America’s credit is getting better.

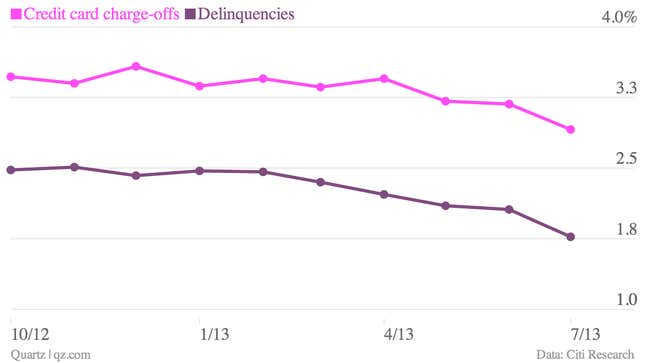

Losses and delinquencies on credit cards hit “multi-year” lows in July, according to Citibank’s index of credit card performance.

The latest data for Citigroup’s credit card index, through July, shows charge-offs—accounts written off as losses—falling 2.91%, a 25% improvement over the prior year. Delinquencies have fallen for 35 out of the last 41 months, hitting 1.77% in June. Payment rates hit a post crisis high of 23.73% in July, according to Citi. (Others, such as Transunion, have also reported near record lows for delinquencies.)

So what’s going on here? Citi cites “striking consumer de-leveraging since the financial crisis combined with relatively still strict underwriting standards” for the improvements. Some others have suggested that post-crisis regulations might be playing a role. Mark Graf, chief financial officer at Discover Financial Services, mentioned that the 2009 US law known as the CARD act “discourages issuers from using deceptive introductory promotions and rates that could increase the likelihood of late payment,” according to American Banker (paywall).

As we’ve mentioned before, with key emerging markets like India, Brazil and China showing signs of faltering, the health of the US consumers is going to play big role in powering the global economy. The most recent credit card data suggest that Americans could afford to pick up the pace of spending without becoming overextended—and that’s a good thing.