Last week, I attended a panel discussion where bankers discussed whether big tech is a threat to big banks, which is a topic we cover a lot here. One of the financiers mentioned that the banking industry’s returns are lower than those in the technology sector. So, why would Apple or Amazon want to break into their line of business? The rest of the panel generally nodded their heads in agreement.

We’re-not-profitable-enough-to-bother-with is an unusual defense, which is why it caught my attention amid the usual distractions at these sorts of conferences (texts, emails, the snack table). The banker cited return on equity, which is a measure of profitability, as proof. FactSet calculates this measure by dividing net income by a trailing two fiscal-period average of total shareholder equity:

Indeed, for the most part, the chart shows about what you would expect: money-spinning tech companies sit above financial companies in the profitability rankings (and then there’s poor old Twitter). Granted, tax cuts and deregulation in the US will make banks there more profitable than before. But Amazon is making so much money selling cloud computing to the financial industry (charging them by the second) that taking deposits or writing mortgages wouldn’t seem worth the hassle by comparison.

Still, bigwigs in the banking industry seem genuinely surprised that big tech has taken so long to move in. The main explanation you hear is that the heavy regulatory burden scares them away. That is less convincing when you consider that banks have a long and storied history of finding ways around regulations, and tech companies have proven plenty adept at skirting the rules themselves.

Likewise, the profitability argument also rings hollow. Books and groceries don’t seem like the high-return building blocks for a tech empire, but here we are. Lower returns at banks may explain why tech has been slow to diversify into the financial industry, but that doesn’t mean they will stay away forever.

