Twitter’s IPO filing underlines that the JOBS Act wasn’t about jobs

In the spring of 2012, the US Congress got together and passed a JOBS act. Not a jobs act. A JOBS act.

In the spring of 2012, the US Congress got together and passed a JOBS act. Not a jobs act. A JOBS act.

It didn’t create any jobs, but it has created a mass of hyperventilation surrounding Twitter’s secret public offering, announced today.

You’re forgiven for being confused. That’s half the point.

The Jumpstart Our Business Start-ups Act loosened rules put in place to protect investors from unscrupulous businesses. It laid the groundwork for crowd-funders of a company to gain equity and not just rewards, for hedge funds to put ads on billboards, and most importantly, for “emerging-growth companies” going public to keep their regulatory filings secret until just three weeks before their securities went on sale.

The idea behind calling it the “JOBS Act” was to win votes. After all, more investment and more IPOs would mean more capital for businesses, and that would mean more jobs—right? But while it’s true that businesses need capital to hire workers, the problem with US job creation in recent years hasn’t been a lack of capital. It’s been a lack of demand for the work the workers do.

And the JOBS act didn’t even raise the number of IPOs. Ultimately, it’s merely made it easier for companies that do go public to keep details of their operations secret for longer. The rate of jobs growth, meanwhile, has not meaningfully accelerated, unemployment remains high, and people are leaving the workforce in droves.

