Are we in a tech bubble? Ask a chipmaker

Two of the best-preforming stocks over the past year have been those of chip manufacturers Advanced Micro Devices (AMD) and Nvidia. AMD’s most recent surge can be at least partially credited to the boom in ethereum, a cryptocurrency second only to bitcoin in its market value, and the miners who use its graphics chips to process their mining calculations.

Two of the best-preforming stocks over the past year have been those of chip manufacturers Advanced Micro Devices (AMD) and Nvidia. AMD’s most recent surge can be at least partially credited to the boom in ethereum, a cryptocurrency second only to bitcoin in its market value, and the miners who use its graphics chips to process their mining calculations.

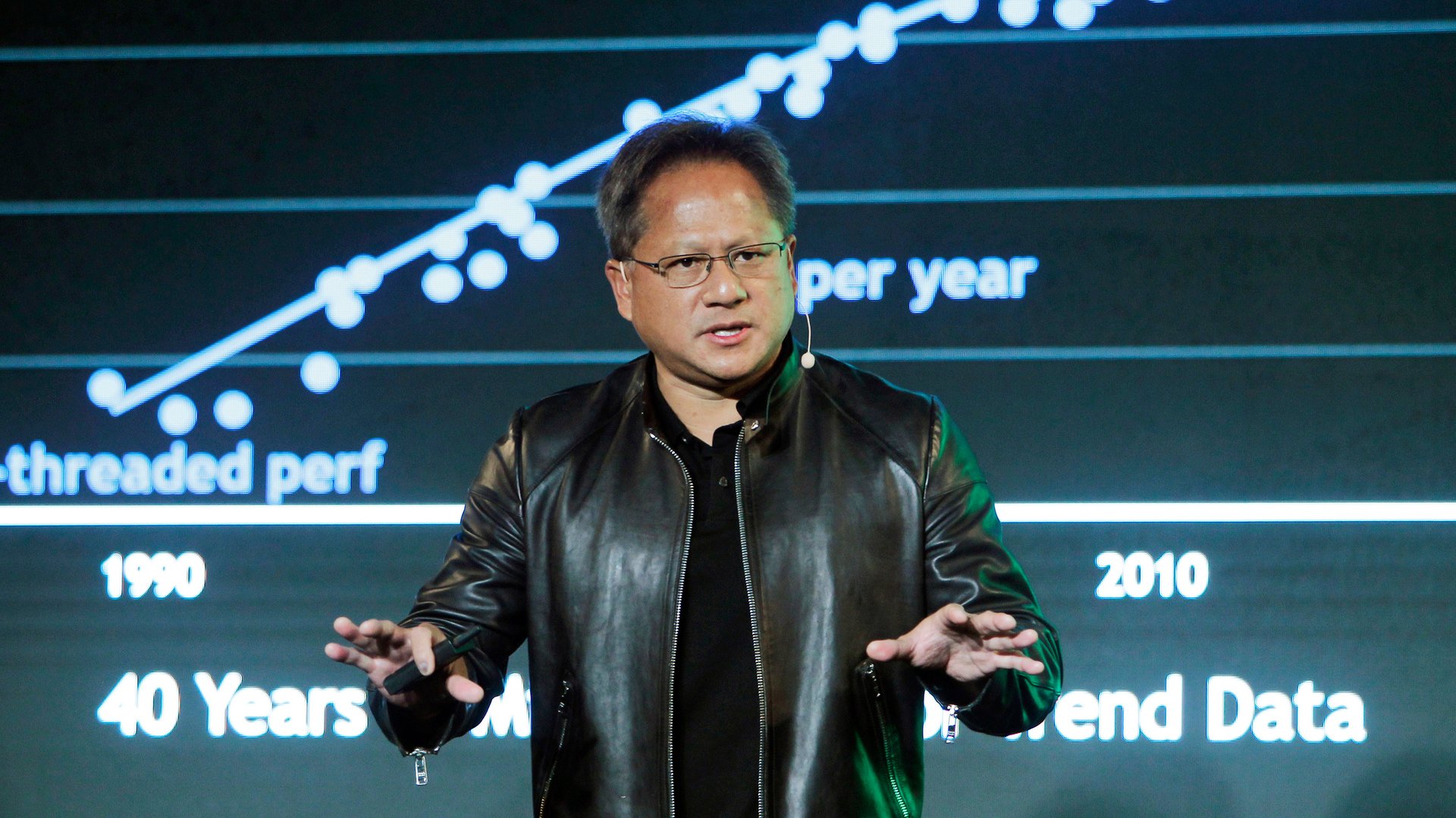

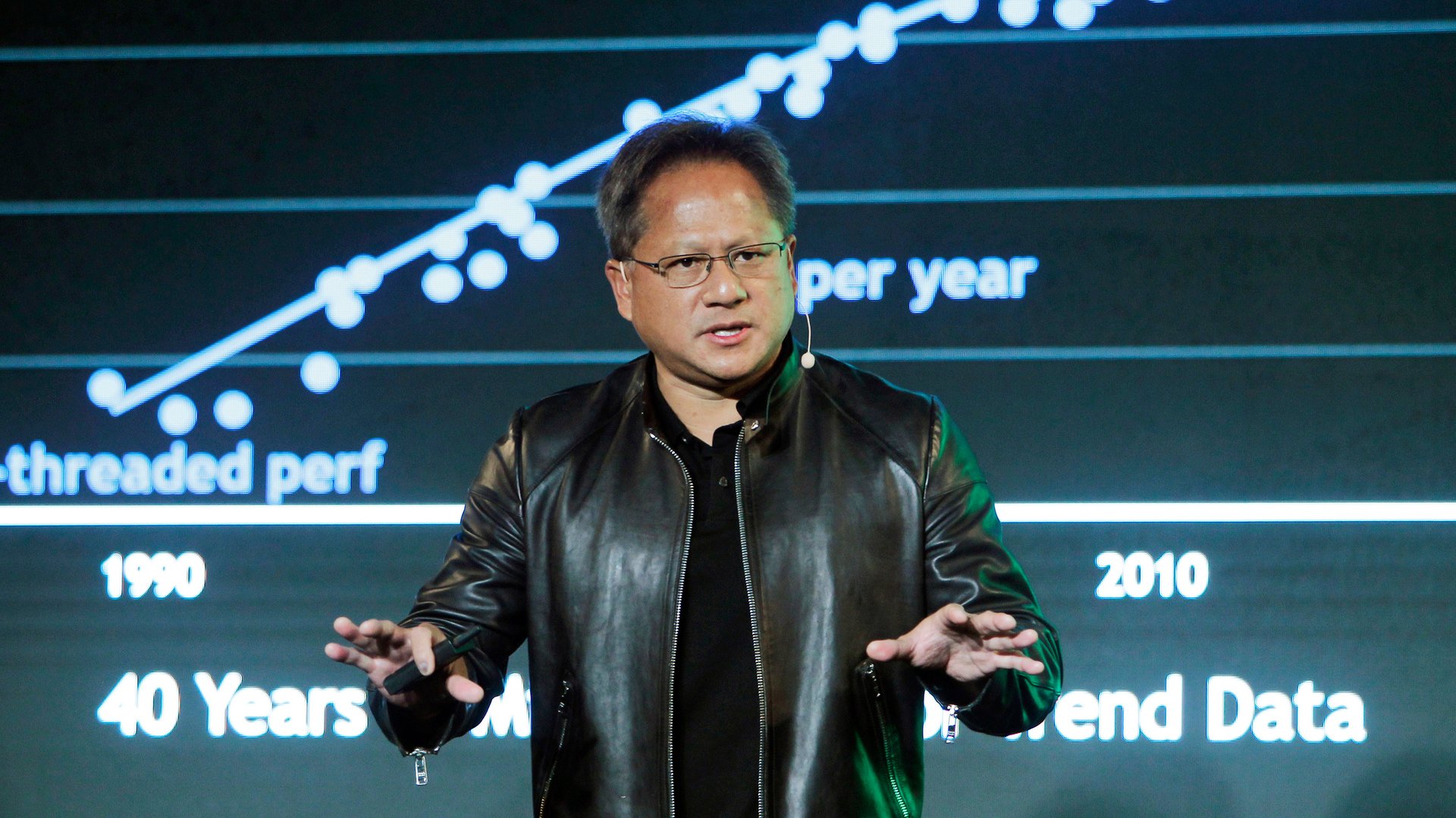

Some are even renting jumbo jets to ship cards from AMD and Nvidia directly to their mining operations as quickly as possible. Nvidia’s graphics chips are being used in just about every future-looking technology application—apart from cryptocurrency mining, they’re massively popular in machine learning setups, and just about every other form of AI research, including self-driving cars, autonomous drones, and augmented reality. Since January 2016, its stock has skyrocketed from around $29 to over $160—a gain over over 570%.

Both AMD and Nvidia’s graphics chips have been around for years—their devices do the heavy lifting in rendering graphics on computers, especially when playing video games—but their recent reapplications in new computing fields has seen their values explode. It’s the the first time for AMD—it, like Intel, had a massive spike around the turn of the millennium, as the desktop computer and the internet began to proliferate around the world. It was soon after that every company began to believe that they could run viable businesses on the internet, in some cases, just because they had a good dot-com name—instead of profits.

After the dot-com bubble burst, many of the firms responsible for building the computer technology these companies relied on suffered. Intel and Qualcomm’s stock prices were decimated. Intel failed to see the shift in the computer industry from desktop to mobile, and it, along with Nvidia and AMD, were left in the mid-2000s wilderness at a time when Qualcomm, which went on to produce the processors in many of the world’s mobile devices, started to thrive. Intel is still searching for its next great business line, and laid off 12,000 workers last year.

But now, around 16 years after that bubble had burst, Nvidia’s stock price is more than double what any chip manufacturers’ stock was valued at around the height of the boom. At the same time we have companies like Snap, Twitter, and Blue Apron that have gone public, all without clear plans for how they will ever turn a profit, and in some cases, offering stock without any shareholder voting rights.

Time, it seems, is a flat circle.