China’s milk powder ban could deal a big blow to New Zealand’s economy

A few days ago, the New Zealand trade minister revealed that China banned all milk powder imports from New Zealand. This came after a highly publicized scare over botulism-tainted whey protein powder in milk products from Fonterra, New Zealand’s dairy behemoth, whose annual revenue is around $16 billion.

A few days ago, the New Zealand trade minister revealed that China banned all milk powder imports from New Zealand. This came after a highly publicized scare over botulism-tainted whey protein powder in milk products from Fonterra, New Zealand’s dairy behemoth, whose annual revenue is around $16 billion.

Dairy is a big deal for the Kiwis; it generates 25% of New Zealand’s export earnings. And China drives a lot of that. It imported around $1.7 billion in milk powder from New Zealand last year.

That’s a hefty chunk of what New Zealand earns from the country that’s one of its top two export markets; milk powder makes up around 18% of the $9.7 billion it shipped to China last year. And New Zealand’s exports to China have surged of late; China imported $627 million from New Zealand in July, up 23% from July 2012, according to China’s customs agency (link in Chinese).

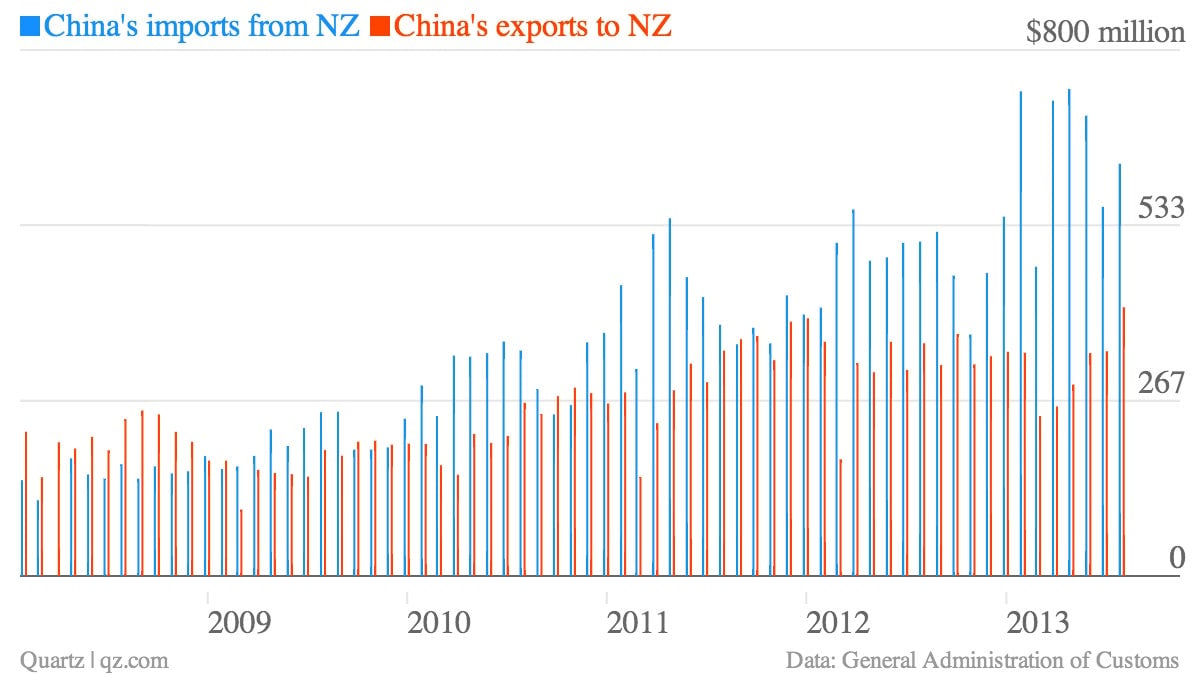

That means China’s ban threatens to flatten the sizable trade gap between the two countries that’s emerged since 2008, when the death of six babies due to contaminated milk set off China’s baby formula panic in earnest:

Though dairy contributed 18% of New Zealand’s exports to China in 2012, it’s probably safe to conclude that dairy was generating a much bigger share going into 2013.

Our first clue is the flocks of Chinese descending onto Kiwi shores. Then there’s the fact that exports to China have exploded since January, when Hong Kong first mooted (paywall) its crackdown on formula-smuggling, which drove Chinese parents abroad to hoard formula. In the months since then, exports have been mostly off the charts (the two exceptions—February and June—were likely due to a business lull during Chinese New Year and tightened regulation of trade invoicing, respectively). Considering that other countries are now jumping on the banning bandwagon, it could all add up to a big hit to New Zealand’s economy.