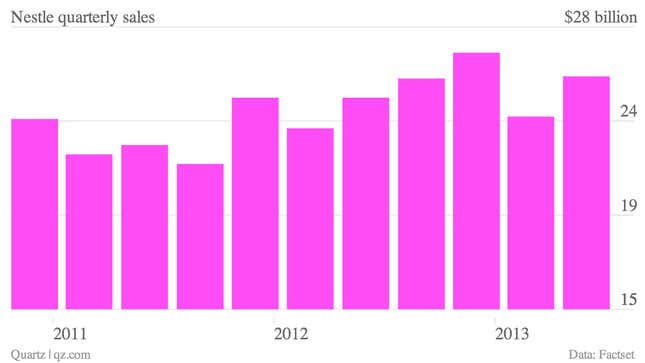

The numbers: Not great. Nestlé, the world’s biggest food group, reported a 3.7% rise in net income (pdf) for the first half of 2013 as against the same period last year. Total revenue rose 5.3% from a year earlier, to $49.1 billion, slightly lower than analyst forecasts of $49.5 billion. The company lowered its full year forecast to around 5% sales growth, from its original target of 5-6%.

The takeaway: Food companies around the world are struggling as consumers tighten spending, but Nestlé appears to be struggling more than its competitors. Nestlé lowered its full-year forecast to around 5% sales growth, from its original target of 5% to 6%, but even the company’s chief financial officer, Wan Ling Martello, isn’t convinced Nestlé will manage to achieve that. ”It’s not going to be easy,” Ms. Martello said in a conference call. “It is in fact a stretch.”

What’s interesting: Europe is causing Nestlé a bit of a headache. Weak spending and acute price sensitivity in the region are pinching the company’s sales growth, which slowed to under 1% there. “In Europe, customers are extremely sensitive to price, and we have been responsive,” Nestlé said in its report. The company has been working to cut prices and tweak its marketing scheme to cater to tightened wallets worldwide. The hope is that lower prices and investment in its brands will fuel better numbers in the second half of the year.