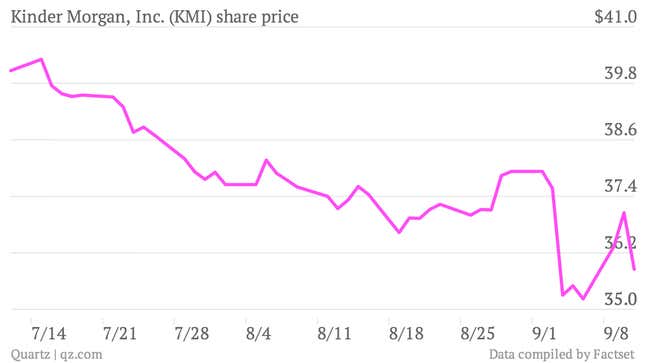

On Sept. 9, Reuters reported that Kevin Kaiser of Hedgeye Risk Management had sent shares of Kinder Morgan, North America’s third largest energy company, reeling 6%. Kaiser had emailed clients advising them to short the stock (i.e., bet it would fall). The following day, Kaiser published a full report on the company, arguing that it was overvalued. In the two days since, Kinder Morgan’s share price has rallied and then fallen sharply.

Analysts at big banks immediately took aim at Kaiser’s note, suggesting the 26-year-old was out of his depth. The public spat continues unabated. So what’s going on? Is Kaiser a jumped-up ignoramus, or a brilliant whiz-kid—or is it all just a symptom of Wall Street’s tribal divisions?

The history

Nobody might be listening to Kaiser had he not made a splash earlier this year when he took aim at Linn Energy, an oil and gas exploration and production company. After critical articles about Linn were published by Barron’s reporter Andrew Bary and investment blogger John Hempton, Kaiser spent some weeks digging into Linn, concluding that the company was overvalued and might encounter difficulty in its proposed merger with Berry Petroleum. Before long Kaiser told his clients to short the stock.

Linn had its supporters. The most prominent was Jim Cramer, the iconoclastic investment commentator on CNBC and The Street, who got into a very public and personal spat with Kaiser’s boss and Hedgeye founder, Keith McCullough, accusing it of conspiring with short-sellers trying to manipulate the markets. (Hedgeye has denied such claims.)

Kaiser’s stature grew when, on July 1, Linn and its parent LinnCo announced that the SEC was investigating its accounting practices and proposed merger. This week, however, the wind seemed to blow the other way. Linn announced that the SEC had made comments on its proposed merger, suggesting that the potentially lucrative deal is moving forward. The share price, having tanked, shot back up (see chart below).

The call

Kinder Morgan is a much bigger fish than Linn. LinnCo’s market capitalization is just over $1 billion. Kinder Morgan is actually four large publicly-traded companies—a master-limited partnership (MLP)—with a combined market value of $110 billion.

Kaiser’s central claim is that the company appears to be spending less than it should on maintaining its pipelines. He argues that means one of two things: it’s seriously underfunding maintenance on the pipelines, and/or it’s misclassifying other money, which is really being spent on maintenance. If it’s the first, he says, the pipelines may be in bad shape and that will cost the company dear in the future. Not to mention that poor maintenance could lead to a public catastrophe like an oil spill. If it’s the second, then Kinder Morgan is overstating its cash flow and the company is overvalued.

Kaiser’s critics argue that energy MLPs have always accounted for maintenance the way Kinder Morgan does, and while it may be complex, it’s legally and financially sound. Indeed, many see Kinder Morgan’s cuts to maintenance capital expenditures as a positive. In their subtle way, they hint that Kaiser’s youth is to blame. “We believe that the issues raised by [Kaiser] are well known, transparent, and appropriately discounted especially to those following them a long time,” wrote Credit Suisse analyst John Edwards in a client note last week.

It’s certainly true that Kaiser is young, just three years out of Princeton University. Moreover, he started out covering only companies that focus on energy exploration and production (E&P), while MLPs, which he came to more recently, typically own and operate transportation infrastructure too. That’s an important distinction in the minds of energy analysts.

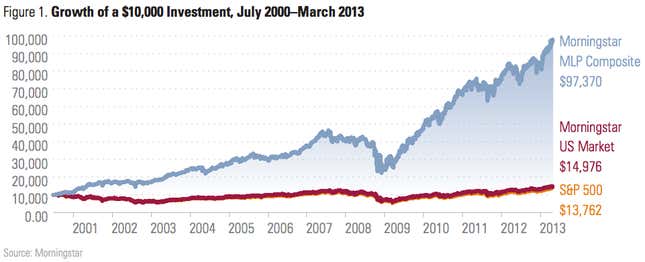

Kaiser, though, told Quartz that he thinks his inexperience is an asset. ”The last 15 years MLPs have done nothing but go up, and everyone that’s been covering this for the last 15 years knows nothing but MLPs go up,” Kaiser explained (see chart below). “I was able to come into this space completely objectively. I’m not influenced at all by the last 15 years.”

The rivalry

The claim that Hedgeye was manipulating markets can be chalked up at least partly to the gulf between “buy-side” and “sell-side” analysts on Wall Street. It’s frequently alleged, in more or less explicit terms, that someone like Kaiser who works for the buy side (i.e., for firms representing investors) is in cahoots with short-sellers—investors who make a profit by driving a firm’s stock price down.

But the analysts on the sell side—those who work for the big investment banks that issue debt for companies—are just as frequently accused of hyping those companies. (That was at least partly to blame for the late 1990s dotcom bubble). New regulations are supposed to prevent these conflicts of interest. Then again, Kinder Morgan generates whopping fees for the banks because it regularly issues hundreds of millions in debt. “I think it’s pretty easy to see why Wall Street loves MLPs so much,” Kaiser told Quartz.

So how to resolve who’s right in this case? In the case of Linn, the success or failure of its proposed merger should, noted The Street’s Antoine Gara, serve as a definitive ruling on Kaiser’s call. But for now there’s no obvious event that could vindicate or prove him wrong on Kinder Morgan. Only time will tell whether Kaiser is at the beginning or the end of a brilliant career.