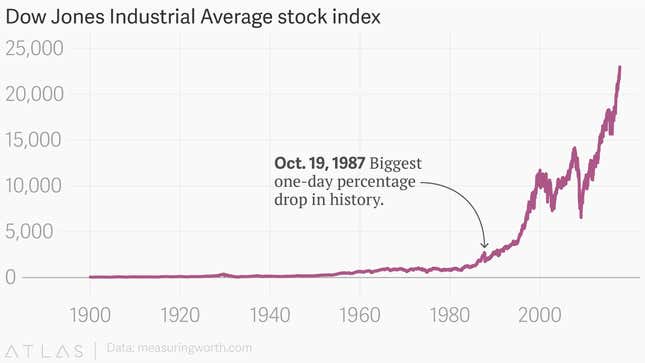

Precisely 30 years ago today, on Oct. 19, 1987, stock markets around the world suffered one of their worst days ever, in what became known as Black Monday. After a long-running rally, the crash began in Asia, picked up steam in London and ultimately ended with the Dow Jones Industrial Average down a whopping 22.6% for the day in New York. This was—and still remains—the worst day in the Dow’s history, in percentage terms.

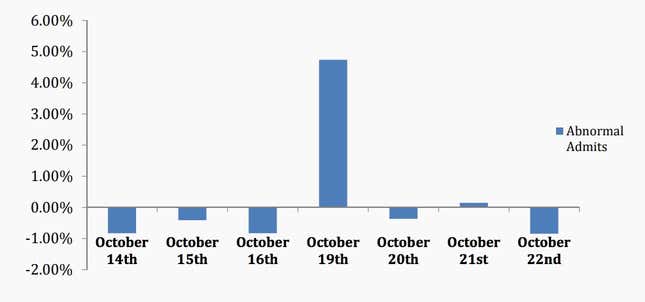

In fact, the crash was so severe that it resulted in a spike in hospital admissions. Joseph Engelberg and Christopher A. Parsons from the University of California at San Diego published a paper last year in The Journal of Finance that looked to see if there was a link between daily stock returns and hospital admissions in California, particularly relating to psychological conditions such as anxiety, panic disorder, or depression. On Black Monday, there was a 5% increase in hospital admissions above what the researchers would normally expect. The chart below shows the percentage difference between actual admissions and the prediction of their regression model during the week of Black Monday.

There are several theories about what caused the 1987 crash. Potential reasons for the initial market downturn include a slowdown in the US economy, falling oil prices, and escalating tensions between Iran and the US. However, Black Monday is considered the first crash of the modern financial system because it was exacerbated by newfangled computerized trading.

So-called program trading meant computers were set up to quickly trade stocks when certain conditions were met, and on this day it led to automatic selling as the market fell. The Federal Reserve said in a 2006 paper that Black Monday was a shock not just because of the price crash but because the market itself was “significantly impaired,” as the volume of sell orders overwhelmed systems.

In the UK, the FTSE 100 fell 11% on Black Monday and then another 12% the next day. The crash also coincided with another infamous event in Britain, what became known as the Great Storm of 1987. BBC weather presenter Michael Fish went down in history for telling the public there would be no hurricane. Instead on Oct. 15 and 16, 1987, a storm hammered the UK. This meant most traders couldn’t get to work on the Friday before the crash, leaving portfolio positions exposed when a financial storm hit the next trading day.

“There was hardly anyone in the Schroders’ London office on the Friday or anywhere in the City,” remembers Andrew Rose, an equities fund manager at the asset manager in London. Additionally, lots of traders had bought portfolio insurance, one of the types of program trading. “Investors thought it was a free lunch and losses would be limited,” Rose wrote in a note. “But everyone was a seller and no one was a buyer when markets went into freefall on Monday morning.”

Given the lofty heights of today’s markets, with the S&P 500, Nasdaq, Dow and FTSE all reaching all-time records in the past week, the anniversary of Black Monday is a poignant reminder that nothing lasts forever in the markets. But is there an imminent risk of another crash?

Outside of stocks, the market today is very different. Bond yields are extraordinarily low, meaning investors have fewer other places to look for returns. For example, 10-year UK government bonds had a yield of more than 10% in 1987, but today are closer to 1%. “Monetary policy settings and the level of bond yields are at levels that suggest the market soufflé can rise a fair bit more before the inevitable happens,” Kit Juckes, a strategist at Societe Generale, wrote in a note to clients.

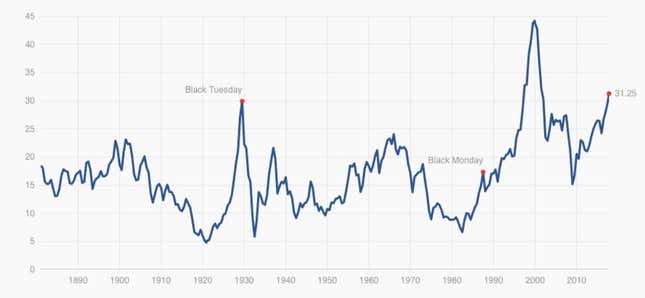

A measure of equity market valuations—the cyclically-adjusted price-to-earnings ratio—in the UK is currently around 17, according to Hargreaves Lansdown. By comparison, the long-term average is about 19 and in October 1987 the P/E ratio was more than 30. However, in the US, the P/E ratio is currently 31.3, higher than during the stock market crashes in 1987 and 1929, but lower than the dot-com bubble.

Unlike the market crash in 1929, Black Monday in 1987 didn’t lead to an economic recession—or, indeed, depression—in the US or UK. In fact, the crash quickly came to look like a blip. Since Black Monday, the Dow index has risen nearly 1,000%.

“In the short term the stock market is a capricious beast and can move sharply in either direction,” Laith Khalaf, an analyst at Hargreaves Lansdown, wrote in a note. “But in the long run, it’s surprisingly consistent.”