Inside Twitter’s plan to go public as quickly and quietly as it can

Twitter would like to go public as quietly as possible. And to do that, it will go public as quickly as possible, too.

Twitter would like to go public as quietly as possible. And to do that, it will go public as quickly as possible, too.

The clock started yesterday when the company tweeted that it had filed paperwork for an IPO. But the confidential filing actually happened a few weeks ago, according to someone who was briefed on the process. The US Securities and Exchange Commission (SEC) has nearly completed its review of the document, which means Twitter could make it public within the next few weeks, much sooner than would ordinarily be expected.

That’s just one of many ways Twitter intends to exploit a new law, called the JOBS Act, in order to take the company public in atypical fashion. (I wrote about the prospect of Twitter filing a “secret” IPO in February.)

Twitter’s hope is to avoid its IPO turning into an overhyped debacle like some other technology companies. Facebook’s IPO, in particular, is seen by Twitter executives as a cautionary tale, the source said. Asked the other day if he had any advice for Twitter’s expected public offering, Facebook CEO Mark Zuckerberg joked, “I’m kind of the person you would want to ask last on how to make a smooth IPO.”

Going public, with all its scrutiny, regulation, and financial pressure, is rarely painless for high-profile firms. Twitter’s strategy is to rip the bandage off as fast as possible. Having concluded that the time is right for an IPO, the company is likely to speed toward its first day of trading as quickly as the law and practicality will allow. While no date has been set, the plan is to get it done in 2013. Twitter’s speedy intentions were reported earlier by Fortune’s Dan Primack.

The pre-“road show”

Once Twitter makes its IPO filing public, it has to wait three weeks before launching a “road show” for big institutional investors and hedge funds that might invest in the company. But Twitter doesn’t intend to wait a day longer than it has to before going on the road, and won’t spend a long time pitching itself, according to the person briefed on its plans. The road show is typically the last big step before pricing the IPO and finally selling shares.

Part of the reason Twitter can speed up the timeline is that, in a certain sense, its road show has already begun. The JOBS Act allows qualifying companies to “test the waters” regarding an IPO by talking to large investors and gauging their interest. Usually, that kind of chatter is strictly forbidden. Twitter has been taking advantage of the new law to feel out hedge funds and institutional investors that could buy large stakes in the IPO, the source said, showing them financial statements and other information that the rest of the public will see later.

Those meetings are likely the source of whispers, first picked up by GigaOm’s Om Malik, that Twitter could price its shares between $26 and $28, valuing the company at $14 billion. Twitter was valued last month at $10.5 billion by one of its investors, the publicly traded GSV Capital.

It’s a good time for Twitter to be gauging interest and racing toward an IPO. Technology, particularly social media, stocks have been surging of late. Facebook is up 88% over the past three months and hit an all-time high yesterday. But the run-up could also generate undue enthusiasm for Twitter’s public offering, driving the valuation into unrealistic territory, all the more reason for speeding up the process.

Selective disclosure

It’s also why Twitter is handling its IPO filing in stealth mode.

Under the Jumpstart Our Business Startups (JOBS) Act, a company like Twitter can keep its IPO filing secret for a time while government regulators scrutinize it and provide feedback. That allows the firm to iron out its disclosures and accounting methods in private without rattling investors or drawing scrutiny from the press. It’s like getting feedback from your teacher on an essay before it’s due.

What Twitter wants to avoid is a public revision to its IPO filing, known as an S-1, that would call attention to a weakness in the company. That’s what happened to Zynga and Groupon in 2011, when the SEC questioned how each company counted its money. And last year, Facebook tripped up its IPO with a belated disclosure about mobile advertising, which then came to be thought of as the company’s Achille’s heel.

An S-1 is supposed to provide potential investors with an honest assessment of the company that’s going public. It’s usually the first time that people get to see financial statements and other details about the firm, which can be used to evaluate if the stock is worth buying. But the JOBS Act allows Twitter to include less information in its S-1 than was previously required of all companies heading toward an IPO.

Twitter can decide to reveal only two years of audited financial statements, instead of the customary three. It could also omit details about executive compensation. Holding back such information would be risky, possibly raising eyebrows among investors and analysts, and it’s not clear whether Twitter has done so.

