Taper shocker: Four explanations for why the Fed held its fire

As we told you before, no taper.

As we told you before, no taper.

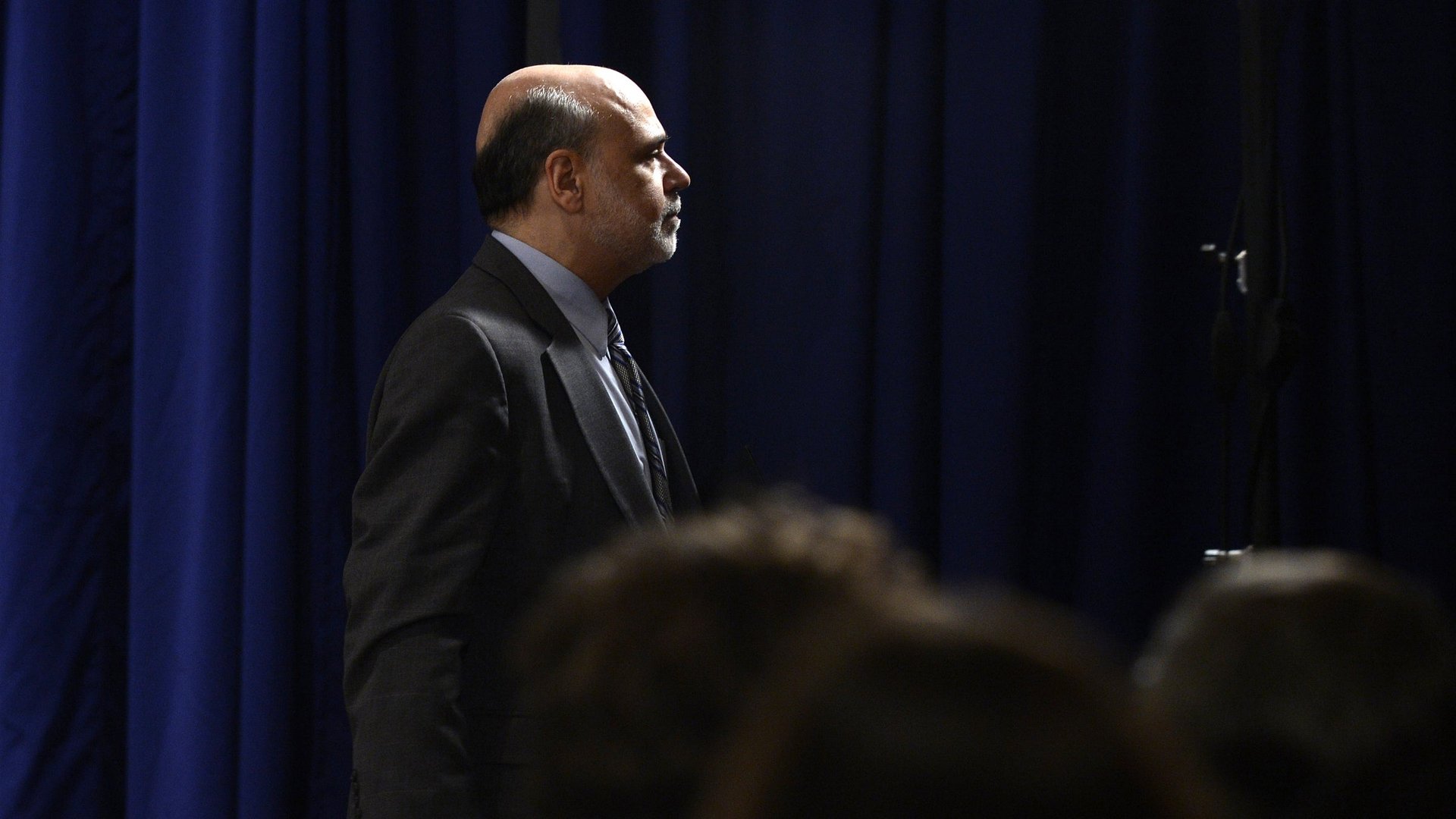

And US Federal Reserve chairman Ben Bernanke—the guy who just a few months ago was talking up the prospects for the central bank to begin winding down some of its extraordinarily easy monetary policy—offered some clues in his press conference today on why the Fed, against almost universal expectations, held its fire.

