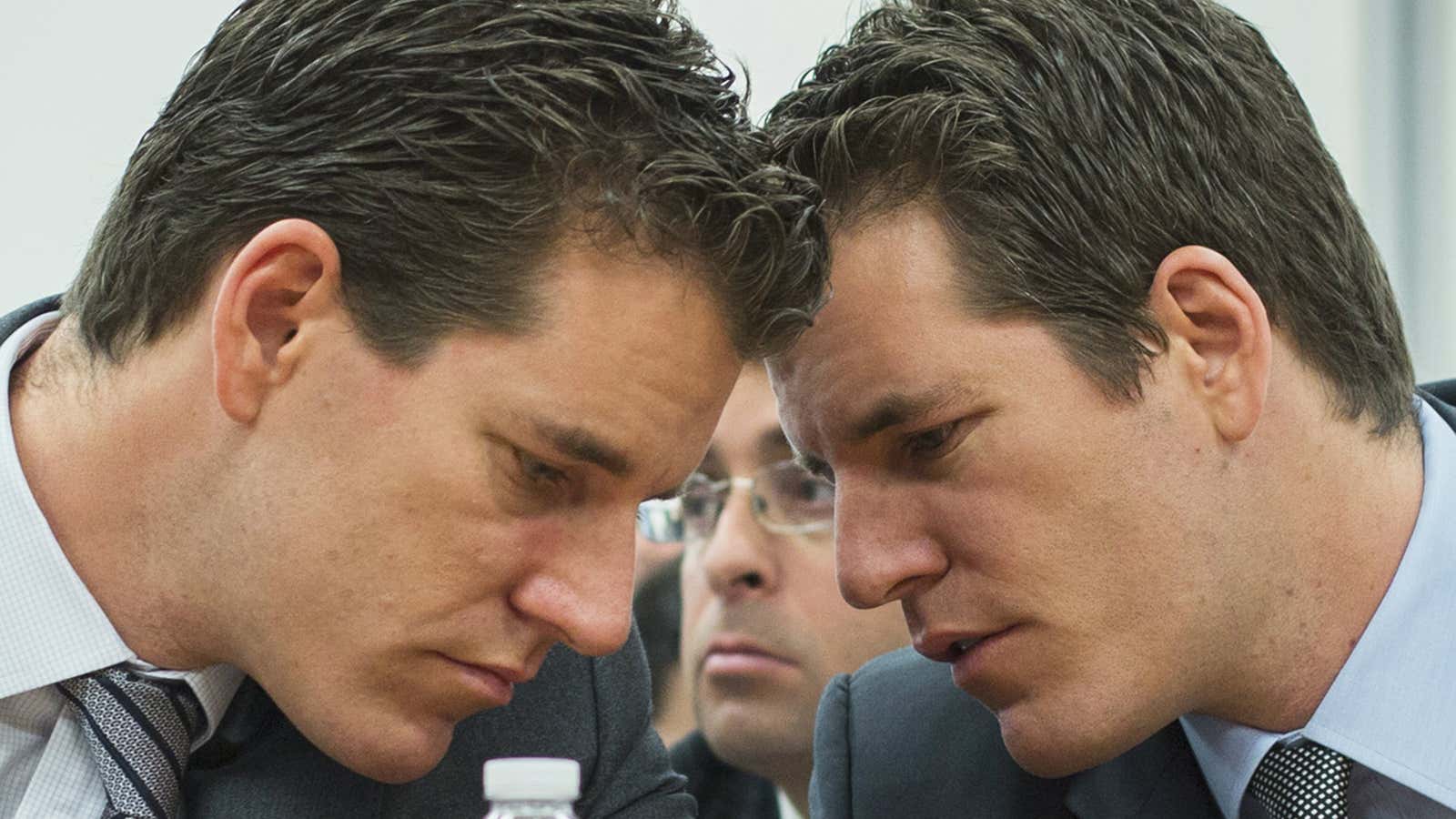

The Winklevoss twins, whose plan to launch a bitcoin exchange-traded fund has so far been thwarted by the US Securities and Exchange Commission, are a step closer to making the cryptoasset more palatable to Wall Street, and possibly to regulators.

Their latest attempt at legitimacy for a bitcoin ETF: an agreement with a major exchange operator that could make it easier for big trading firms to get involved.

For the most part, big institutional traders have stayed out of cryptoassets like bitcoin. One of the many problems is that the market is far too small for them to take substantial positions. Bitcoin has a market capitalization of about $44 billion, meaning some big hedge funds could swallow the market whole. Derivatives, however, have a ceiling that’s theoretically infinite; their value is derived from another asset but can exceed that asset in market value.

Futures are one type of derivative—they allow traders to speculate on what a price will be at some later point in time. And that’s what the deal announced today (Aug. 2) enables, assuming it receives approval from the US Commodity Futures Trading Commission.

CBOE Holdings, which runs major markets for stocks, options, and futures (and owns the rights for the famed VIX Index of volatility, sometimes called the fear gauge) now has the right to create bitcoin futures using data supplied by a bitcoin exchange called Gemini, which is run by Cameron and Tyler Winklevoss.

The brothers, made famous by their legal battle with former Harvard classmate Mark Zuckerberg over the founding of Facebook, previously tried to list a bitcoin ETF on an exchange now owned by CBOE. The SEC shot down that attempt, citing a lack of regulation in the bitcoin market, but the agency agreed to review the matter again.

The availability of bitcoin futures could ease several issues for the big firms. Institutional traders frequently use futures to hedge their ETF positions. A bitcoin future at the CBOE, if approved, would also be a relatively easy plug-in for banks and hedge funds since it’s within a framework they’re already using. And while bitcoin was designed to bypass the traditional financial system—and thus became a notorious haven for drug dealers and cyber ransom—anchoring it in old-fashioned markets like the one for futures will ensure that it’s highly regulated, making it more attractive to big investors who want to keep the red flags to a minimum.