Nike is still the king of the sneaker industry, but even great empires can fall

Nike has dominated the sneaker world for so many years that it has come to seem invincible, particularly in the US, its home turf and the world’s biggest sneaker market.

Nike has dominated the sneaker world for so many years that it has come to seem invincible, particularly in the US, its home turf and the world’s biggest sneaker market.

Lately, though, some holes have started to open up in Nike’s armor. In 2016, for the first time in more than a decade, Nike didn’t have the top-selling sneaker in the US. That distinction went to Adidas’s retro Superstar. Last week, Nike laid off hundreds of employees in a downsizing move that was first announced in June and will cut about 2% of its workforce, or roughly 1,400 people. Sports-industry analysts have also become increasingly concerned that the Nike brand, including its premium Jordan label, is losing its cachet.

For the first time in ages, Nike’s iron grip on the sneaker world is visibly slipping. The question now is: How much will it slip?

Nike owns enough of the sneaker market that it can afford some stumbles without falling from the top spot, and that’s especially true in the US. Data from the research firm NPD Group puts Nike’s US market share, including the Jordan brand, at about 44%. Adidas, its closest competitor, has roughly 11%.

But that doesn’t mean Nike can relax. That 11% of the US market Adidas holds is nearly double what it had a year ago, putting it at number two in the country—and most of the share it’s stolen has been from Nike and Jordan. Adidas’s latest styles, such as the NMD, are winning over new fans, including even the hardcore sneaker collectors who have long worshipped at Jordan’s throne.

