Tezos was one of the biggest initial coin offerings (ICOs) of the last year. It raised $232 million in July with a utopian pitch: to create “a new digital commonwealth.”

This would take the form of developing a new blockchain—the technical idea behind cryptocurrencies like bitcoin—that would avoid the fractious disagreements that have split the bitcoin world. Instead, it would institute a harmonious governance process to create a “self-amending cryptographic ledger.” An investigation by Reuters published yesterday suggests that isn’t happening any time soon.

Tezos itself is beset by infighting, according to Reuters. The company had set up a complex governance structure where the inventors of the protocol, a couple named Arthur and Kathleen Breitman, own a company that develops and owns the code. But instead of the $232 million raised in the ICO going to the company, an independent Swiss foundation was created to handle the money. The Breitmans are now in a dispute with the head of the foundation, Johann Grevers, with both sides alleging an illegal power grab. Meanwhile, that $232 million has grown to $400 million, thanks to the rocketing value of bitcoin and ether, which is what the funds are denominated in.

Reuters reported that the Breitmans sent a letter on Oct. 15 demanding that Grevers be removed from the foundation. They also asked for a “substantial role” for themselves. They accuse Grevers of “self-dealing” and misrepresenting the size of a bonus that they claim he tried to grant to himself. Grevers calls this “character assasination,” and claims the Breitmans are the ones trying to overstep their legal bounds by controlling the foundation.

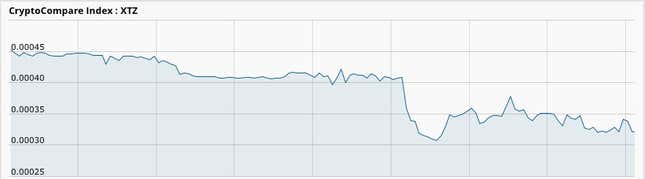

The dispute means that development of the Tezos protocol will be delayed, which in turn prevents the tokens from being disbursed to ICO participants. That leaves Tezos token buyers empty-handed indefinitely. Before the ICO, token buyers were told that the Tezos network would be active around mid-November, and that secondary trading would happen after that. Still, there’s a small futures market in Tezos tokens that lets anyone speculate on the future value of “tezzie” tokens. The price of those instruments fell 27% since the news broke yesterday.

The Tezos fight has wider implications for the cryptocurrency world. The conflict could draw the Swiss regulator’s scrutiny to the practise of using foundations, or stiftungs, in vogue among cryptocurrency developers. Grevers says he has already filed a complaint with the regulator. The stiftung structure has gained favor among ICO issuers in particular, and the practice has been christened by some observers “the Zug defense.” The SAFT is another legal framework that’s been devised to try and keep ICOs within securities law.

In the meantime, Grevers told Reuters that he’s liquidating the $400 million stash at a rate of $10.2 million a week. He will invest the proceeds in a “diverse portfolio.” It’s a safe bet that portfolio doesn’t include more crypto tokens.