People have been waiting for this for a long time. And now it’s happening.

Money has started pouring out of the bond market. And more importantly, it’s pouring back into the US stock market, reversing the bond-loving proclivities that investors developed when the financial crisis hit.

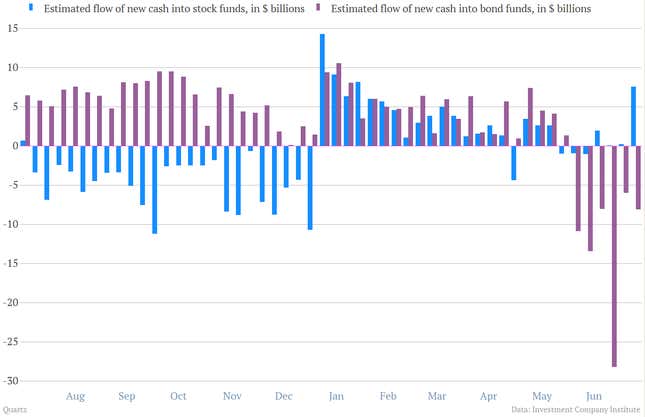

Data provider EPFR says that $19.7 billion inundated US equity markets this week. That’s the biggest weekly inflow seen since 2008. And other data services seem to confirm the trend. Here’s a chart of estimated weekly flows into US mutual funds over the last year, from the Investment Company Institute. You can see that until the start of the year, investors were pulling money out of stock funds and socking it into bonds. Then early in 2013, they began adding to stocks as well as bonds. Now they’re pulling money out of bonds and pumping it into stocks.

Of course, stock market sophisticates always point out that when smaller investors start buying, that signals a rally is approaching its final run. (The rationale is that the market depends on pulling in new buyers to continue moving up, and retail investors are usual the last buyers available.) With the stock market consistently hitting record highs recently, that could be something to keep in mind.