Japan logged its thirteenth consecutive trade deficit in July, as just-released statistics underscore the challenge facing Abenomics. Simply put: It’s the energy costs.

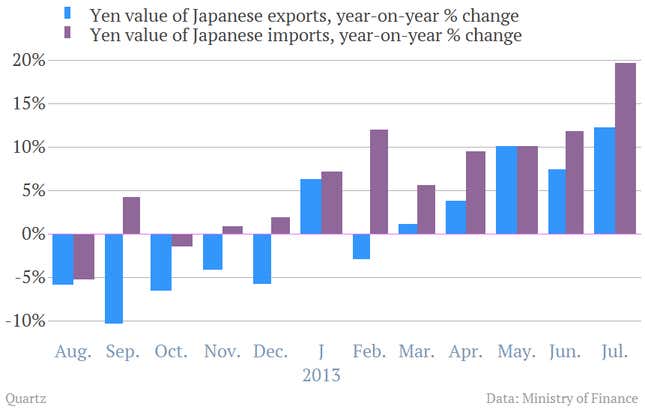

Japan logged a trade deficit of ¥1.02 trillion in July (roughly $10 billion). Exports rose a tidy 12%, the fastest annual pace in three years. But imports surged 20%, thanks to jumps in oil and gas imports.

An aggressive easy money policy that is a central part of prime minister Shinzo Abe’s multi-pronged approach to reinvigorating economic growth. That weakens the yen. And the weaker yen helps Japan boost exports. (It makes goods produced in Japan cheaper for foreign buyers.)

But it also makes foreign imports more expensive in yen terms. And Japan has become more and more reliant on foreign energy imports since shuttering most of its nuclear reactors in the wake of the Fukushima disaster. In July, the yen value of imports of liquified natural gas jumped 30%. And petroleum imports increased by about 17%.