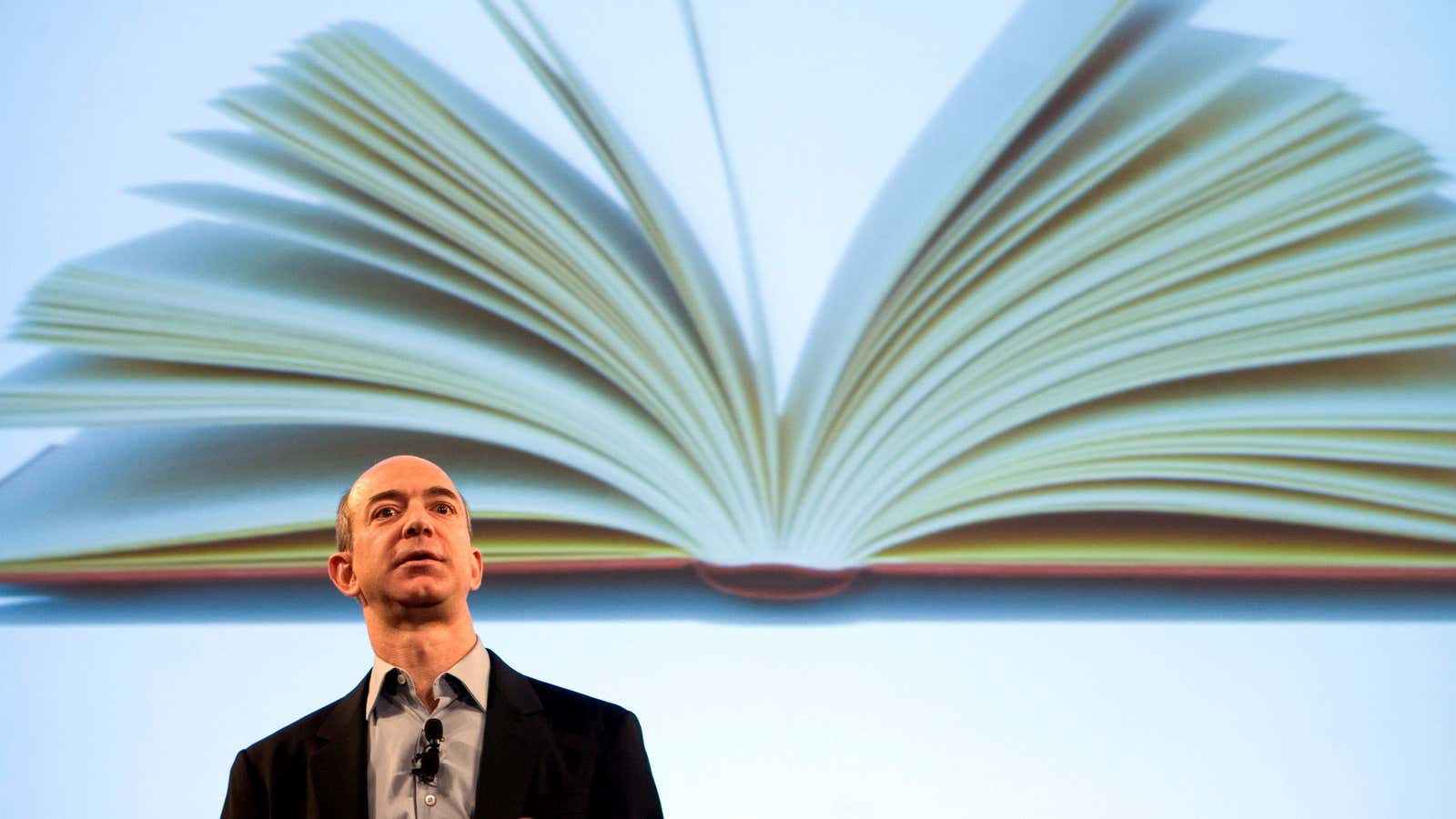

Today, Amazon CEO Jeff Bezos personally bought the Washington Post from its parent corporation for $250 million in cash, an acquisition that at once astonished the financial media and made us think: We should have seen it coming.

1. On Friday, Bezos cashed out at Amazon.

Bezos sold 614,938 shares of Amazon stock last week, for a rough return of $185 million. (Give credit to tech journalist Tim Carmody, who spotted the transaction on Friday). The move might have been seen as a negative sign for Amazon’s prospects, although it barely puts a dent in Bezos’ ownership stake in the company, but today it makes much more sense. Billionaires like Bezos may carry plenty of spare change in their bank account, but when they’re buying something for hundreds of millions, they need to get a little more liquid.

2. Bezos is a friend of Washington Post Company chairman Donald Graham.

Graham, whose family has owned the Post since 1933, worked his way up through the paper as a journalist before taking over the business side in 1976. But his business interests extend beyond the newspaper world. He was an early investor in Facebook and is a member of the company’s board, and has maintained a friendship with Bezos that included advising him on Amazon’s development of the Kindle. Now, Bezos is taking the least-performing part of Graham’s company off his hands, including its pension obligations. What’s a few hundred million between pals?

3. Bezos loves running unprofitable businesses.

At Amazon, Bezos has focused on market-share and customer satisfaction, often at the expense of his margins. Nonetheless, markets have continued to reward his disinterest in their metrics, sending Amazon’s stock soaring above $300 despite the company’s $7 million in losses last quarter. While the Post won’t be part of the Amazon company, journalism as a business certainly fits the Bezos style: a low-margin operation that has to find a way to succeed online.