The recent chaos in Syria, Egypt and Libya has pushed up oil prices by as much as $16 a barrel above the three-year average of 2010-2012, making it far more expensive to drive and to run businesses. But the root of the price spike is not the mayhem itself, but the fact that the the world is ill-equipped to absorb more trouble.

This morning the price of Brent crude oil, the international benchmark, eased below $115 a barrel. But it’s still $14 a barrel higher than the three-year average, which was $100.98.

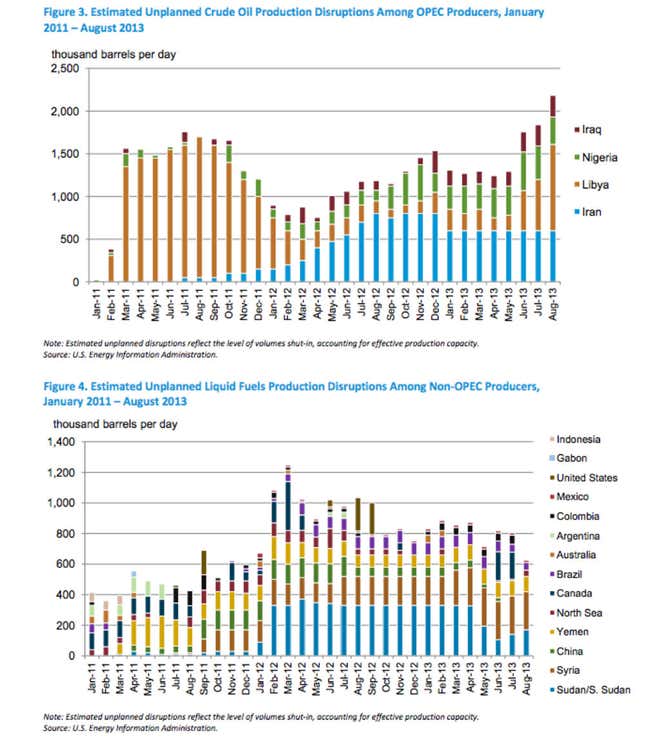

In search of an explanation, a new report (pdf) from the US Energy Information Administration (EIA) says that the chaos has helped to push an extraordinary volume of oil off the market. As you see in the chart below, 2.8 million barrels of oil a day have been idled by the various problems—2.1 million barrels a day between Iran, Iraq, Libya and Nigeria, and about 600,000 barrels a day in non-OPEC countries.

In theory, these lost barrels would not be a terrible problem since supply and demand have been more or less in balance over the last year—both consumption and supply have risen by 1.2 million barrels a day.

The bigger problem is that the chaos has knocked out a lot of what the industry calls spare production capacity. This refers to idle oil wells that can be brought on-stream within a month and be sustained for three months. The market is serene when there is a lot of spare production capacity—say 5 million barrels a day. But when you get down to 3 million barrels a day or less, traders start to twitch nervously and bid up the price of oil.

So it is now. Producing nations—mainly Saudi Arabia—have spare capacity of 2.2 million barrels a day of production, the EIA says. That is down from the three-year average of 3 million barrels a day in 2012. By the industry’s standards it’s a razor-thin margin.

Spare capacity is set to rise in a few months when more US shale oil is expected on the market. But until then, the risk premium may be stubbornly built into the oil price.