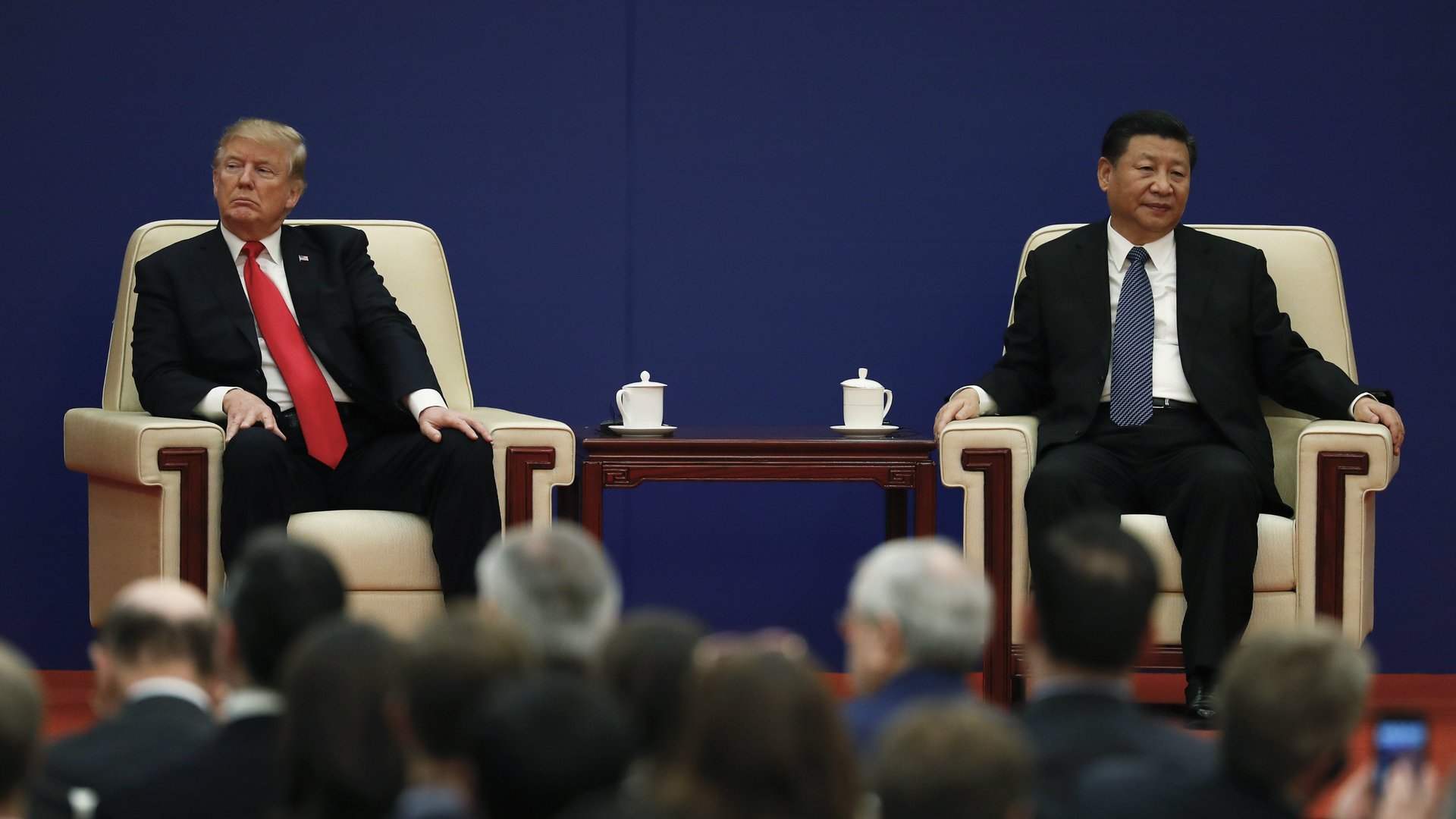

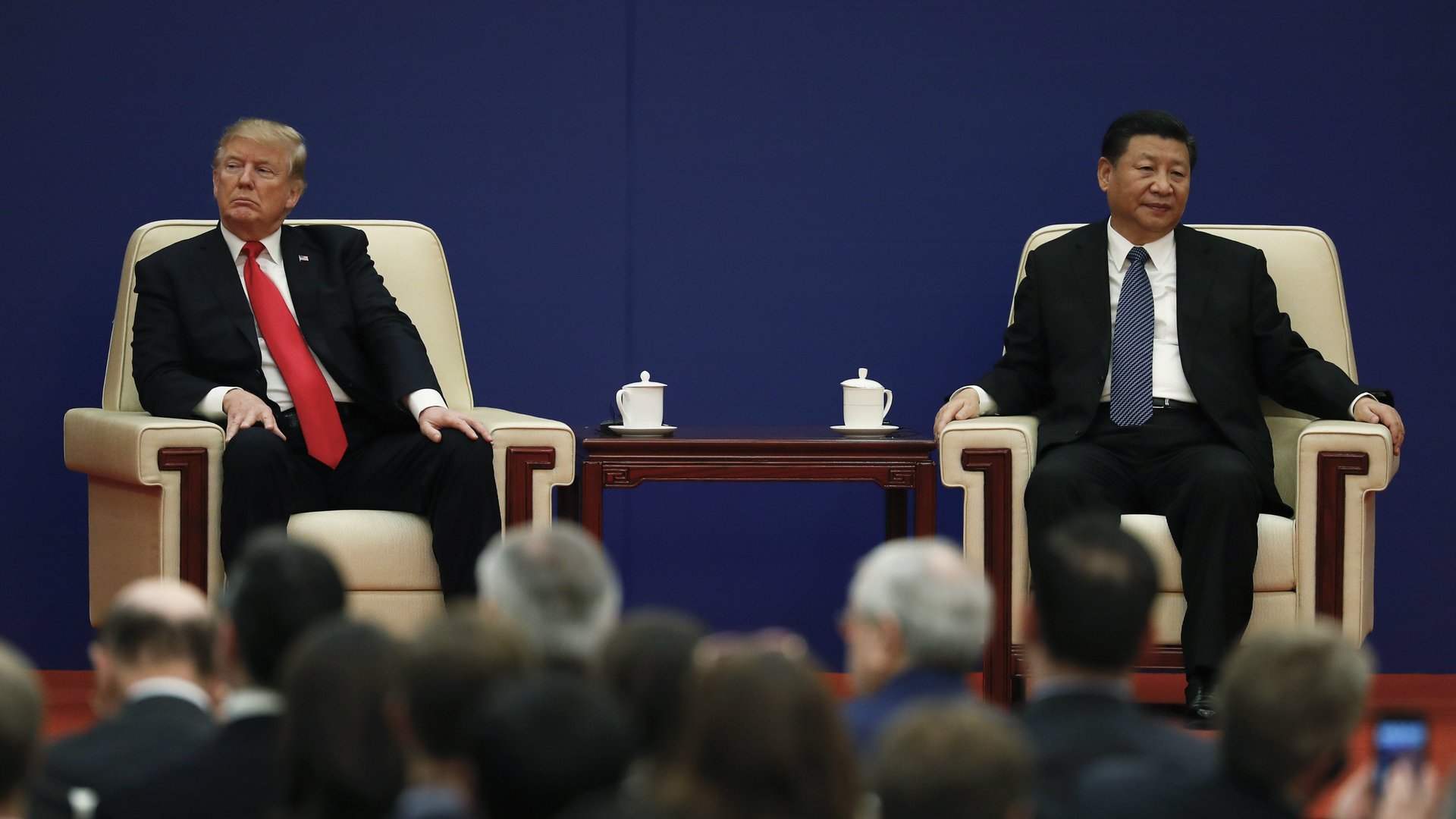

Trump’s trade battle with China is discombobulating the stock market

Escalating trade skirmishes broke out between Washington and Beijing this week, with investors caught in the middle. Although the S&P 500, for the moment, is trading roughly where it started the week, it’s been a wild ride…

Escalating trade skirmishes broke out between Washington and Beijing this week, with investors caught in the middle. Although the S&P 500, for the moment, is trading roughly where it started the week, it’s been a wild ride…

Monday, April 2

Beijing imposes import duties on $3 billion worth of American imports, targeting more than 100 product categories, ranging from dried fruits to stainless steel pipes. It is the first direct retaliation for the Trump administration’s threat of tariffs on steel and aluminum imports, and spooks the markets.

Tuesday, April 3

Stocks recover their Monday losses, and focus on things like Spotify’s market debut. After the close, though, Donald Trump fires back, proposing additional tariffs on approximately $50 billion worth of Chinese imports, across 1,300 categories of goods. It could get choppy again on Wednesday…

Wednesday, April 4

