China’s government just announced the most radical reform measure in years

Stodgy central banks aren’t generally known for making sudden, mind-blowing moves—especially those that are directly controlled by their country’s government.

Stodgy central banks aren’t generally known for making sudden, mind-blowing moves—especially those that are directly controlled by their country’s government.

But starting tomorrow, China’s will do something fairly shocking: It will lift the lending rate floor for banks, the central bank just announced (link in Chinese). At present, the government permits banks to lend at as low as 70% of the official benchmark rate.

It’s the first major step in China’s quest to liberalize interest rates—a reform that’s more important than any of the many China needs to implement to open up its capital markets and encourage demand-based growth. To do so, it must deflate asset bubbles that have developed from decades of distorted capital allocations and depoliticize its banking sector. And those two reforms require liberalizing interest rates.

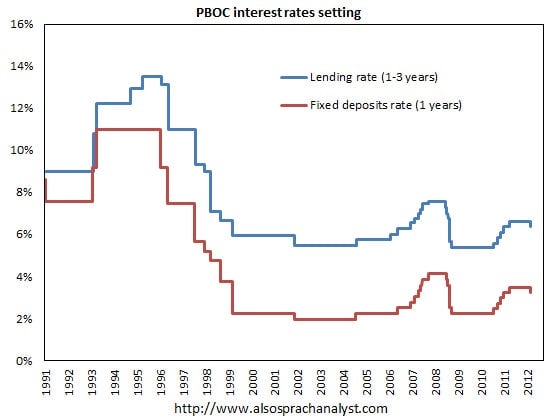

Here’s a look at how the interest rate spread has worked in the past, via Also Spracht Analyst:

In theory, allowing interest rates to be set by the market should shift funds away from massive government-led corporations toward small- and medium-sized enterprises, which have been starved of funding. The government sets interest rates keep deposits artificially low—usually lower than inflation—while setting an interest rate floor on lending to businesses. That cushy setup for banks has made it easier to lend cheaply to state-owned enterprises (SOEs) and goosed many industrial sectors, most notably steel and shipping. It has also inflated speculation in property and stock markets and created a debt crisis, exacerbated by a liquidity crunch.

The People’s Bank of China, the central bank, has been talking about liberalizing that system for decades, to no avail. Today’s announcement suggests that the pro-market reform factions of the Communist Party—particularly PBOC governor Zhou Xiaochuan—have enough clout to change policies that will upset many powerful interests, including those of SOEs and local governments. It also hints that premier Li Keqiang, who has been talking a big game when it comes to reform, can follow through on structural reform. That’s important, since China’s bureaucracy tends to favor talk over action.

In addition to the interest rate reform, the central bank also eliminated the lending rate cap for rural credit cooperative and controls on the discount rate for bills. It liberalized housing credit policies, temporarily lifting controls on floating interest rates.

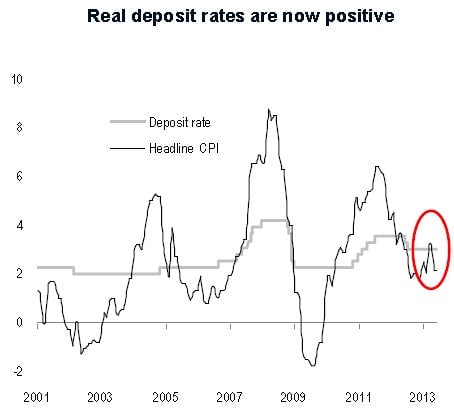

But hold the fireworks, because it also left bank deposit rates caps in place, which limits the wealth of households that have few other places to put their savings. Banks’ low deposit rates encourage saving, not spending. And the meager returns for households are eroded by inflation, as you can see in this chart:

Meanwhile, investment-starved households have poured their savings into the property market, driving up housing prices. Knocking out the deposit rate floor is the first major step in reversing the tide to encourage more consumption.