Vodafone will make $130 billion by selling its stake in Verizon Wireless, it was announced yesterday. Now what?

What we know, based on a presentation (pdf) and conference call announcing the deal, is that $84 billion of that total will flow to Vodafone’s shareholders in a mix of cash and Verizon shares. Of the remainder, Vodafone will use around $20 billion to pay down debt and $9 billion on investments in its infrastructure.

Taking taxes and other expenses into account, this leaves roughly $5 billion, some of which is tied up in Verizon loan notes, unaccounted for. Vodafone’s boss, Vittorio Colao (pictured above), will not be drawn on specifics, but bankers and analysts are stoking speculation that the British telecoms group will use at least some of the surplus on acquisitions in its key remaining markets.

Vodafone’s $10 billion purchase of Munich-based cable company Kabel Deutschland earlier this year suggests that bolstering its European operation is a priority. Thus, you will read many stories this week with lists of companies on Vodafone’s purported acquisition radar. The most frequent names, like Spain’s Ono, Italy’s Fastweb and Ziggo of the Netherlands, fill a similar niche to Vodafone’s German purchase.

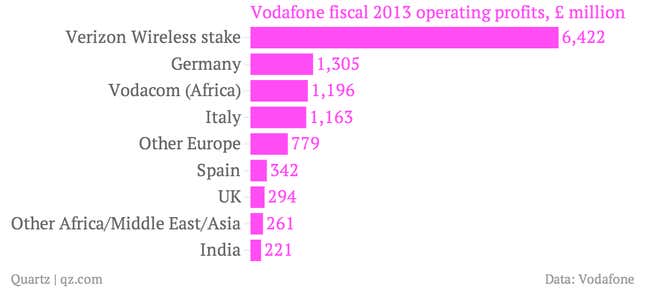

But amid all the deal fever, it is also worth taking a step back to appreciate just how comprehensively the deal transforms Vodafone’s financial profile. In Vodafone’s latest fiscal year (ending March), its stake in Verizon accounted for just over 50% of operating profits. It is also one of the few units in the group’s portfolio posting profit growth. After the disposal of the Verizon stake, operating profit in the current fiscal year will be cut by around 60%, according to Vodafone’s forecast.

Vodafone’s struggling European operations led to a 90% collapse in net profits in its latest fiscal year. Important ventures in growth markets like India still operate at loss after taxes. It’s not surprising, then, that alongside talk of the deals that Vodafone will do with its Verizon windfall, the slimmed-down operator is now itself a target for others looking for a foothold in Europe. AT&T and Softbank are two of the most commonly cited suitors.

Vodafone has already earned a spot in two of the three largest acquisitions in history. At current valuations, a deal for the “rump” of Vodafone—with a market capitalization, at most, half of its current £100 billion ($155 billion)—would rank much further down the league table.