1. Interest rates were too high

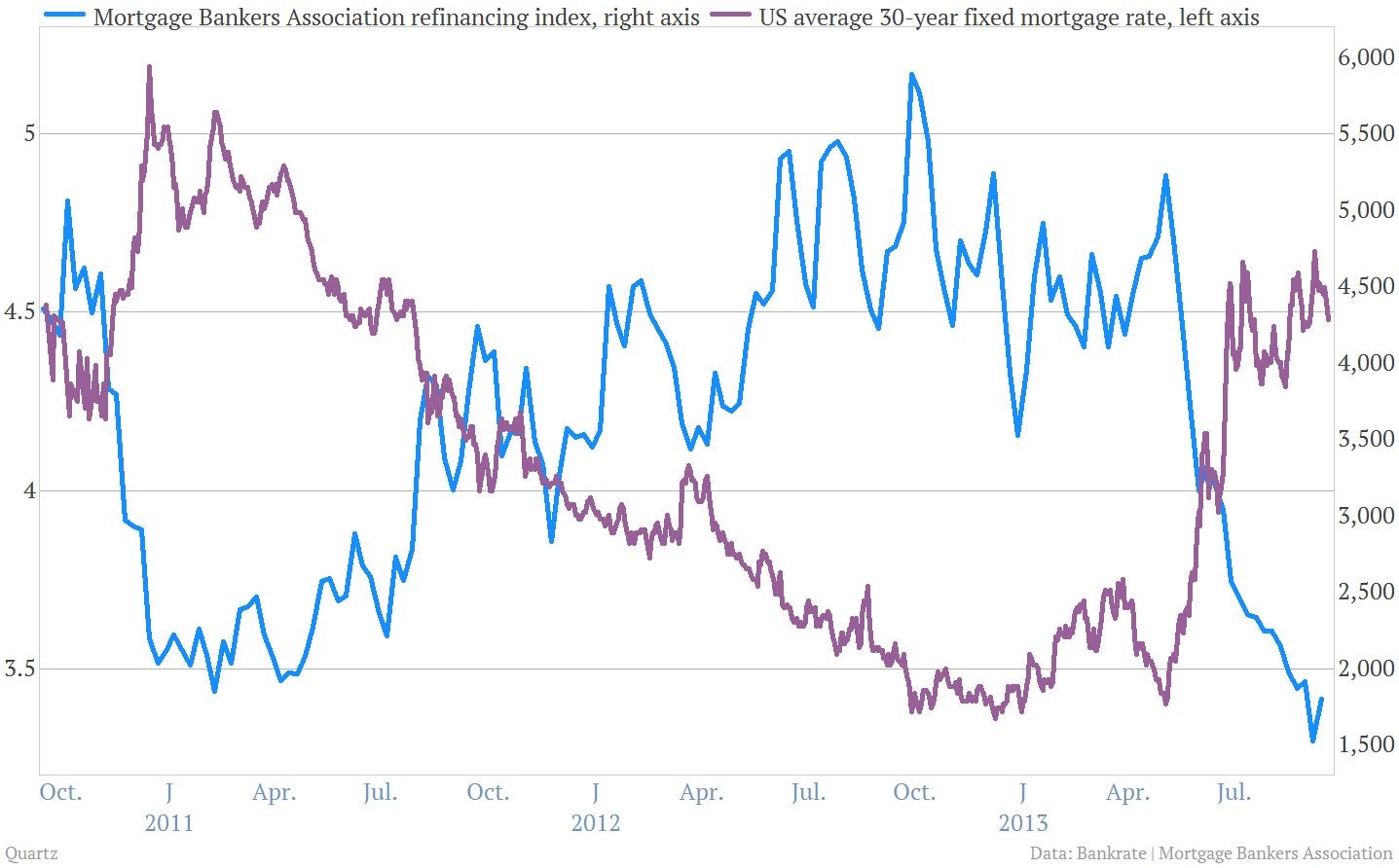

We know, it was the Fed itself that got the rise in interest rates going by talking up the taper over the last few months. But still, the climb has been pretty remarkable. The yield on the benchmark US 10-year note went from less than 1.70% before the taper talk to flirting with 3.0% a few days ago. Rates for the 30-year fixed mortgage went from less than 3.5% to nearly 4.7%.