Not quite “emerging growth”

One risk Twitter deemed worthwhile was invoking the JOBS Act in the first place. The law, which went into effect in April 2012, is controversial—not just according to me. It was largely written by venture capitalists who said the bill would generate jobs, but it hasn’t. Instead, the JOBS Act has allowed lots of shell companies and even a Goldman Sachs subsidiary to avoid regulation under a law ostensibly meant for small businesses.

Twitter, too, is hardly the poster child of an “emerging growth company,” the law’s term for qualifying companies with less than $1 billion in annual revenue. Though it is hardly the first technology company to use the JOBS Act, it is certainly the most prominent, and it may turn out to be the highest-valued.

Not many people seem to mind the path Twitter has chosen; instead, we are mostly bemused by the notion of a secret IPO. But sentiment can change quickly and fiercely when a prominent company is going public. Which is all the more reason why Twitter wants to get this thing done as fast as it can.

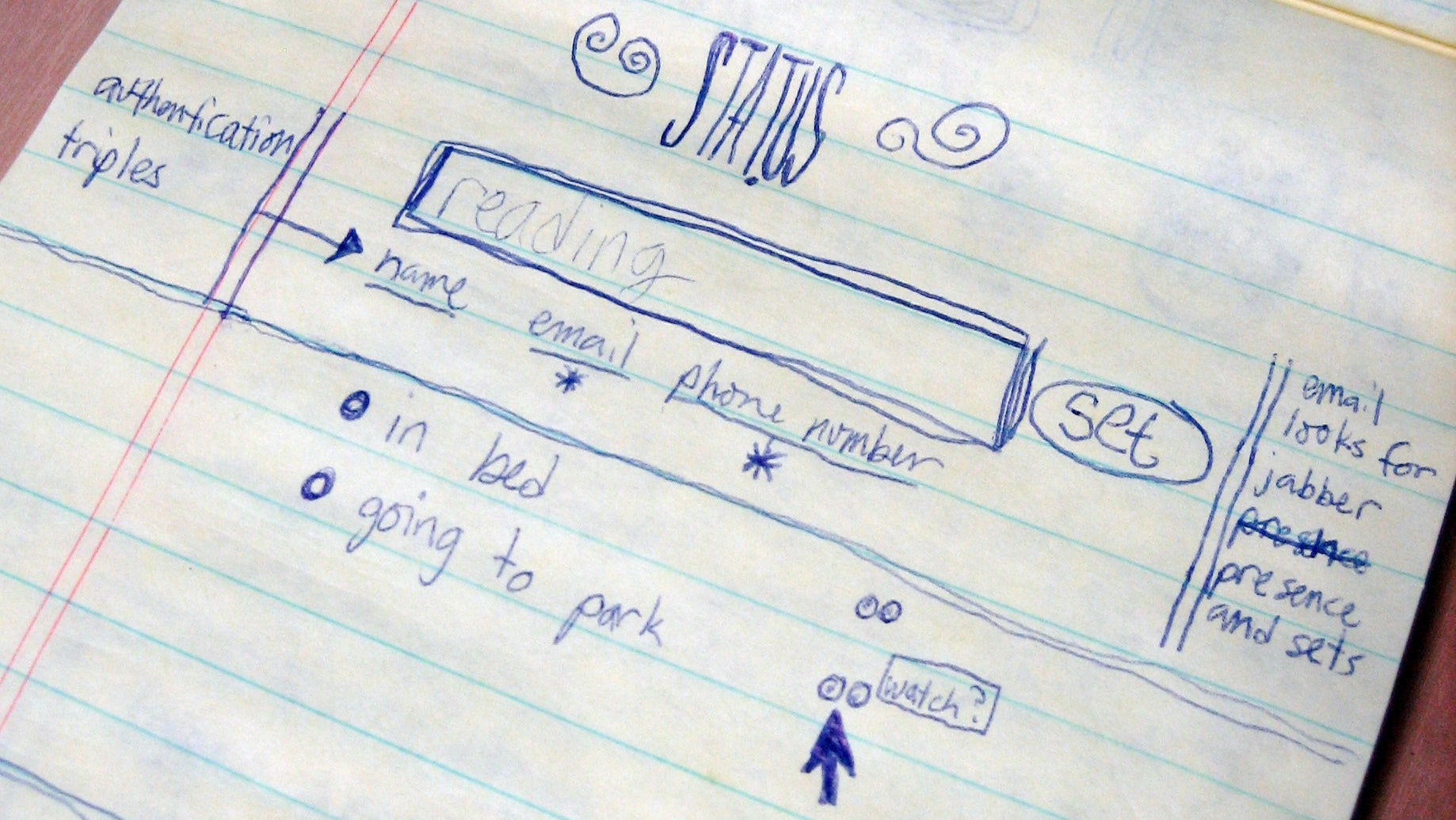

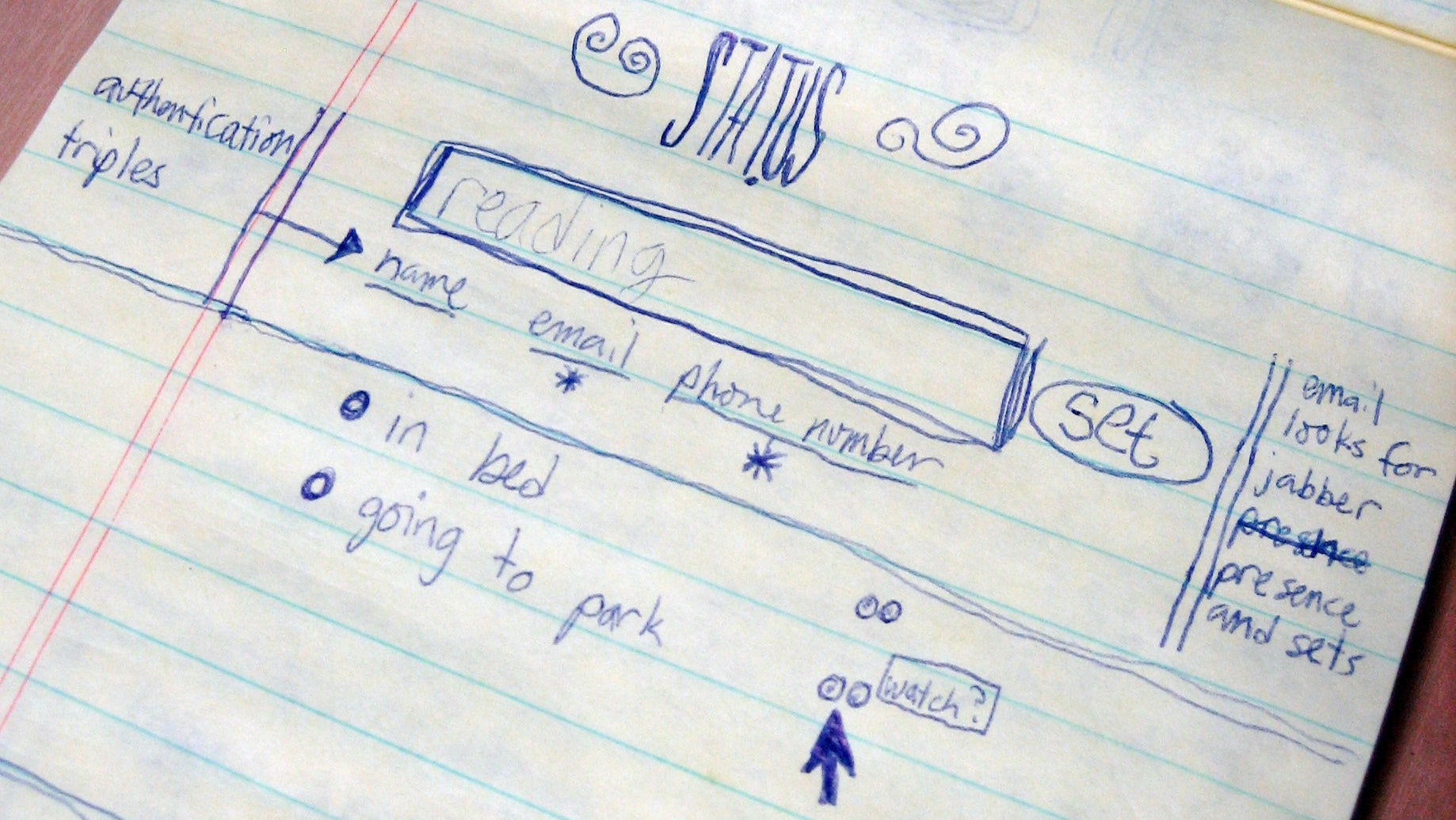

The photo of Jack Dorsey’s sketch is used under a Creative Commons license.