This will be the most important number in the US jobs report

US mortgage makers are hiring again. Don’t be frightened.

US mortgage makers are hiring again. Don’t be frightened.

Yes, true, over-exhuberant home lending got the US and the global economy into its current muddle. Even so, this new upturn could be good news.

The Fed’s latest round of money creation and bond buying— QE3—has pushed mortgage rates down to record lows. And those ridiculously low rates have gotten the attention of consumers, who are increasingly picking up the phone to try to refinance. That’s what the Fed wants. If people refinance at a lower interest rate, it means that they’re spending less of their paycheck on their mortgage and have a little bit more to spend elsewhere. That helps the economy. At least that’s the way it should work.

Here’s the catch. There haven’t been enough people at the mortgage broker or bank to answer that phone and help push that refinancing through quickly. That creates a backlog of would-be refinancers, and that means fewer people with a little more money in their pockets, etc. In the mortgage business, this is known as a “capacity constraint.” It’s one of the thing that makes it tough to make mortgages.

Banks also argue they’ve been slower to lend, in part, because they have to have really high standards to protect themselves in case the loan goes bad. Others will note that the increased requirements for licensing new brokers in the wake of the crash means its not as easy to hire people to make loans.

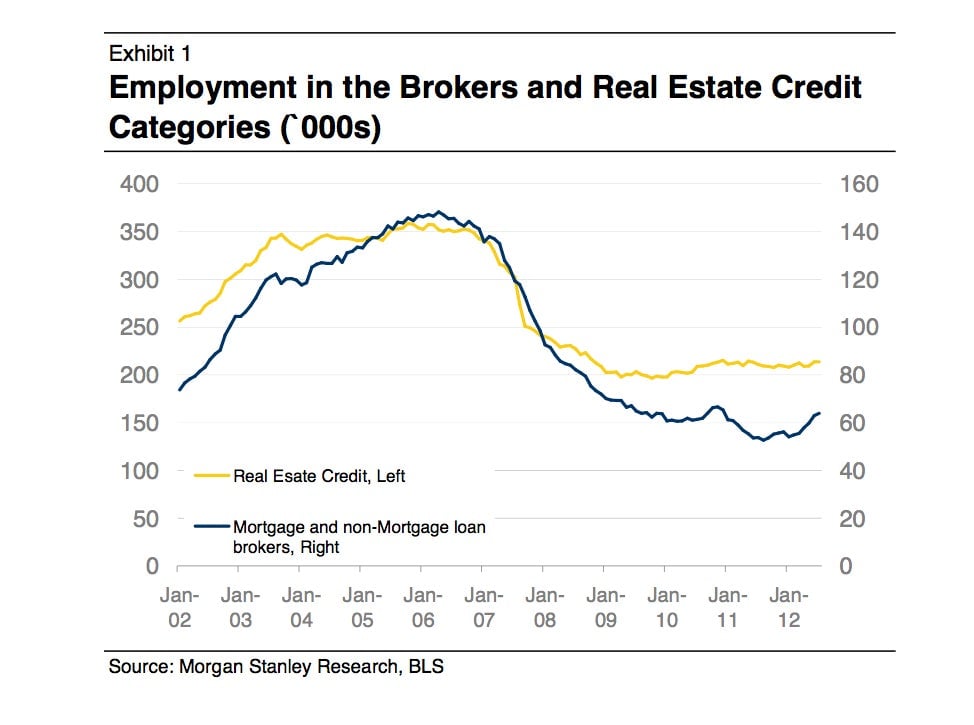

“Capacity constraints have held back the stimulative effects of lower rates from reaching more borrowers,” wrote Morgan Stanley mortgage market analysts in a recent note. In other words, the understaffed US mortgage market has muffled the impact the Fed was trying to make on the economy.

Of course, no one wants to return to reckless lending pattern that served as the prelude to the financial crisis. And at least by job count, we’re no where near there.

Still if these hiring numbers are right, it means that some entity out there sees the opportunity to make decent quality loans — given the additional regulations at the moment — at a good profit. That would be a welcome return to normal banking after the last few years.