Today, the Wall Street Journal reported (paywall) that General Electric, the massive US conglomerate, is looking to spin off its consumer lending segment, a part of the lucrative GE Capital, with a public offering. The $15.58 billion unit manages dedicated credit cards for US retail chains like Walmart, GAP, and Lowe’s, but also accounts for $50 billion in GE’s $274 billion in debt.

The move appears to be intended to shore up cash for rickety GE, which since the financial crisis has been struggling for cheap cash to fuel its industrial business. But it also reflects the fact that lending money to consumers isn’t that lucrative anymore.

Given the high fees charged by credit card companies, you would think consumer lending would be a cash cow, especially at a time when borrowing rates for banks are extremely low.

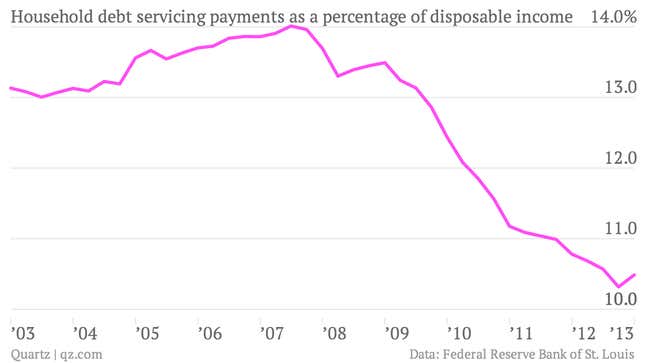

But US consumers have learned a hard lesson since the financial crisis; they’re much less interested in sporting a wallet full of credit cards.

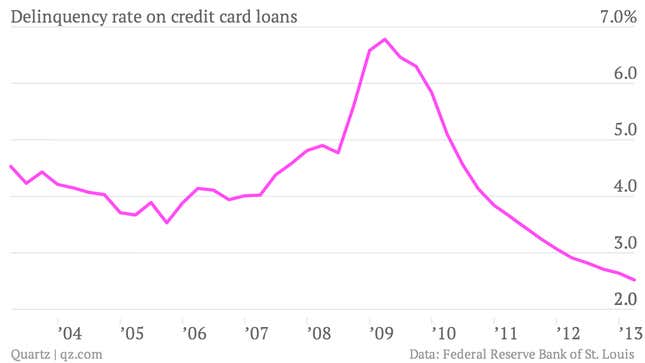

That’s likely because consumers are still smarting from the spike in credit card loan defaults between 2007 through 2010. The delinquency rate nearly doubled from 2005 to 2009.

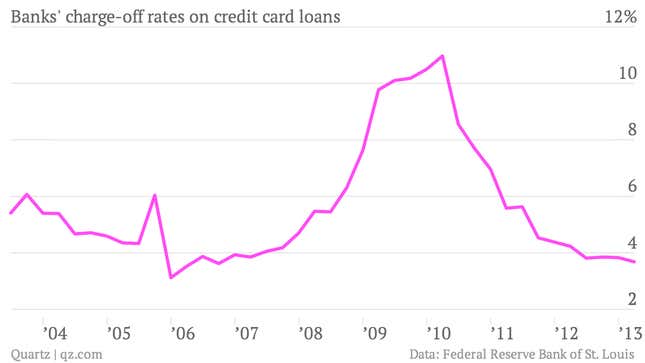

The skyrocketing number of defaults meant that banks had to write off a relatively large percentage of their credit card loans.

Tighter financial regulation has also made lending to consumers more difficult and less profitable. It’s worth noting that GE Capital was named a non-bank systemically important financial institution (or non-bank SIFI, if you’re a fan of that lingo) by the US Financial Stability Oversight Council (FSOC) after the financial crisis. The designation subjects GE to greater regulatory scrutiny, which means eliminating the consumer finance piece of the business could make GE Capital’s life a whole lot easier.