If you thought the US’s fiscal cliff—that combination of rising taxes and slashed fiscal spending that scared investors and shook the economy in December 2012—was bad, have a gander at what Japan’s prime minister, Shinzo Abe, faces. He entered the job with a mandate to grow the economy and escape deflation. But before Abe took over, the government passed a tax hike on consumption to show that the Japanese government is serious about shrinking its ¥1 quadrillion ($10.3 trillion) in public debt.

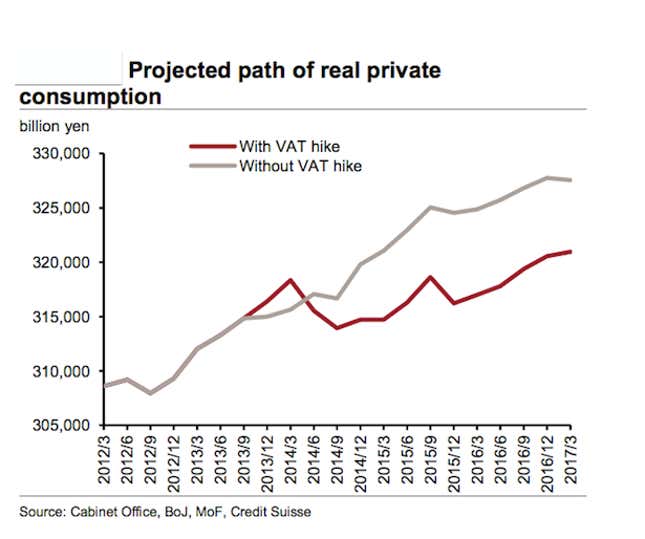

Tomorrow, Abe announces whether he’ll let the hike, which will jack up consumption taxes to 8% in April 2014 and to 10% by 2015, take effect. Like the US fiscal cliff, this will shift money from consumers to the government—some $600 per person, say economists. That will crimp growth; Credit Suisse projects that it will whittle annual GDP growth down to 0.7%, from 2.9%, in fiscal 2014 (April 2014 to April 2015). Here’s a look at how the tax will likely hurt private consumption:

With everyone from the International Monetary Fund to the opposition party calling for the tax hike, Abe is almost certain to allow it, says Tobias Harris, an analyst at Teneo Intelligence.

But as Abe hurls his country off the cliff, he and his cabinet have a cushion planned: fiscal stimulus of between ¥5 trillion and ¥6 trillion ($50 billion and $60 billion) designed to offset the impact of the tax. ”With the balance between the stimulus and the tax increase, Abe is trying to have his cake and eat it too,” says Harris tells Quartz. “He’s trying to signal to foreign investors that Japan is serious about tackling its debt—but not yet.”

In other words, the government will collect taxes from consumers—around $75 billion—and then turn around and spend nearly all of it on projects and tax cuts to stimulate the economy. (The government is unlikely to announce details of stimulus tomorrow, but measures are likely to include tax cuts to corporates and the poor.)

Why go that route? For one, to avoid a repeat of 1997, when Japan bumped the consumption tax to 5%, from 3% and plunged the country into a recession, which exacerbated its troubling debt-to-GDP ratio. The fiscal measures Abe is planning are designed to help buoy growth even as the tax discourages consumer spending.

Other recession-proofing measures include an aggressive continuation of quantitative easing by the head of Japan’s central bank, Haruhiko Kuroda, which will drive investors out of bonds and into riskier assets (Kuroda, as it happens, is a big proponent of the tax hike). If the stimulus includes a tax cut for businesses, that should help stimulate investment as well. It should also help that there’s no Asian financial crisis brewing, as there was in 1997.

The round-about strategy should get debt hawks off Japan’s back; most seem mainly concerned that the tax be on the books, says Teneo’s Harris. “I suspect there’s confidence that in the near term this is going to work. Once the economy looks like it’s on a stable trajectory” the government can stop offsetting the tax, he says. “In the mean time, Abe can [do what he must to keep growth going], having gotten political forces lined up for austerity.”