Shopping at Whole Foods is finally a good deal—if you have Amazon Prime

The “Whole Paycheck” era at Whole Foods is finally over—if you have Amazon Prime.

The “Whole Paycheck” era at Whole Foods is finally over—if you have Amazon Prime.

Amazon is serving up a smorgasbord of discounts to Prime members to make shopping at the upscale US supermarket chain more affordable. On May 16, Amazon announced that Prime members could get an extra 10% off sale items by downloading the Whole Foods mobile app, signing in with their Amazon account, and scanning a code at checkout. The “member deals” are available now at Whole Foods in Florida and will begin rolling out to the rest of the US this summer, Amazon said.

Whole Foods spent years unsuccessfully trying to shake its “Whole Paycheck” nickname before selling to Amazon for $13.7 billion in June 2017. Since then, Amazon has done what Whole Foods by itself never could, slashing prices on popular items like organic avocados and rotisserie chicken and offering steep discounts on whole organic turkeys at Thanksgiving (the deepest price cuts went to Prime members). Amazon’s Prime-branded Visa credit card unlocks even more savings, with 5% cash back on purchases at Whole Foods (and Amazon.com) for Prime members.

“No question, what Amazon is trying to do is dispel the idea of ‘Whole Paycheck,’” said Phil Lempert, a food industry analyst. With the new Prime member discounts, he said, Whole Foods would be comparable to well-loved grocery chains Wegmans and Publix on pricing.

Prime has long been a pillar of Amazon’s business, and Whole Foods is poised to become one. In the first quarter of 2018, Amazon reported $3.1 billion in revenue from subscription services, a category that includes Prime, and $4.3 billion in revenue from physical stores, which includes sales at Whole Foods. During that quarter, Amazon further integrated the two services, rolling out two-hour grocery delivery from Whole Foods through Prime Now in 10 metro areas.

Analysts at Morgan Stanley, who tend to be bullish on Amazon, said in a May 2 report that Amazon had lowered prices at Whole Foods by an average of 5% over the last year. Combining those price cuts with additional cash back from the Prime Visa rewards card, they noted, “could make Whole Foods cheaper than conventional grocery stores for Prime members in some instances.” The savings from those rewards and discounts, they added, could easily justify the cost of Prime, even after Amazon hiked the price to $119, from $99.

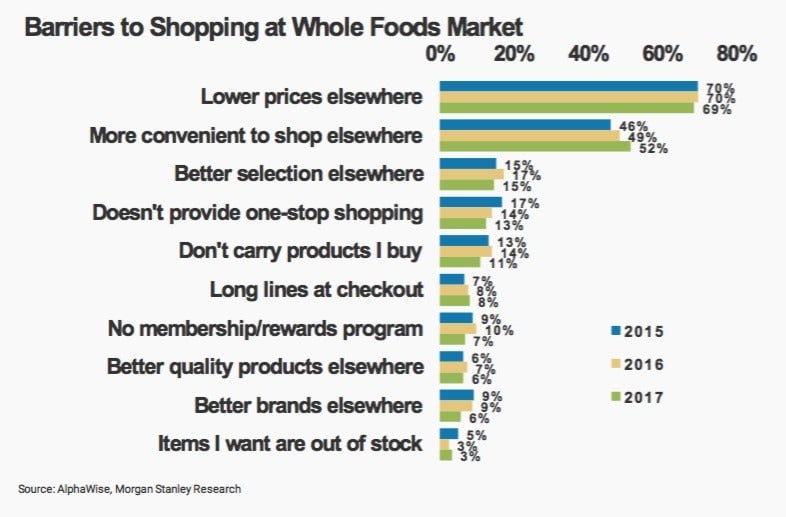

One likely reason Amazon is pushing Whole Foods so hard to Prime customers is that most of them don’t already shop there. In September 2017, shortly after Amazon completed its acquisition of Whole Foods, Morgan Stanley estimated that 80% of US Prime members, or some 38 million households, did not shop at the grocery. Morgan Stanley’s survey data also showed that 70% of consumers who said they didn’t shop at Whole Foods listed “lower prices elsewhere” as the reason why. If Amazon can truly make Whole Foods a more compelling value proposition, that’s a lot of Prime members it can potentially turn into Whole Foods shoppers, increasing the revenue it generates from them.

On the flip side, there are also plenty of Whole Foods shoppers who aren’t Prime members. In that same September 2017 research report, Morgan Stanley also estimated that nearly 40% of Whole Foods shoppers, or 5 million households, weren’t Prime subscribers. These people are presumably among the few remaining upper-middle-class Americans whom Amazon hasn’t already converted to Prime, and Amazon’s Prime-linked discounts at Whole Foods seem designed to win them over.

As Jeff Bezos wrote in his 2016 letter to shareholders, “We want Prime to be such a good value, you’d be irresponsible not to be a member.” If you shop at Whole Foods, that definitely seems to be the case.