More proof that taper talk and higher interest rates are weighing on US housing

Talk of a taper is taking its toll. (Now say that five times fast.)

Talk of a taper is taking its toll. (Now say that five times fast.)

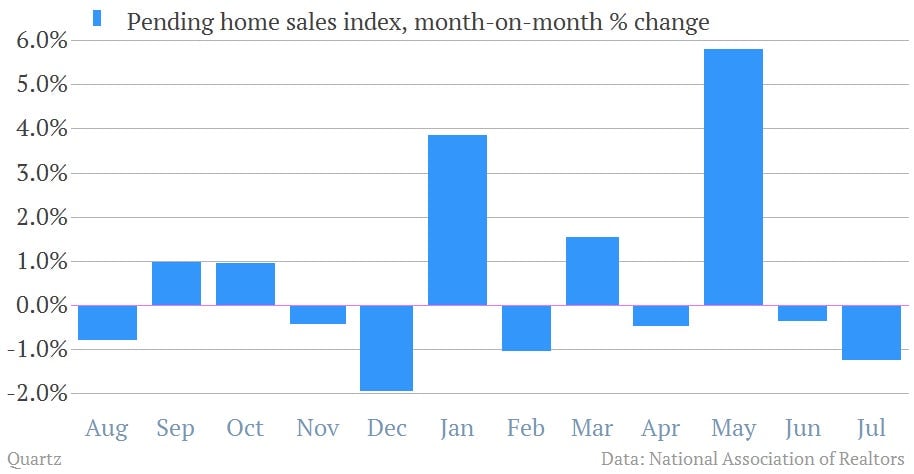

Home sales under contract in the US fell 1.3% in July, according to just-released numbers from the National Association of Realtors. That’s yet another sign that higher mortgage rates brought on by the Federal Reserve could start dragging on a crucial economic sector.

Mortgage rates have risen roughly one percentage point in the US since May. It was late that month when Fed chairman Ben Bernanke surprised markets by suggesting that the Fed could start to cut back on its bond-buying program the “next few meetings.”

Lower mortgage rates—brought on in part by Fed efforts to keep interest rates low by buying Treasurys and mortgage securities—provided some of the most tangible proof of monetary easing helping to drive the US recovery.

Fed hinting that it will cut back on its support has had the reverse effect, driving mortgage rates higher. Refinancing activity and applications for housing purchases have declined. America’s biggest mortgage banker, Wells Fargo, also moved recently to cut some 2,300 mortgage production employees.

The news isn’t all bad. For instance the latest quarterly survey of senior loan officers by the Fed showed the demand for mortgages remained robust, at least through the end of the second quarter. But it could take a bit longer for the slowdown to show up in those quarterly figures.

At any rate, the Fed appears to be dead set on the commencing the so-called taper of its bond buying programs at its September meeting. With the clouds gathering over the housing market (not to mention the conflict in Syria and the prospect of another messy fiscal fight in Washington), that will be a very gutsy call.