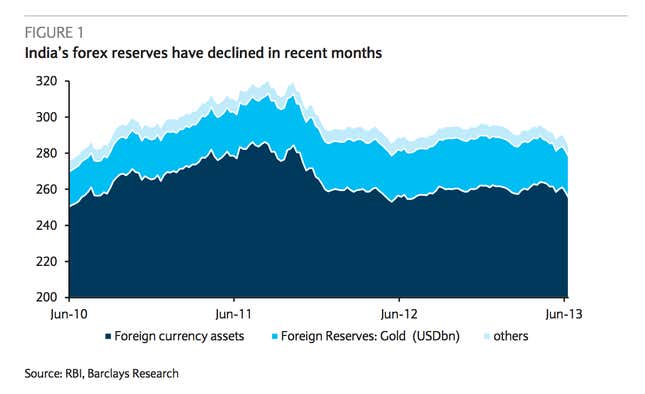

One way to stabilize India’s currency is to intervene in the financial markets. Essentially, the central bank starts selling dollars and buying rupees to increase the ratio of rupees to dollars in the economy. The central bank is trying, but it may not have enough ammunition—i.e. foreign exchange reserves—needed to have a long-lasting impact.

As a result, Indian economists are asking some of the world’s biggest banks to come up with ideas about where to find fresh capital.