Update: This morning, Dell’s special committee said it won’t change how uncast shares are counted, although it is willing to alter some other terms of the vote.

It’s well known that Michael Dell attached some strings to the latest, sweetened version of his buyout offer for the computer company that bears his name. The key change he wants before the vote, currently scheduled for Friday, Aug. 2: to ignore shares that investors don’t bother voting, instead of counting them as votes against the deal.

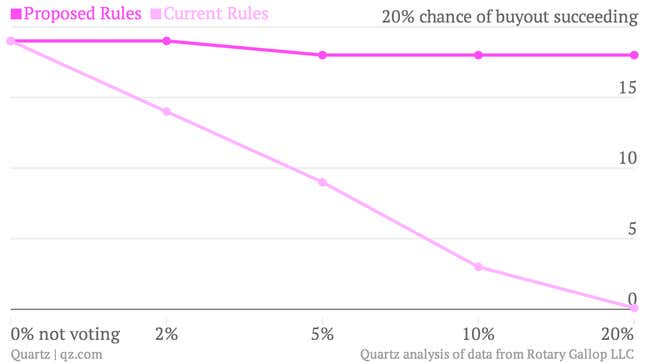

The chart above shows just why this is such a big deal to him. It shows the odds of the buyout succeeding under the current rules, which treat unvoted shares like “no” votes, and the proposed rules, which would ignore unvoted shares altogether.

Under the current rules, the buyout’s chances sink below 4% if at least 10% of shares aren’t voted, which is not uncommon in proxy fights of this kind. If 20% of shares aren’t voted, the buyout has essentially no chance of passing. Guess what? When votes were counted on July 18, before Dell’s board postponed a final tally, 23% of shares hadn’t been cast.

That number is likely to drop, but if Michael Dell gets the rule change he wants, it won’t matter one way or the other: The buyout’s odds of success stay relatively level, no matter how many shares go unvoted. It isn’t clear when Dell’s board will decide if it is going to change the rules ahead of Friday’s vote.

The odds in our chart were calculated by research firm Rotary Gallop, which ran statistical simulations of every possible vote outcome, based on what’s known about investor stock holdings and some other factors. With or without the change, Michael Dell’s odds of winning are low, statistically speaking. There are two main reasons for this: First, the buyout has to win the approval of a majority of shares, excluding those owned by him—a “majority-of-the-minority” provision intended to ensure that dominant shareholders can’t push through their own preferences to the detriment of others.

But that provision gives outsized influence to other big institutional shareholders, particularly activist investor Carl Icahn, who has made no secret of his contempt for the buyout effort. The chart assumes Icahn and his ally, Southeastern Asset Management, would vote against the deal under either set of rules, as they have suggested they will.