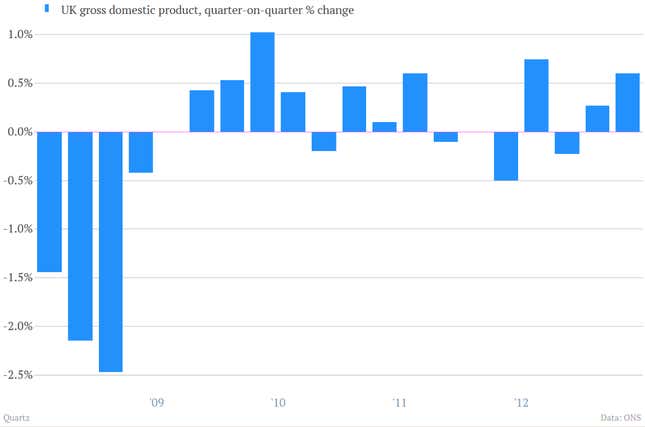

The numbers: Not bad at all. As predicted, UK GDP grew by 0.6%, increasing at twice the pace of the the first quarter (0.3%). The economy had been slowing until very recently. In last quarter of 2012, it contracted by 0.3%. Historically, the economy tends to expand at a rate of between 2.25%-2.5% per year. If the trend from the second quarter continues for the year, Britain’s annualized growth rate would be around 2.5%.

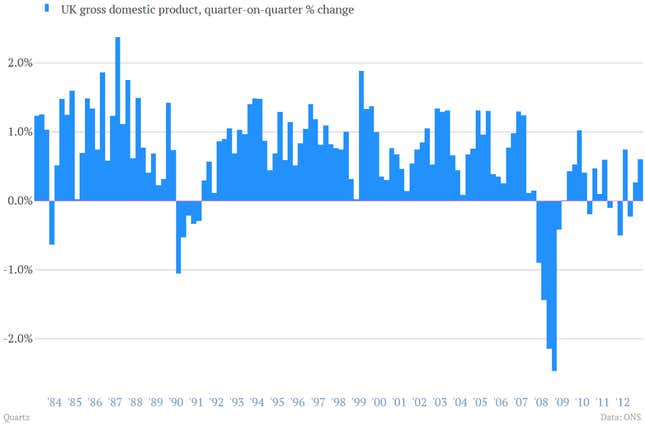

The takeaway: Unlike in Q1, all sectors of the economy are performing well, according to the Office for National Statistics. In particular, the cherished service sector, which accounts for more than 75% of British economic output, grew by 0.6% ( contributing 0.48 percentage points to GDP growth). However, economic growth is still well below the numbers (6.9%) forecasted in the fall of 2010, having grown only 1.9% in that time. The US economy has grown by 4.7% over the same period (as of Q1 2013).

What’s interesting: Cautious optimism is one thing, but chancellor George Osborne shouldn’t get too carried away. While GDP is steadily rising, growth in the aftermath of a recession tends to increase at a fairly sharp rate. Recent slow growth means that the British economy needs to grow by 3.3% to reach its pre-financial crisis peak from Q1 2008. By way of comparison, the US economy is now 3% above its pre-crisis peak.