In recent months, it’s become fashionable among financial cognoscenti to argue that Ben Bernanke’s Federal Reserve can’t really do much more to influence the real economy. “Sure,” the groupthink goes, “The Fed can definitely still push the stock market up, and press interest rates lower. But that’s about it. It’s not going to do much to support growth.”

The groupthink is wrong.

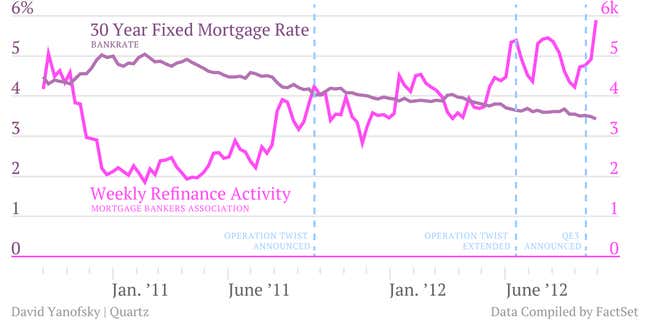

Check out the mini-wave of mortgage refinancing that surfaced in US economic data Oct. 3, showing the Mortgage Bankers Association (MBA) refinancing index hitting a three-year high, as mortgage interest rates continue to plumb record lows. ”Weekly MBA data this morning showed a very large rise in the refinancing component, +20% to its highest level since 2009 and above the highs seen with QE2, suggesting that QE3 is having the desired effect of spurring refi activity, at least in terms of applications,” wrote analysts with TD Securities in a note to clients Oct. 3.

QE3, of course, refers to the third and latest round of quantitative easing (i.e., injecting money into the company) that the Fed announced on Sept. 13.Pep

As a refresher, one of the ways that the Fed tries to help the economy is by pushing down interest rates. And one of the reasons that it wants to push down interest rates is because doing so tends to lower the rates on home loans. In normal times, lower mortgage rates prompt homeowners to refinance, and since they’re paying a lower rate of interest after refinancing, less of their monthly paycheck goes to their mortgage payment. That effectively puts more cash in their pocket to be spent on trips to the movies and beer. That helps the economy.

Of course, the US economy isn’t exactly in normal times right now, and the fallout from the financial crisis has thrown all sorts of wrenches into the gears of this mechanism. For example, if homeowners owe more on their mortgage than the house is worth—as many Americans do after the crisis—that that renders them largely unable to refinance.

Even so, with QE3 the Fed stepped up its strategy of trying to generate activity, amid some signs of life in the US housing market. QE3 focuses squarely on buying the packages of mortgage bonds where nearly all US home loans eventually end up. By targeting those bonds, the Fed is zeroing in even more precisely on the housing market. And mortgage rates dug deeper into record low territory on the heels of the QE3 announcement, falling from an already eye-popping mark of 3.57% the day before the announcement to an unheard of 3.39% on Oct. 2, according to financial information provider Bankrate.

Given that rates have been falling and refinancing has been rising steadily for a while, as the chart above shows, it’s perhaps a little early to be sure that the latest spike in refinancing is the outcome of QE3 and not just another blip. But few would dispute the claim that the Fed is, at least in some part, playing a role in the current low-interest rate environment. And consumers have and are responding to those low rates. That’s the definition of affecting the “real” economy.