And that may have been hurting the economy. Higher mortgage rates have all but killed off what had been a healthy boom in refinancing:

2. The debt ceiling is coming up

When Washington policy-makers played footsie with debt default back in the summer of 2011, the stock market plummeted and consumer confidence cratered. As the debt ceiling looms again this fall, a government shutdown is possible. “Upcoming fiscal debates may involve additional risks to financial markets and to the broader economy,” said Bernanke today. So the economy needs all the help it can get.

3. The job market is still a worry

The Fed’s view on jobs seems to be evolving: Though the overall unemployment rate is inching down, it no longer seems to be the only indicator the Fed thinks is important. Bernanke’s comments today showed a new preoccupation with labor-market participation too. That’s a bit odd as participation has been falling for quite some time. But Bernanke’s comments suggested that the Fed could do more to coax more workers back.

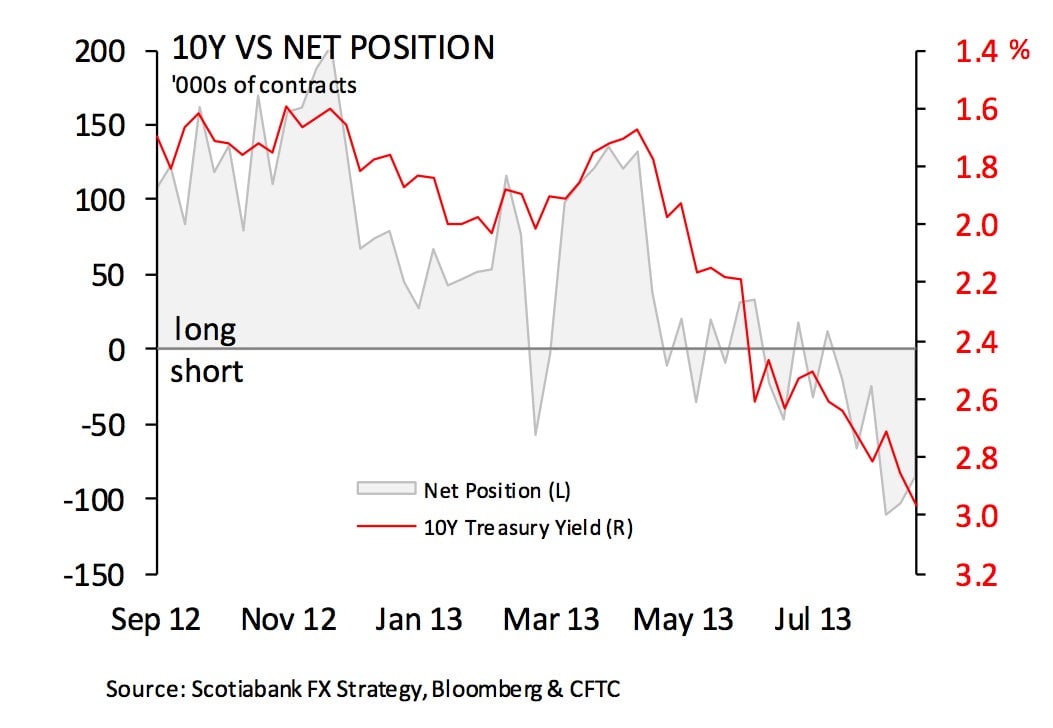

The bond markets aren’t so frothy any more

It’s never been fully appreciated that one reason Bernanke started to talk about the taper was to rein in speculation in the bond markets. Wall Street had been stocking up on US government bonds, betting that interest rates would be low for a very long time. Bernanke’s worry was that when the taper finally came, the sudden drop in the bonds’ values could sink a key player that held too many of them. As you can see from the chart below, which tracks speculative positions in US Treasury note futures contracts, the market went from very long to very short once the prospect of a taper came up.