Yes, higher mortgage rates really do hurt the economy

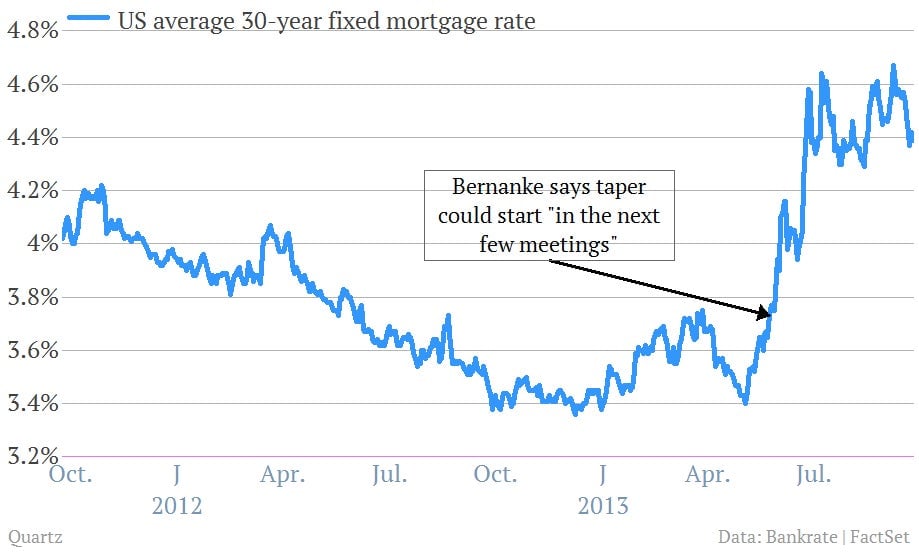

A big reason why the Fed didn’t taper? The central bank is worried that higher mortgage rates—which it brought on by bringing up the idea of the taper in the first place—might be a headwind for economic growth. And guess what: They are.

A big reason why the Fed didn’t taper? The central bank is worried that higher mortgage rates—which it brought on by bringing up the idea of the taper in the first place—might be a headwind for economic growth. And guess what: They are.

Take today’s news that Citigroup is axing personnel from its mortgage production unit. The WSJ reports (paywall) that some 7,000 mortgage makers at major banks have gotten pink slips so far this year, thanks largely to the rise in mortgage rates. (We’ve been spotlighting the trend for a while.)

Just yesterday New York Fed president Bill Dudley—considered a confidant of Fed chair Ben Bernanke—cited the run-up in mortgage rates as a worry.

Another new source of drag for the economy is the sharp rise in long-term interest rates, especially residential mortgage rates—that has occurred since May. So far we don’t have much hard data on how this is affecting the housing sector. But data through mid-September generally indicate that the rise in rates has cut into the upward momentum of the housing sector.

Here’s the rub: The markets have already been burned for poorly predicting the Fed’s moves on the taper, so it’s going to be tough for the Fed to convince investors that interest rates are going to fall substantially from here. After all, the bank spent an enormous amount of time and energy—and money that it created—on convincing the global financial system that US interest rates would be low, low, low for the foreseeable future. And when it brought up the taper, all of that certainty vanished. It’ll take a lot of work to get investors back to a pre-taper mindset.