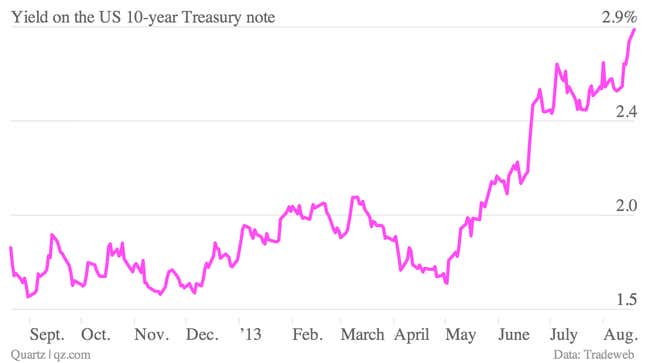

A slew of well-sourced Washington reporters (here, here and here) now write that former Treasury secretary Larry Summers is sitting in the catbird seat and likely to become president Barack Obama’s pick to run the US Federal Reserve after Ben Bernanke steps down, as he’s expected to do, early in 2014. Meanwhile, in the bond markets, the yields on US Treasurys are touching their highest level since 2011.

Coincidence? Wall Street bond watchers think not. At BNP Paribas, Julia Coronado, chief economist for North America, noted that US bond markets seem to be assuming that Summers will get the job and may be a bit more aggressive about dialing back quantitative easing, the Fed’s $85-billion-a-month bond-buying program:

A nervous market began to zero in on the Fed chair succession issue at the end of the week as rumours again wafted out of Washington DC that Larry Summers is the front runner for the position. We heard from investors that the possibility is starting to get actively priced into markets and we saw online betting sites putting greater odds of Summers getting the job than [current Fed] Vice Chair [Janet] Yellen. Knowing that Summers harbours skeptical views about QE [quantitative easing], bond yields rose and stock markets fell.

Over at Morgan Stanley, bond watchers saw the same thing:

In addition to rising confidence in the economic outlook, our desk saw the Fed repricing as being supported by investors seeing a rising likelihood that Larry Summers will be the next Fed Chairman and presuming that he would support a more rapid pace of policy normalization.

As the Morgan Stanley team suggests, you’d expect interest rates to rise for a number of reasons lately, not the least of which would be an improving economic outlook for the US. But if the markets are moving on expectations that Summers is more likely to ratchet back QE, they might be overdoing it. Summers’ comments on monetary policy have been few and far between, not to mention heavily hedged.

Still, Summers’ chief rival for the top job at the Fed, Janet Yellen, is viewed by the markets as essentially indistinguishable from Bernanke when it comes to policy. So even if we don’t know what Summers would do at the Fed, you can make the case that his arrival there would bring a certain amount of uncertainty. And such uncertainty could very likely push yields higher.