Once, Nike was the upstart

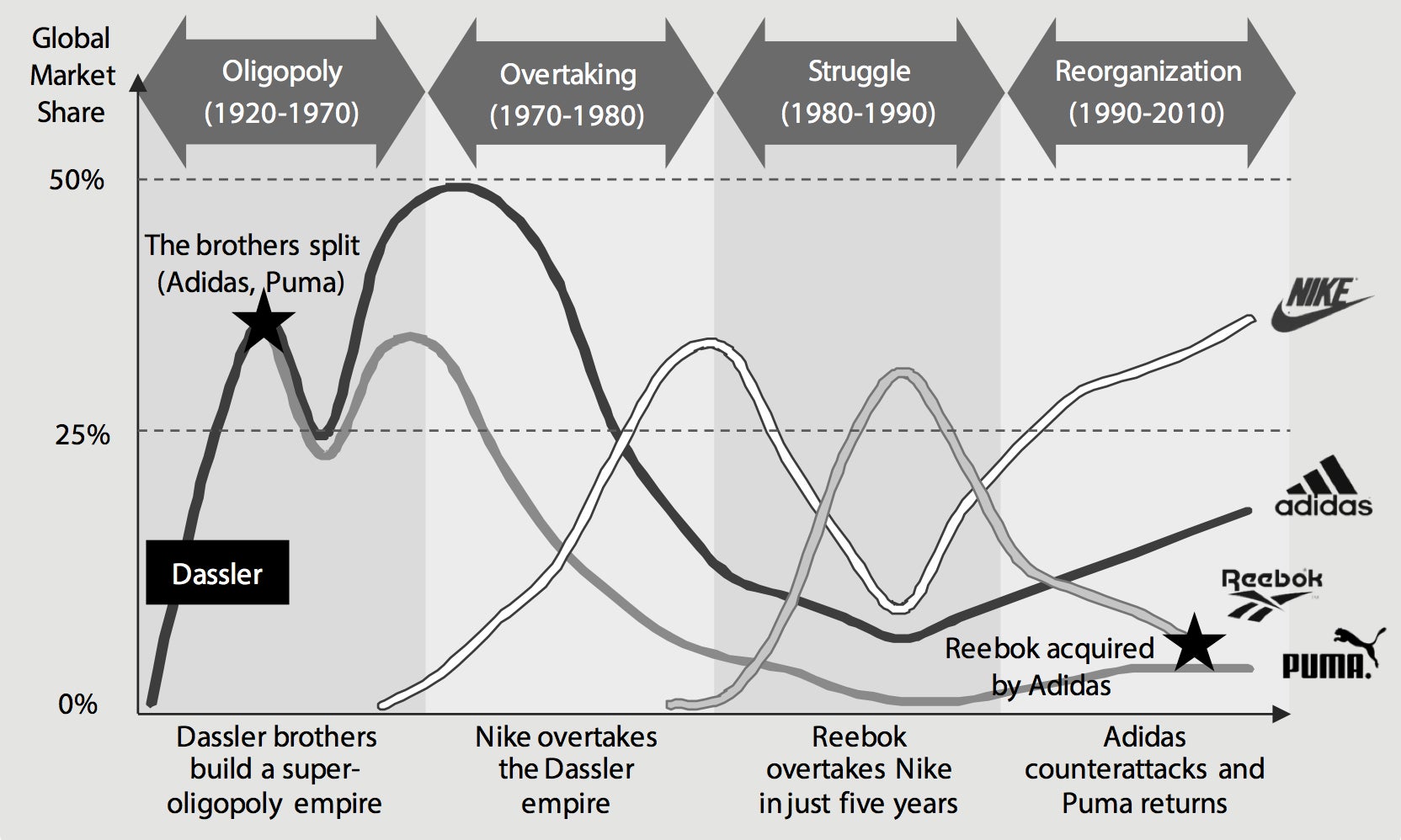

Nike hasn’t always ruled the sneaker market, as this chart from a 2013 report by Samsung’s Economic Research Institute that looked at the global market share of the major sneaker brands over the years shows:

In the 1970s, Nike overtook the former giants of the industry—Puma and Adidas, the companies created in the split of the German Dassler brothers’ shoe empire. But Nike saw its fortunes dip in the 1980s, while the newcomer Reebook soared. Samsung’s Economic Research Institute found that Reebok thrived by appealing to the “leisure sportsperson.”

Today, despite Nike’s market dominance, Adidas has become the hottest brand in sneakers by capitalizing on a similar trend. Shoppers are buying up casual, fashionable footwear, and leaving performance products, especially basketball shoes, on the shelves. Nike simply hasn’t adjusted as well to give shoppers what they want.

The pressure is mounting

In an Aug. 29 note to investors, Morgan Stanley analysts cautioned that Nike’s problems in North America appear to be worsening. It’s relying more on discounts to get shoppers buying, threatening to devalue the brand if the markdowns go on unchecked.

The Jordan brand, which has always thrived on scarcity, may also take a dent as Nike aggressively pumps up the number of shoes available. Foot Locker CEO Richard Johnson mentioned on a recent call with investors that sales of certain Jordan styles had slowed considerably. (It doesn’t help either that, as mentioned, fashion has shifted away from basketball sneakers.)

Johnson highlighted another issue on that call as well: Nike hasn’t introduced a breakthrough innovation in years. When he pointed to “the limited availability of innovative new products” for Foot Locker’s poor quarter, he laid most of the blame at Nike’s feet, since it accounts for the majority of what Foot Locker stocks. About 68% Foot Locker’s inventory came from Nike in 2016.

Adidas, on the other hand, is enjoying a strong positive response to its new Boost soles, a springy technology made of foam pellets on exclusive license from chemical company BASF. They’re perfect for all those casual sneaker-wearers who want something comfortable, that also looks good.

Adidas’s momentum, Morgan Stanley noted, may just come down to it having better products right now. But the brand’s still-growing popularity could help Adidas keep claiming Nike’s customers for some time to come. ”We may be witnessing a sea change in consumer preferences which will take years to play out as sales trends ultimate [sic] come to match mindshare trends,” they write.

Outside the US, a more precarious situation

So what happens if Nike continues to slip? It’s not going to lose its crown anytime soon, but there’s no company better positioned to take advantage than Adidas—and not just in the US.

In Western Europe and China—two huge markets—the sales gap between Nike and Adidas is much smaller. China is the world’s second-biggest spender on sportswear, according to the research firm Euromonitor, and still has a lot of room for sales to grow, which is why sportswear companies look to it as a massive reservoir of untapped income. Nike is currently the market leader in China, but Adidas is catching up fast enough that it could conceivably overtake Nike soon. Soccer-loving Western Europe, meanwhile, is Adidas’s home field, and the brand is historically strong there. Nike’s sales will likely keep growing. But it may see its profits squeezed, along with its share of the global pie.

Nike didn’t get to the top of the sneaker world by coasting, though. It’s still a powerhouse of a company, dedicated to innovation and getting better at everything it does. It has some major projects in the works to speed up its supply chain so it can deliver customers what they want as soon as they want it. Fashion trends in the sneaker world, like the clothing world, also come and go much more quickly than they used to. The winds could easily shift back in Nike’s favor in the next couple years.

And there may be an upside to all this for consumers: It could open up the field to more genuine competition. Nike has been practically in a league of its own for years, but it’s facing a tough brawl against Adidas. The pressure is on for Nike to really listen to consumers about what they want—and deliver it.