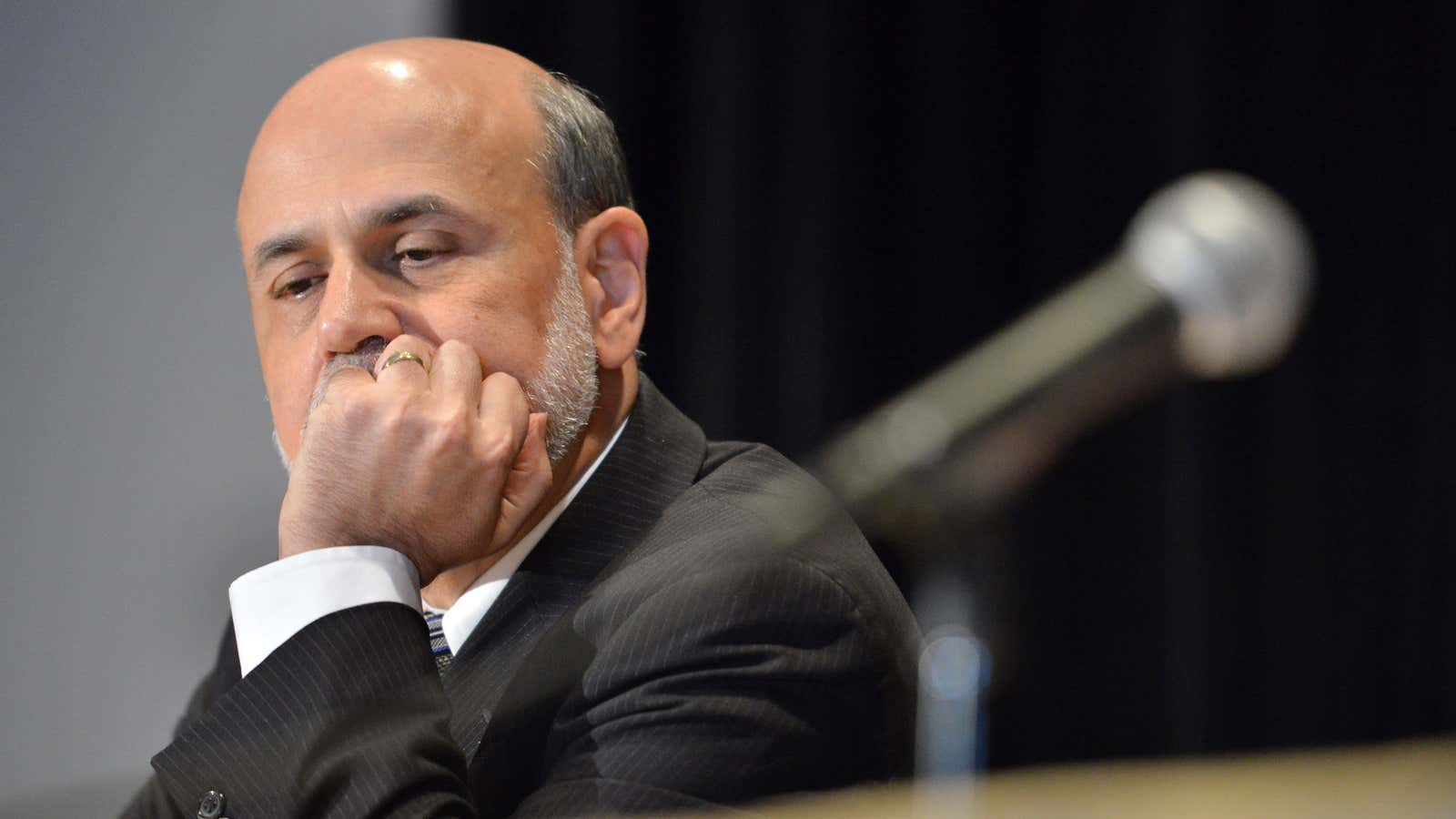

Wall Street is killing itself trying to figure out when the Federal Reserve will start trimming the $85 billion worth of securities it’s buying each month. But if you believe the prepared testimony Federal Reserve Chairman Ben Bernanke is about to deliver to Congress, then nobody knows—not even the Fed itself.

That’s because the Fed’s decision on what to do depends on how the economy does. The Chairman took pains to emphasize that to the markets in his prepared remarks. We consider this the most telling tidbit from the prepared text: “I emphasize that, because our asset purchases depend on economic and financial developments, they are by no means on a preset course.”

Of course, a lot can change once Bernanke starts parrying questions in the Q&A portion of his testimony before Congress, which you can see here. It was his May 22 command performance on Capitol Hill—when Bernanke conceded that the taper could start “within the next few meetings”—that bond markets went into their recent tizzy.

Stay tuned.