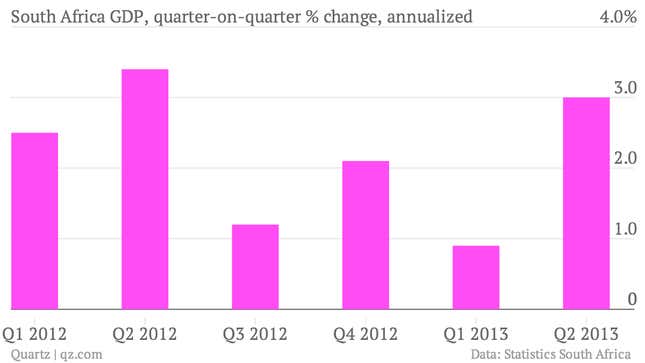

South Africa’s quarter-on-quarter GDP growth of 3% was much better in the second quarter of this year than it was in the first (0.9%) but that’s nothing to celebrate.

With nation-wide strikes picking up steam, South Africa’s economy is taking a hit.

Most notably, 30,000 workers in South Africa’s automotive industry have been on strike for about a week, demanding higher pay to deal with rising inflation (paywall). Carmakers fear the strike will cost them almost $70 million a day, and have already raised wage offers for workers. And the labor unrest is spreading: just this week, construction and airport workers, and petrol station and car dealership workers have gone on strike as well.

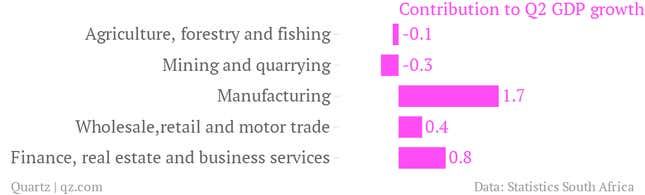

South Africa’s manufacturing industry—the second largest private sector industry—is slowly becoming plagued by strikes. But it still managed to contribute the most (pdf) to GDP growth this quarter.

If that situation sounds familiar, that’s because it happened very recently in a different industry, and it didn’t turn out well for South Africa. A year ago, mining Q2 growth was 30.9%, and it was by far the most important factor driving second quarter GDP growth last year. Then came the Marikana miners’ strike, which led to the worst incidence of state violence since apartheid. The National Treasury estimated that $518 million of platinum and gold mining production was lost last September as a result, according to Bloomberg.

This year, mining contracted 5.6% in Q2, and miners are still unhappy about wages. South Africa’s main mining union is in talks with producers about higher wages. And if its demands are not met by Friday, another disruptive strike is likely to happen. It doesn’t help that gold prices and the rand have been falling; the mining strikes only worsened investor fears. In addition, they have corresponded with a 45% decrease in corporate tax collections.

With the many, adverse effects of mining strikes, it’s alarming that mining is only about a third of the size of the manufacturing industry. If the manufacturing strikes reach the scale of the mining strikes, South Africa’s troubles right now will seem minor by the end of the fiscal year, especially if manufacturing growth trends continue to fall below expectations.