People are dumping their yuan, which may spell more bad news for the Chinese economy

Yesterday, Reuters warned of an emerging trend in China: rising demand for foreign currency among China’s banking customers, who bought 24.5 billion yuan ($4 billion) more of it in July than they did in June.

Yesterday, Reuters warned of an emerging trend in China: rising demand for foreign currency among China’s banking customers, who bought 24.5 billion yuan ($4 billion) more of it in July than they did in June.

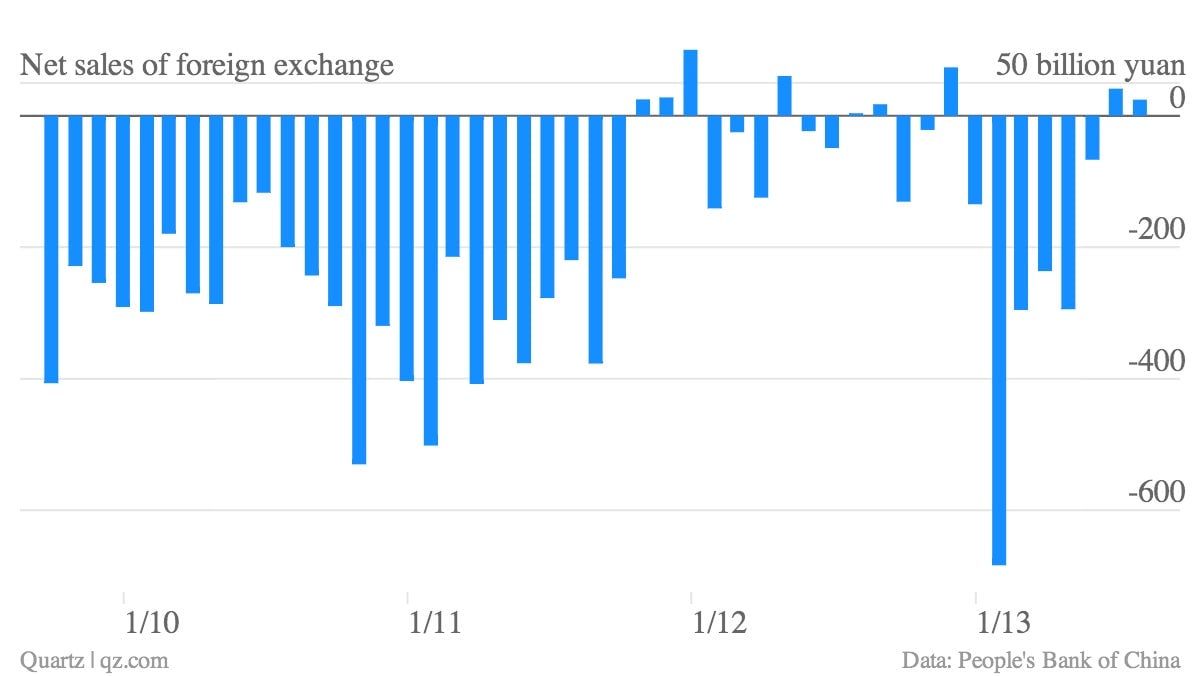

That was only just more than half of the 41.2 billion yuan more in foreign currencies bought in June than in May—and was still a relatively small amount of money. But it was the second month in a row that capital flowed out of China, after six months of flowing in. Here’s a look at the trend:

This is somewhat odd given that holding onto yuan, a currency that has been steadily strengthening against the US dollar, is widely considered to be a safe and easy investment. Some think the only reason to trade out of that yuan investment would be major concern about the health of the Chinese economy. As a result, capital flight is sometimes seen as a bet against China’s economy. And there’s good reason to take that bet; so far in 2013, China’s economy looks set to slow more than it has in 23 years.

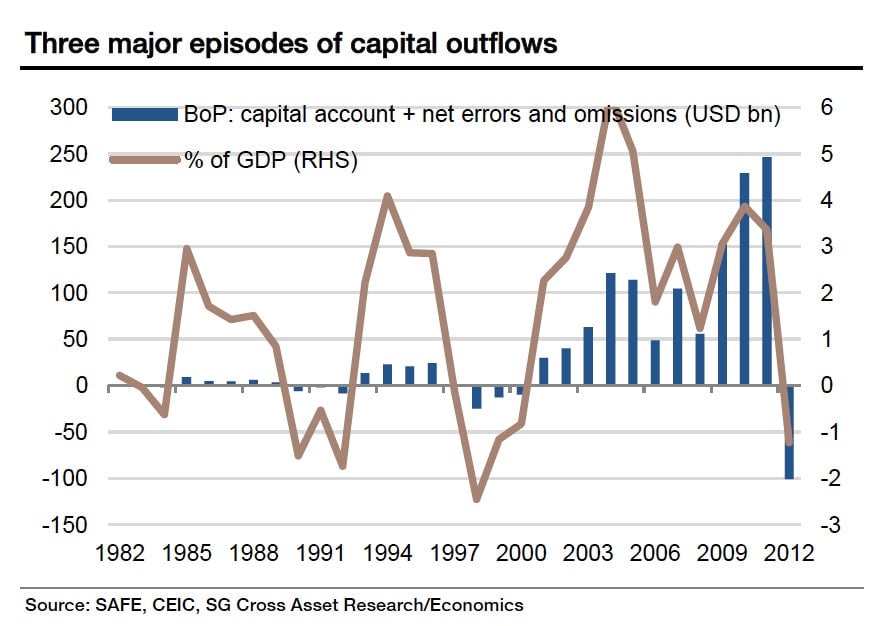

If the capital flight continues, it could be a reprise of 2012, when the worrying state of China’s economy spurred what Société Générale’s Wei Yao estimated to be $100 billion in outflows, amounting to 1.2% of GDP. Here’s a look at how that trend worked historically:

Then again, confidence may be improving. Li Huiyong, an economist at Shanghai’s Shenyin & Wanguo Securities, noted that less money flowed out in July than in June. He told Reuters that the “future trend of capital flows depends on the fundamentals of China’s economy.”

But typically, when capital flows out of China, the yuan depreciates against the dollar. That happened a little in June and July. But for the most part, China’s central bank, the People’s Bank of China (PBOC), has kept the yuan’s value fairly steady, and has even let it strengthen compared with May, as you can see from this chart of the middle of the yuan’s trading band shown on the PBOC site:

That could mean that the PBOC is actually selling dollars to keep the yuan strong, according to traders who spoke to Reuters.

Why would the PBOC want to do that? Many economists think that during the capital exodus of 2012, the yuan’s 1% depreciation against the dollar actually perpetuated the capital flight, fanning fears that the yuan would shed even more value. Selling dollars could mitigate that effect.

However, that type of currency control takes liquidity out of the economy. (When the PBOC buys dollars from exporters, it has to create the equivalent amount of yuan to buy those greenbacks. To prevent the resulting inflation, it usually raises the reserve requirement for banks.)

But less liquidity comes with other problems: When cash froze up in June, a massive bank panic ensued. The PBOC has other ways of boosting liquidity, which it has been using aggressively lately. It will need a lot more of that, though, if money keep exiting the financial system.