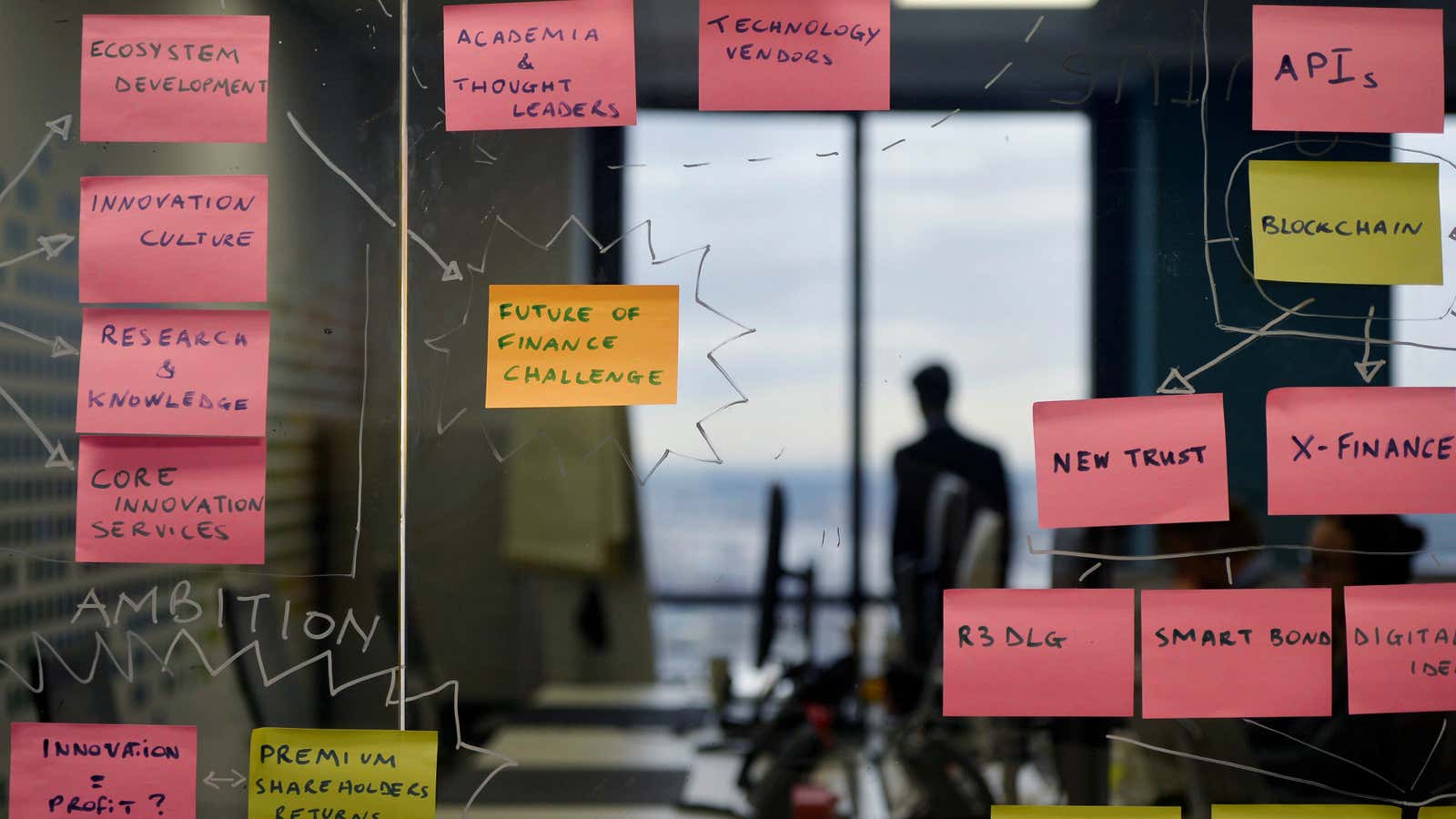

The future of finance on Quartz

Speaking of Amazon… The e-commerce giant was mentioned more than 160 times over the past year by financial industry execs during earnings calls, nearly triple the rate two years ago. That’s partly a sign of admiration, but also fear.

Junior bankers at Morgan Stanley are getting paid more. Wall Street isn’t the only place where new graduates can make a lot of money these days, so banks are adapting by adding extra perks for staff. A recent memo from Morgan Stanley reflects this changing culture at big banks, offering bigger raises, faster promotions, and fewer hours for junior bankers.

Safaricom is launching a chat platform that can also send and receive money. The move will reinforce the dominance of African mobile money transfer service M-Pesa.

Is ethereum a security? If US securities regulators decide that it is, that could spell trouble for the second-largest cryptocurrency. Whatever the case, the industry would welcome more clarity from regulators.

The Year of the Dog has not been good to dogecoin. Since Chinese new year in February, the meme-tastic cryptotoken has underperformed bitcoin. Also, here’s everything you need to know about Chinese crypto slang—don’t be an old leek (老韭菜).

The future of finance elsewhere

Amazon is encouraging retailers to use its payment service. The e-commerce company is offering to pass along its discounts on credit card fees, according to Bloomberg. The strategy is another example of its willingness to sacrifice profit to extend reach, and could pose a threat to companies like Visa, Stripe, and PayPal, as well as banks that issue credit cards.

Goldman Sachs is preparing to trade bitcoin derivatives. After reports that the bank will start a crypto desk, followed by a denial from the CEO, now Goldman bankers have told the New York Times that they will, in fact, trade bitcoin contracts. Mind you, Goldman has been clearing bitcoin futures all year.

Peter Thiel is backing a crypto broker-dealer. His Founders Fund is among the investors in Tagomi Systems, according to the Wall Street Journal (paywall). Tagomi’s co-founders include Greg Tusar, previously of Goldman and electronic trading firm KCG, now owned by Virtu. A veteran of the latter firm co-founded AirSwap, a decentralized crypto exchange.

Financial watchdogs may need to regulate the cloud. As major banks rely more on cloud computing from the likes of Amazon and Microsoft, regulators may test their resilience to assess what would happen during an interruption (paywall). Meanwhile, BuzzFeed reports that a decade worth of customer data at an Australian bank fell out of a truck.

European fintechs are going public. Swedish payment processor iZettle (paywall) and point-of-sale lender GreenSky (paywall) plan to brave the public markets. Adyen, a Dutch payment processor, and British online lender Funding Circle also reportedly have IPO ambitions. Who says the public markets are dead?

You don’t have to be a bank to do banking. TransferWise founder Taavet Hinrikus has invested in Cleo, a banking chatbot that’s not a bank. As for TransferWise (also not a bank), its multi-currency online deposit account has reached more than $1 billion under management.

What to watch for next week

- Saturday: Berkshire Hathaway’s meeting with shareholders will stream live. CEO Warren Buffett and Charlie Munger will share their views on the company, the economy, and life in general.

- Monday: A working group of US regulators will discuss whether ethereum is a security, according to the Wall Street Journal (paywall).

- Tuesday: Finovate Spring 2018 kicks off in Santa Clara, California. The product chief of Goldman’s retail bank Marcus is scheduled to be there, as will reps from the likes of Square, Visa, Kabbage, Wells Fargo, and Coinbase.

- Friday: Blockchain week begins in New York. Ethereum creator Vitalik Buterin says he’s boycotting the event, led by Coindesk, which he claims has been complicit in promoting crypto scams.

Previously, in Future of Finance Friday

April 27: Crypto traders may not care about market manipulation, but governments do

April 20: Tech companies with financial industry aspirations will find a way around the rules

April 13: Big tech companies think they can make a lot of money from the world’s unbanked