And so it proved. China retaliated within hours by targeting $50 billion of US imports, with its target list including soybeans, cars, and planes. The market gave back all of its Tuesday gains, but then turned things around when White House officials stepped in with reassurance: National Economic Council director Larry Kudlow said the tit-for-tat moves were simply the start of a “process” and “absolutely not” signs of an imminent trade war.

Thursday, April 5

Stocks bump along until, in another evening salvo, Trump cites China’s “unfair retaliation” (paywall) as justification for the US drawing up plans for new tariffs on $100 billion of Chinese goods. This is starting to look an awful lot like a trade war, although none of the US duties take immediate effect. “We do not want to fight, but we are not afraid to fight a trade war,” China’s ministry of commerce said in a statement. Stocks drop in after-hours trading.

Friday, April 6

Pre-market trading suggests another down day, with S&P 500 futures trading at almost exactly where they started the week.

So what was all that about, then? Investors seem to be betting that the threats are merely bluster meant to bring American and Chinese officials to the negotiating table. The dollar, buffeted in 2017 by worries about unrestrained US spending and the potential for—yes—destabilizing trade battles, is up this week against a basket of its peers.

Of course, financial markets can be (and often are) wrong, but their recent resilience reflects an underlying logic: The US and China are both likely losers in a bona fide trade war, so they have an incentive to find a compromise, despite all the tough talk.