It’s been a good decade to be Australian. The average Australian household saw incomes jump an inflation-adjusted 49% between the mid-1990s—based on a survey data collected between 1994 and 1995—and the recently released estimates from the same survey conducted between 2011 and 2012, according to the Australian Bureau of Statistics.

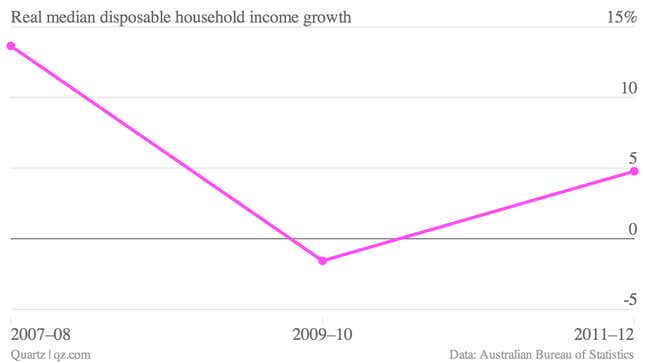

Granted, things have slowed down a bit recently. Aussie household incomes dipped in the immediate aftermath of the financial crisis. And the most recent estimates show median household disposable incomes—a measure that strips out the impact of both the richest and the poorest households—growing at roughly 5%. That’s lower than the 13% income increase seen during the hottest years of Australia’s mining boom, just before the crisis.

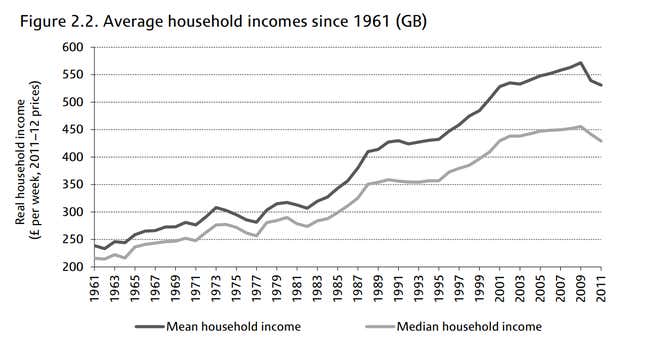

But that’s a heck of a lot better than, say, the United Kingdom, where households are facing the sharpest two-year decline in income since the dour years of the mid-1970s.

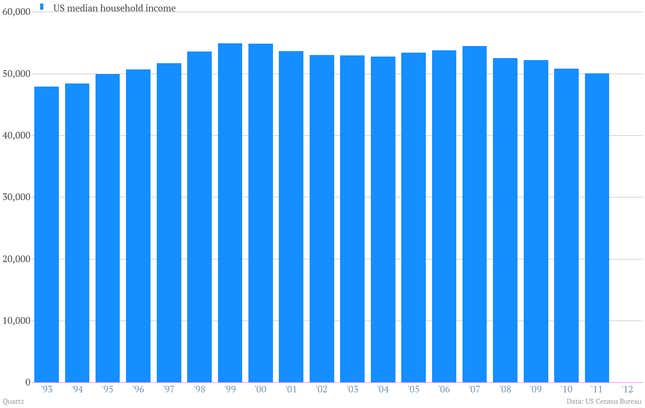

It’s also far better than the US. US median household incomes were up a paltry 4.5% over the 20 years through 2011, the last year for which data is currently available. (They’ve gone pretty much nowhere since 1995.)

Of course, emulating the Australian economic model—which is largely based on digging stuff out of the ground and selling it to China—would be difficult for the UK or US. And with recent indications that Chinese growth is cooling, it’s probably not a wise bet anyway. But still, for Australians of all stripes, the China-focused commodities boom has been an incredibly enriching experience.