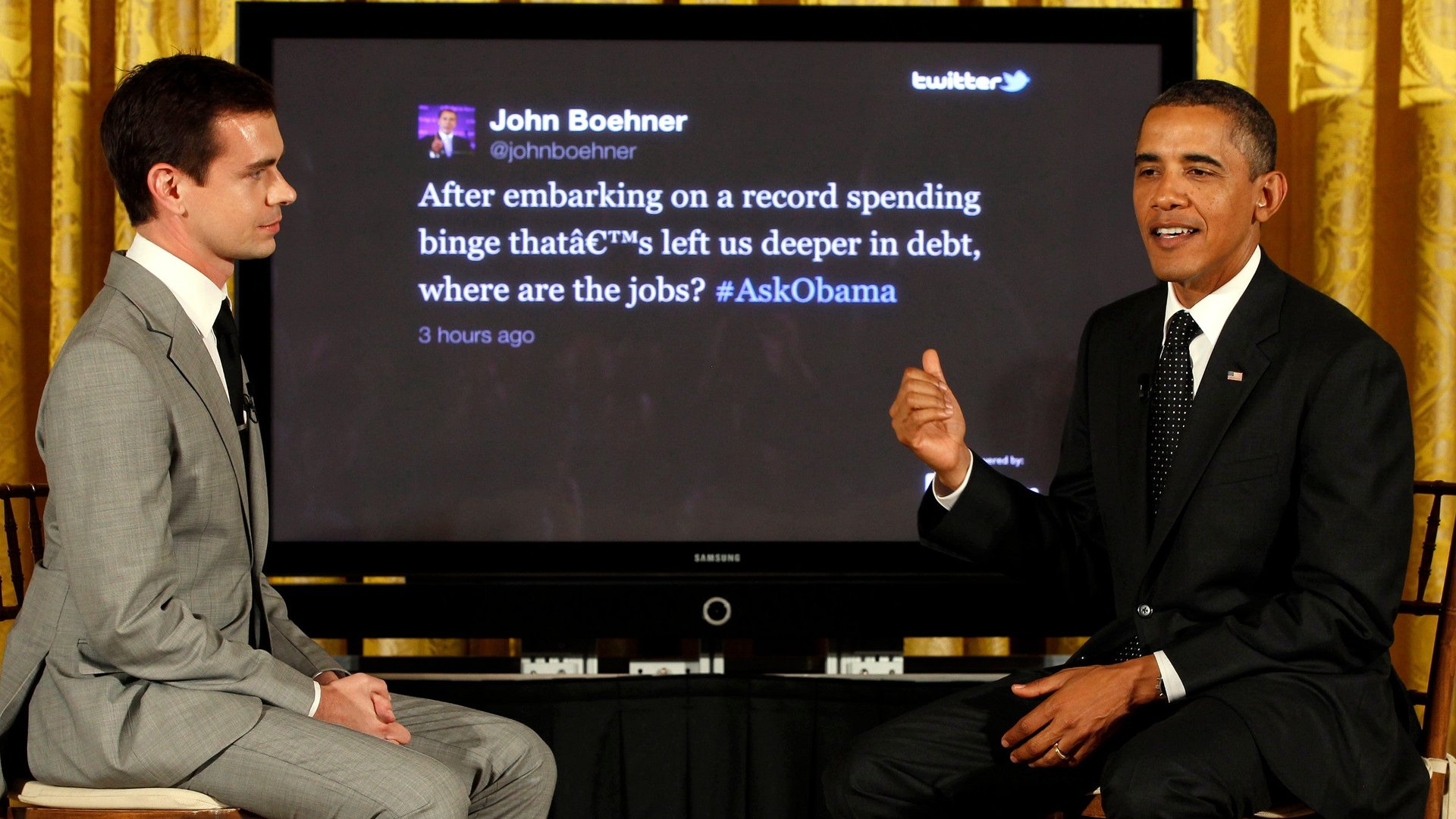

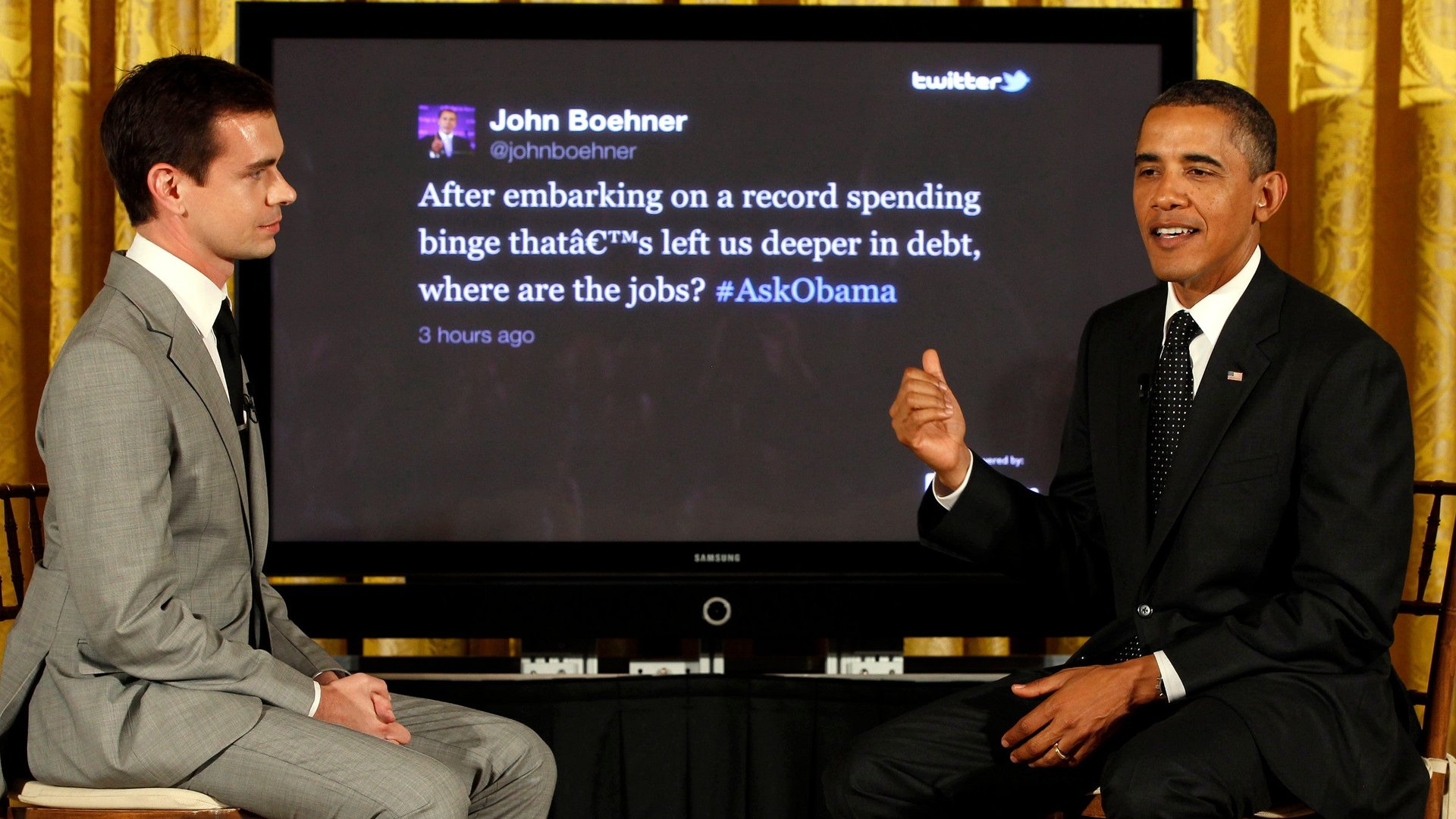

Meanwhile, Congress hasn’t done anything meaningful to create jobs since the stimulus bill in 2009. (It allowed unemployed Americans to claim unemployment insurance for longer, and just about prevented the country from falling off the fiscal cliff, but these don’t qualify as anything other than “first, do no harm.”) Since 2011, President Barack Obama and his party have been flogging various versions of the American Jobs Act—a passel of infrastructure investment, school modernization funding, small business loans, and training programs that offer a chance to actually, you know, create jobs—but this apparently has no chance of getting through Congress.

Apparently, a regular jobs act—unlike a JOBS act—doesn’t enjoy the same bipartisan support engendered by the interests of Wall Street and Silicon Valley.